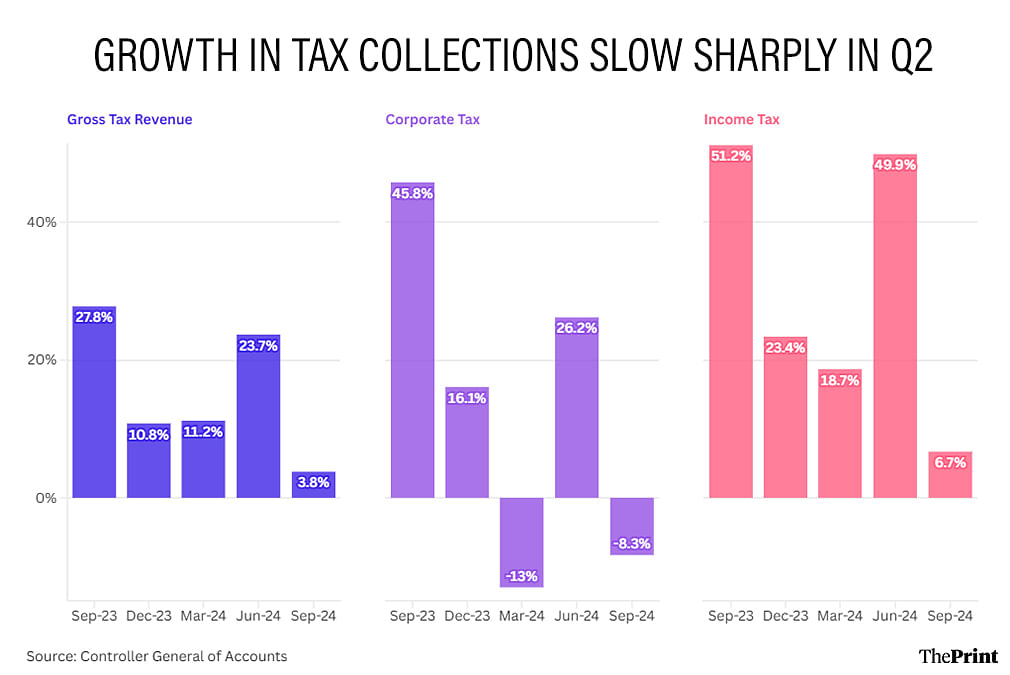

New Delhi: India’s gross tax collection slowed sharply in the second quarter of this financial year—growing just 3.8 percent—down from a robust 23.7 percent in the previous quarter, and an even stronger 27.8 percent growth in Q2 of the previous financial year.

The main reason behind this, an analysis of tax data with the Controller General of Accounts (CGA), is the 8.3 percent contraction in corporate tax collection in the second quarter (July to September), which is a dramatic reversal from the 26.2 percent growth in the first quarter (April to June), and a whopping 45.8 percent growth in Q2 of 2023-24.

Apart from corporate tax collection, even personal income tax collection dropped markedly in Q2—slowing to 6.7 percent from a 49.9 percent growth in Q1, and 51.2 percent growth in Q2 of last year.

While tax analysts and economists say the high base of last year is one reason for the slowdown in collection, the other major factor is a significant slowdown in profits earned by Corporate India.

However, the government has a few budgetary tricks up its sleeve, they said, to ensure this lower-than-expected collection does not affect fiscal maths for the year. In addition, the government’s finances could receive a boost going ahead from an unwanted source—high inflation.

Also read: Personal income tax now over 30% of govt’s tax revenue, significantly higher than corporate tax

Corporate slump a key factor

“Some of the factors that could be responsible for the lower tax collection include lower corporate earnings for Q2 2024-2025 (announced in October), the relatively muted capital gains from stock market transactions, and the base effect as the tax collection for Q1FY25 were higher,” said Shalini Mathur, director, tax and economic policy group, EY India.

Corporate India has had a dismal Q2. According to news reports, the total profits earned by listed companies that have declared their Q2 results contracted by 0.6 percent, reportedly the first such contraction in cumulative profits for these companies in two years.

“The most evident (trend) we have seen is that growth in corporate profits has not been that buoyant in the second quarter,” Madan Sabnavis, Chief Economist at Bank of Baroda said. “And for some industries, we have seen profit growth turn negative… it has fallen.”

D.K. Pant, chief economist at Crisil, said while last year’s high base was a contributing factor to the chill in tax collection, the overall slowdown in the economy has also played its part. “There is no doubt that the overall economic growth slowing as compared to last year would be reflected in the tax collection,” he said.

Low spending, budget tricks & ‘ally’ inflation

However, analysts also said the slowdown was not likely to impact the government’s fiscal projection for the year.

“If you look on the other side, the expenditure growth has been very muted,” Pant said. “The capex growth is muted and the revenue expenditure growth is also not very strong.”

Budget 2024-25 presented in July estimated only an 8.5 percent growth in the government’s total expenditure, something economists said was low enough a projection to allow it to stick to its fiscal targets.

Adding to this, Sabnavis said, was a budgetary trick governments routinely perform, which allows them to stick to their targets comfortably.

“The government always has the prerogative to control its discretionary spending,” Sabnavis explained. “Normally, what they tend to do is to overstate expenditure and understate revenues. This is a normal practice in all budgets. So, if they are falling short on revenues, they can cut expenditure without really affecting anything.”

The other factor that could help the government in the next few months is the relatively high rate of inflation, which came in at 6.2 percent at the retail level in October, higher than the Reserve Bank of India’s upper target limit of 6 percent.

Pant said indirect taxes were levied on an ad valorem basis, which means they were imposed on the final price of a product.

“Even if the real economic growth remains the same, a higher inflation will fetch the government more taxes because prices are higher,” he said. “This is not the ideal situation since an increase in tax collection should ideally come from real growth and not inflation. But, as of now, the chances are the government will meet its 4.9 percent fiscal deficit target.”

Income tax & non-tax revenues to the rescue

The latest provisional tax data put out by the Income Tax Department for the period April to 10 November 2024 show a “satisfactory” growth of 21.2 percent in gross tax collections, Shalini Mathur said.

“Though the net corporate income tax revenue growth was muted at 6.5 percent during this period, net personal income tax collection, excluding other taxes like STT (securities transaction tax), grew at 20.7 percent,” she explained.

Mathur added that backed by a continued strong performance of personal income tax, it was expected that collection numbers would stay on course and in line with the overall budgeted target.

The government had budgeted a 10.8 percent growth in gross tax revenue in 2024-25.

“Nothing really distorts income tax data since it is based on the tax cut from salaried employees on a monthly basis and also on advance tax paid by assessees,” Bank of Baroda’s Sabnavis added.

He said there were likely to be further revisions to the personal income tax data after authorities reconcile data of people who switched from the old income tax scheme—which has higher rates but includes exemptions—to the new income tax scheme, which has lower rates but no exemptions.

“Non-tax revenues are very good, if you look at the state of the banking sector,” Sabnavis said. “So, the government is likely to get high revenues from the public sector banks (in the form of dividends). On the whole, the budgets are all managed that way, and there’s nothing wrong with it.”

(Edited by Tikli Basu)

Also read: Fiscal boost can’t rely on spending cuts alone, Modi govt must consider non-tax measures