The Chase Sapphire Reserve Card is the ultimate choice for road warrior travelers.

seb_ra/Getty Images/iStockphotoTravel fans, meet your match with the Chase Sapphire ReserveⓇ card. Though it has a substantial $550 a year fee, the rewards easily (and quickly) balance it out. The Sapphire Reserve takes the best-in-class travel benefits of the Chase Sapphire Preferred and adds a $300 annual travel credit, airport lounge access, more rewards for travel spending, and even more value when you redeem points for travel — which makes it one of the best travel credit cards on the market.

This suite of benefits makes the card a favorite among road warriors, but you don’t have to be at the airport every week to get enough value to justify the card’s annual fee. The card’s travel credits are simple to use and automatically offset a wide list of travel purchases, and lounge access can mean free food and drinks while on the road. Plus, you’ll earn more points on travel and get more value when you go to redeem them.

Here’s what you need to know about the Chase Sapphire Reserve.

Chase Sapphire Reserve Card review

Highlights

- Earn 10 points per dollar on hotels and car rentals purchased through Chase, five points per dollar on flights purchased through Chase, and three points per dollar on all other travel.

- Earn three points per dollar spent on dining, plus 10 points per dollar when you dine with Chase Dining.

- $300 annual travel credit that’s applied automatically when you charge travel to your card.

- Priority Pass lounge access for cardmember and authorized users, including guest access for two companions, plus access to restaurant and market partners.

- Points worth 50% more when redeemed for travel through Chase Ultimate Rewards.

- Best-in-class travel insurance benefits, including primary auto rental collision damage waiver, trip delay reimbursement, baggage delay, and lost luggage reimbursement.

- Points transfer to airline and hotel partners, including Air Canada Aeroplan, Air France/KLM Flying Blue, British Airways Executive Club, Southwest Airlines Rapid Rewards, United Airlines MileagePlus, and Hyatt.

- No foreign transaction fees.

Chase Sapphire Reserve pros and cons

The Chase Sapphire ReserveⓇ card is a standout among travel cards, offering one of the most comprehensive suites of travel insurance benefits of any premium travel card.

Pros

- Best-in-class travel protections, such as trip delay protection, which can cover a hotel and other expenses if your travel is delayed overnight.

- At least three points per dollar on travel purchases, plus up to 10 points per dollar when you book hotels and car rentals through Chase Ultimate Rewards.

- Points can be redeemed for one cent each toward cash back redemptions or 1.5 cents each for travel booked through Chase Ultimate Rewards.

- Ultimate Rewards offers many easy-to-use transfer partners, including Air Canada Aeroplan, Air France/KLM Flying Blue, British Airways Executive Club, Southwest Airlines Rapid Rewards, United Airlines MileagePlus, and Hyatt.

Cons

Current welcome offer

The Chase Sapphire ReserveⓇ offers 60,000 bonus points to new cardmembers after spending $4,000 on purchases within the first three months after opening the card. These points can be redeemed for $600 of cash back rewards. Because the Chase Sapphire Reserve gives you 50% more value when you redeem your points for travel through Chase Ultimate Rewards, you can get $900 toward travel when you redeem your bonus points through the issuer’s travel portal.

You are eligible to receive a welcome offer on the Chase Sapphire Reserve if you do not have any Chase Sapphire card and have not received a welcome bonus for any Sapphire card in the past 48 months.

How to earn rewards

You earn the most points with the Chase Sapphire ReserveⓇ when you use the card for travel purchases. Here’s what the Chase Sapphire Reserve card earns:

- 10 points per dollar on hotels and car rentals purchased through Chase Ultimate Rewards.

- Five points per dollar on flights purchased through Chase Ultimate Rewards.

- 10 points per dollar on Lyft rides, through March 31, 2025.

- Three points per dollar spent on all other travel purchases.

- 10 points per dollar spent with Chase Dining.

- Three points per dollar spent on all other dining purchases.

- Ten points per dollar spent on Peloton equipment and accessory purchases over $150, through March 31, 2025.

- One point per dollar spent on all other purchases.

In addition to earning points for spending on your Chase card, you can earn Ultimate Rewards points by shopping with select merchants with Shop through Chase.

How to redeem Chase Sapphire Reserve rewards

You’ll find no shortage of ways to redeem your Ultimate Rewards points, but some options are more valuable. Here are the best ways to use your rewards.

Travel through Chase Ultimate Rewards

Travel bookings are one of the best ways to use the points you earn with the Chase Sapphire Reserve. Through Chase Ultimate Rewards, you can redeem your points to book flights, hotels, car rentals, activities, or cruises. When you book travel through Chase’s portal using your points, you’ll get 1.5 cents of value out of each point.

Booking travel through Chase Ultimate Rewards works much like booking travel through an online travel agency like Orbitz or Expedia. In most cases you’ll be able to select from the same flights, at the same prices that you would if you booked directly with the airline. You’ll see the price in points alongside the cash price when you search for travel.

Cash back

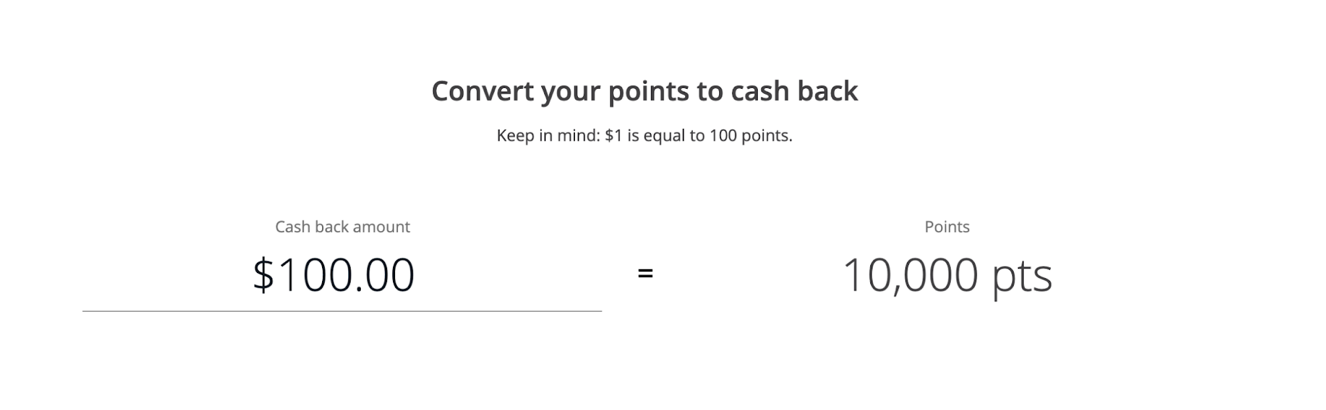

Your Ultimate Rewards points are worth one cent each when you redeem them for a cash back award. This award can be redeemed easily through the Chase website. Cash back redemptions take up to three business days to post to your account

Your Ultimate Rewards points are worth one cent each when you redeem them for a cash back award. This award can be redeemed easily through the Chase website.

HearstTransfers to travel partners

Chase offers point transfers to 12 airline frequent flyer programs. Many of these programs offer award sweet-spots, allowing you to book business or first class flights for a relatively low number of points.

Here are Chase’s airline transfer partners:

- Aer Lingus Avios

- Air Canada Aeroplan

- Air France KLM Flying Blue

- British Airways Avios

- Emirates Skywards

- Iberia Avios

- JetBlue

- Qatar Privilege Club Avios

- Singapore Airlines KrisFlyer

- Southwest Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

Of Chase’s 12 airline transfer partners, Air Canada Aeroplan, Air France/KLM Flying Blue, British Airways Executive Club, United Airlines MileagePlus offer the most opportunities to get more than 1.5 cents per point of value out of each point.

Ultimate Rewards can also be transferred to three hotel transfer partners, however only transfers to Hyatt are likely to yield more value than you could get from booking travel through Chase Ultimate Rewards.

Here are Chase’s hotel transfer partners:

- Hyatt

- IHG

- Marriott Bonvoy

Gift cards

Most of the time, redeeming your Chase Ultimate Rewards points for gift cards doesn’t offer more value than cash back awards. But Chase does frequently run sales on gift card redemptions, allowing you to get more than one cent of value out of each of your points.

Chase frequently run sales on gift card redemptions.

HearstOther redemption options

These other redemption options rarely offer more value than cash back redemptions:

- Pay yourself back allows you to use your points to cover select categories of purchases. In very limited cases, this might offer an opportunity to get more than one cent of value out of each point. Through December 31, 2023, you can redeem points to offset donations to select charities at 1.5 cents each.

- Apple on Ultimate Rewards lets you use points to pay for part or all of your purchase with Apple.

- Pay with Points lets you use your points to pay for purchases at Amazon or with merchants that accept PayPal. Often this option yields less than one cent of value per point.

Benefit highlights

Priority Pass and Chase Sapphire lounge access

Chase Sapphire ReserveⓇ offers airport lounge access through Priority Pass and the bank’s nascent Chase Sapphire lounge network.

Cardmembers and authorized guests receive Priority Pass Select memberships, allowing complimentary access for themselves and two accompanying guests when traveling on a same-day flight. Notably, the benefit includes access to airport lounges, restaurants, cafes, and markets. The Priority Pass perk included with most other premium travel cards only provides access to airport lounges.

While the Priority Pass network is strongest abroad, the program lists 42 U.S. domestic airports with lounges or other experience benefits. The Priority Pass network of lounges includes more than 1,300 airport lounges across the globe.

Chase also offers Sapphire Reserve cardmembers exclusive access to its own lounges, branded as “Chase Sapphire Lounge by The Club.” The lounge network is still in its infancy. Open locations include Boston and Hong Kong. Future locations are slated to include Las Vegas, New York City’s LaGuardia airport, Philadelphia, Phoenix, and San Diego. Chase also offers Sapphire Reserve cardmembers access to airport experiences like the Sapphire Terrace at the Austin-Bergstrom airport.

$300 travel statement credit

Each year, Chase Sapphire ReserveⓇ cardmembers receive up to $300 in statement credits to offset travel purchases. The Sapphire Reserve’s travel statement credit applies to a long list of travel purchases and is applied automatically when you charge eligible travel purchases to your card. If you hold the Chase Sapphire Reserve card, you’re probably spending at least $300 a year on travel, so this benefit can go a long way toward offsetting the card’s $550 annual fee.

The travel statement credit resets on your first statement date after your account opening anniversary each year.

Travel insurance protections

- Trip cancellation and interruption insurance – Get up to $10,000 to cover prepaid travel expenses if your trip is canceled or cut short for a covered reason.

- Primary auto rental collision damage waiver – When you rent a car with your Chase Sapphire Reserve and decline the rental company’s collision damage waiver, you get primary insurance against theft or collision damage. Having primary coverage means you don’t have to file a claim to your personal auto insurance.

- Roadside assistance – You’re covered for up to $50 up to four times a year for roadside assistance services like towing, tire changing, jumpstart, lockout service, fuel delivery, and standard winching.

- Baggage delay insurance – If your baggage is delayed by more than six hours, you can be reimbursed for essentials like toiletries and clothing, up to $100 per day for five days.

- Lost luggage reimbursement – Get reimbursed for the value of your luggage, up to $3,000, if an airline or other common carrier loses your luggage.

- Trip delay reimbursement – When your flight, train, ferry, or bus is delayed by more than six hours or overnight, you can receive up to $500 in reimbursements for meals, hotel costs, and other essentials.

- Emergency evacuation and transportation – If you become injured or ill while traveling and need emergency medical evacuation to a hospital for treatment, you can be reimbursed up to $100,000.

Other perks/benefits

In addition to the benefits you get when you travel, Chase Sapphire ReserveⓇ offers several benefits that are useful closer to home:

- Purchase protection – Receive up to $10,000 of reimbursement if a new purchase is damaged or stolen within 120 days.

- Extended warranty protection – Get one additional year of coverage equivalent to the U.S. manufacturer’s warranty. Coverage applies on eligible items with manufacturer’s warranties of three years or less.

- Return protection – Get a reimbursed up to $500 if you want to return an item you purchased and the merchant does not provide a return, exchange, or credit within 90 days of purchase.

- DashPass Subscription – Receive a complimentary one year DashPass subscription, plus a $5 monthly DoorDash credit. You must activate this benefit by December 31, 2024.

- Instacart+ Benefits – Receive 12 months of complementary Instacart+ membership when you activate by July 31, 2024. Instacart+ members also receive up to $15 in statement credits each quarter through July 2024.

Who the Chase Sapphire Reserve Card is good for

The more you travel, the more you will benefit from Chase Sapphire ReserveⓇ. Business travel road warriors will benefit the most from the card’s earnings on travel purchases, lounge access, and travel insurance benefits. But families who travel a few times a year can get plenty of value out of the card’s $300 annual travel credits, plus the peace of mind that comes with carrying the card with a comprehensive suite of travel insurance benefits.

Who should look elsewhere

Chase Sapphire Reserve vs. Chase Sapphire Preferred

If you spend more than $300 annually on travel, the Sapphire Reserve’s $300 annual travel credit offsets the majority of the $550 annual fee. Between the airport lounge access benefits, increased point earnings for travel redemptions, and 50% more value when you use your points for travel bookings, many frequent travelers will find plenty of value in excess of the Sapphire Reserve’s annual fee.

If you are an infrequent traveler or don’t think you’ll get enough value from the Chase Sapphire Reserve to justify the card’s annual fee but still want access to best-in-class travel insurance protections, consider Chase Sapphire Preferred.

Is Chase Sapphire Reserve worth it?

With any premium credit card, you should get more value than you’re giving up with the annual fee. In the first year, that’s an easy calculation, since the card’s 60,000 point welcome bonus can be redeemed for $900 in travel rewards.

But many cardmembers like to keep the Sapphire Reserve long-term because they get plenty of value above and beyond the card’s $550 annual fee. Your value calculation will be based on your travel patterns and how you use the card, but here are a few things to consider:

- $300 annual travel credit – This benefit covers nearly 60% of the card’s annual fee.

- Priority Pass Select membership – A large amount of the value of lounge access comes from the complimentary food and beverages you’ll find in many airport lounges. If you travel with a family of four twice a year and otherwise spend $25 each on meals each way, this benefit could be worth $400 a year.

- Increased earnings in reward categories – Consider how many points you could earn with spending in the card’s bonus categories like travel and dining. Remember that purchases through the Chase Ultimate Rewards travel portal and select partners often earn five times as many points as no-annual-fee cards.

- Additional value on point redemptions – The Sapphire Reserve offers 50% more value when you redeem your points for travel through Chase Ultimate Rewards. If you redeem a modest 50,000 points a year, that’s $250 of value over what a cash back card would give you.

Bottom line

For frequent travelers, the Chase Sapphire ReserveⓇ offers a package that’s hard to beat: The most comprehensive suite of travel protections among travel credit cards, a generous lounge access benefit, an easy-to-use travel credit and points that are easy to earn and give you more value when you redeem them for travel.

Looking for a different travel credit card? We’ve got you covered.

Editorial Disclosure: All articles are prepared by editorial staff and contributors. Opinions expressed therein are solely those of the editorial team and have not been reviewed or approved by any advertiser. The information, including rates and fees, presented in this article is accurate as of the date of the publish. Check the lender’s website for the most current information.

This article was originally published on SFGate.com and reviewed by Lauren Williamson, who serves as Financial and Home Services Editor for the Hearst E-Commerce team. Email her at [email protected].