New Delhi: Investors who put their money in the Pakistan Stock Exchange’s even just five months ago would have seen investments grow on average by a blistering 46 percent, compared with a little more than 3 percent growth had they instead invested in the Indian stock market.

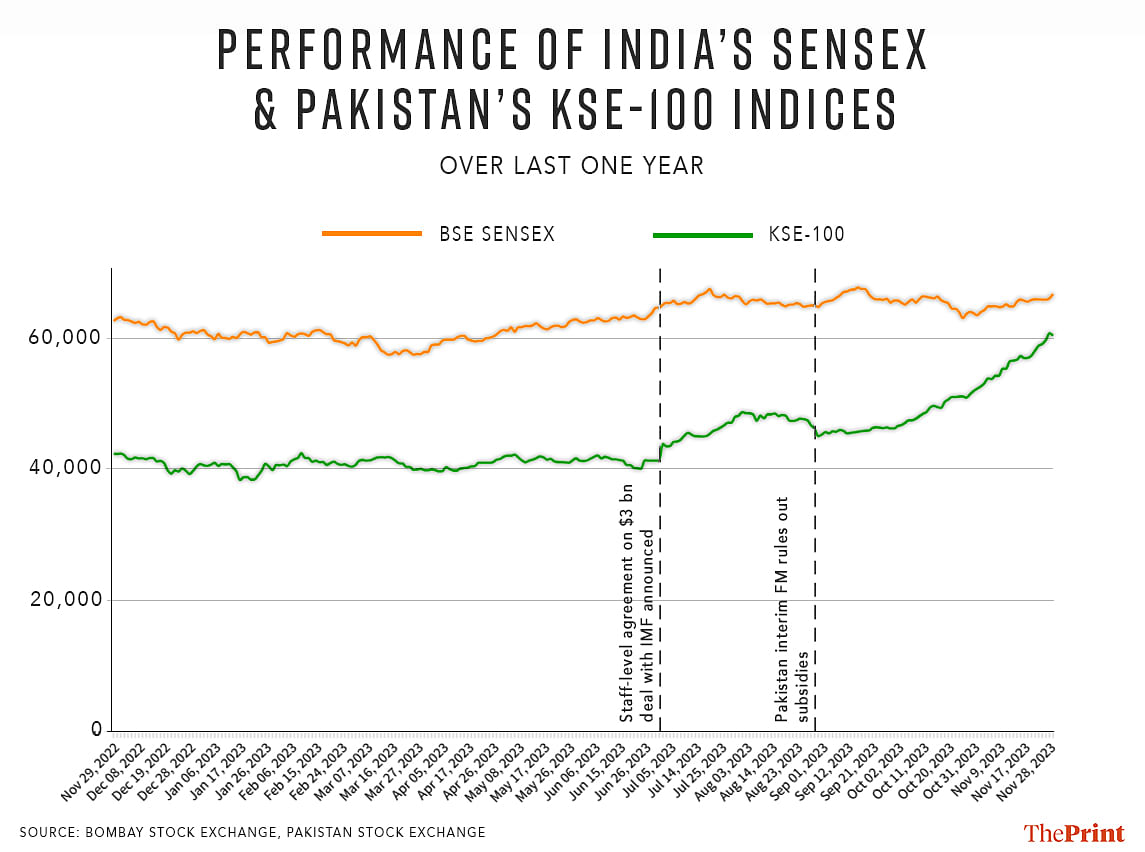

Over a longer time period of one year up to 29 November 2023, the Karachi Stock Exchange-100 — the benchmark index in Pakistan — grew about 43 percent, while India’s BSE Sensex grew 6.6 percent over the same period, an analysis of the performance of the two markets by ThePrint reveals.

It must be noted that the comparison between the two markets is limited to just their growth, since a look at their respective market capitalisations shows the two cannot be compared when it comes to their sizes.

For instance, where the Bombay Stock Exchange’s market capitalisation stands at about Rs 336 lakh crore or $4 trillion, this stands at about 6.88 lakh crore Pakistani rupees or just $24.2 billion for the Pakistan Stock Exchange.

That said, the performance of the KSE-100 over the last five months has been remarkable, and it closely coincides with several major developments — including a deal with the International Monetary Fund (IMF), foreign exchange-related agreements with Saudi Arabia and the UAE, and a corporate rebound — that could see the Pakistani economy turning around its fortunes in the medium to long term.

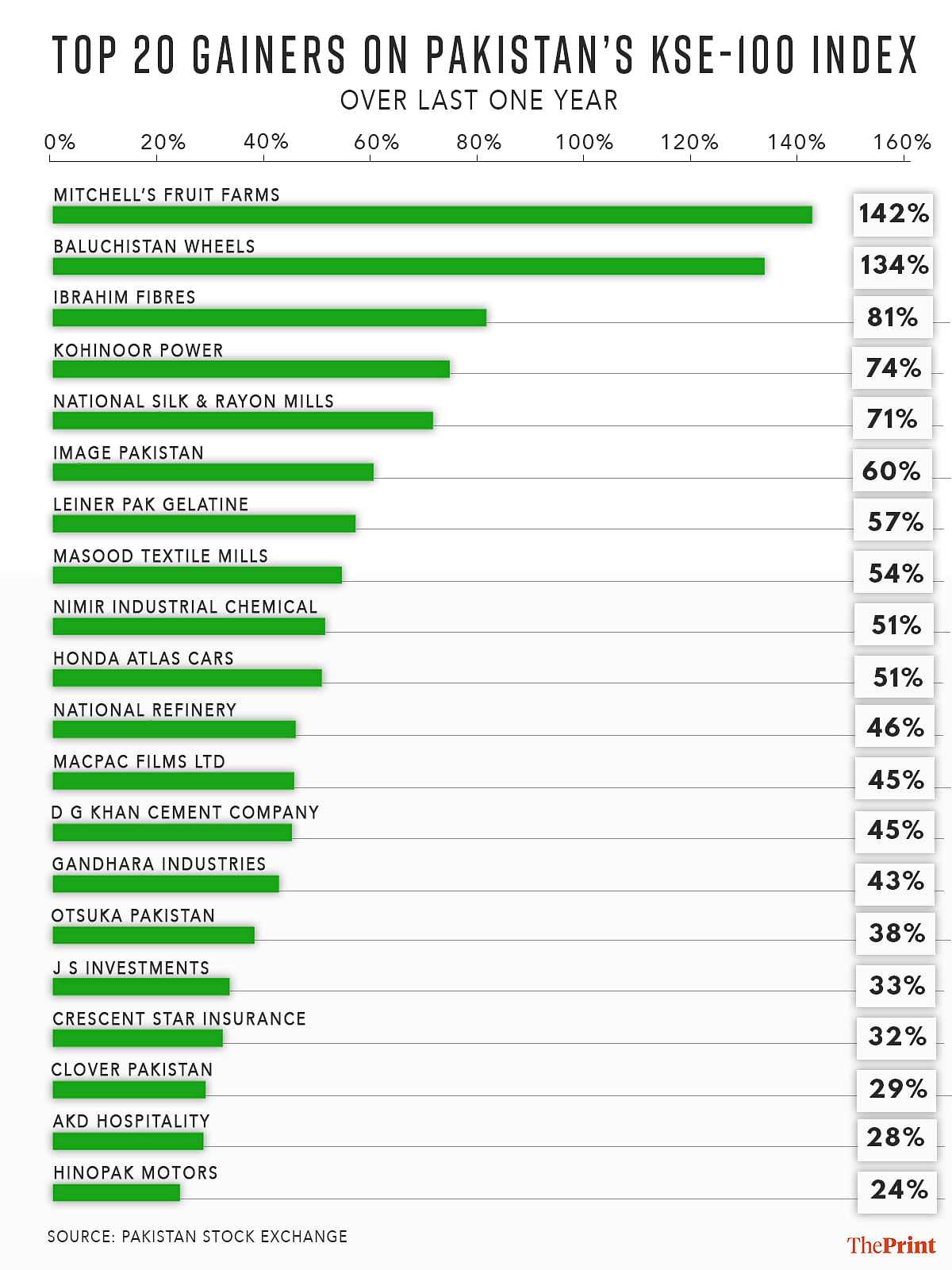

The data also shows that the stock market rally in Pakistan seems to be driven by companies operating in the manufacturing and industrial sectors, and those that are catering to the consumption economy, such as carmakers.

In the early trading hours on Tuesday, Pakistan’s benchmark index crossed the psychological barrier of 60,000 points for the first time in its history.

Also Read: Suit-boot ki sarkar? Most tax breaks under UPA went to corporates, individuals gain more under Modi

Rallying after economy’s rescue

The rise in the KSE-100 index started on 3 July, 2023, when the index jumped 6.2 percent over its previous close on 29 June. The reason for this jump can largely be put down to what happened in the intervening days.

On 30 June, then Prime Minister Shebhaz Sharif announced that his government and the IMF reached a staff-level agreement about a $3 billion standby package that the Pakistani economy sorely needed at the time.

The IMF board approved the deal on 12 July, which kept the market rally going.

This optimism in the stock market was buoyed by Pakistani media reports saying that Saudi Arabia and the UAE were releasing $2 billion and $1 billion, respectively, so that Islamabad could shore up its foreign exchange reserves.

According to Uzair Younus, director of the Pakistan Initiative at the Atlantic Council’s South Asia Center, a US-based think tank, the rally in Pakistan’s stock market can be attributed to a range of factors, including the IMF deal, and the correction of the market in response to the performance of the corporate sector in the country.

“It is a combination of factors, but key among them is the fact that Pakistan had a smooth review with the IMF and reached the staff level agreement without any hiccups,” he told ThePrint. “In addition, the PSX (Pakistan Stock Exchange) has been extremely undervalued while companies have continued to perform well.”

The stock market again rallied following interim finance minister Shamsad Akhtar’s 30 August statement that Pakistan would be sticking with its commitments to the IMF (a part of the $3 billion deal), and that no additional subsidies would be made to the people.

Manufacturing & consumption led rebound

The data also shows that the top 20 companies which saw stock prices rise the most — by triple digits in some cases — over the last year are largely in the manufacturing or consumption-oriented spaces.

So, for example, Pakistani packaged food manufacturer Mitchell’s Fruit Farms saw its stock price rise 142 percent over the year ending 29 November 2023. Similarly, the stock price of apparel seller Image Pakistan jumped 60 percent over the same period. Three auto companies — Honda Atlas Cars, Ghandhara Industries, and Hinopak Motors — were also among the top gainers during the last year.

On the manufacturing and industrial side, companies like tyre maker Baluchistan Wheels, gelatine manufacturer Leiner Pak Gelatine, National Silk & Rayon Mills, wind energy company Kohinoor Power, and packaging equipment manufacturer Macpac Films were among the top gainers.

Reports from the news portal Dawn show that the July-September quarter saw a strong performance by Pakistan’s corporate sector, which reportedly witnessed “highest-ever quarterly earnings” during the period. The automobiles, cement, and fertiliser sectors reportedly saw their highest quarterly profits in almost two years.

Younus added that a combination of this strong corporate performance and the smooth process of the IMF deal buoyed foreign investors’ confidence in Pakistan’s markets once again.

According to data shared by him, net monthly buying by foreign portfolio investors in Pakistani stocks stood at nearly a four-year high so far in November. Younus further added that FPI inflows in November are so far double the amount that came in in the previous 10 months.

That said, the consensus still seems to be that the Pakistani economy is still in for some tough times, with the October 2023 update of the IMF’s World Economic Outlook predicting a 0.5 percent contraction in GDP in 2023, and an anaemic 2.5 percent growth in 2024.

(Edited by Tony Rai)

Also Read: Loans to own directors, families — why Gujarat’s cooperative banks are increasingly under RBI scanner