The leather goods brand Polène is no longer part of the portfolio of Otium Capital, the investment company of Pierre-Édouard Stérin, the far-right billionaire. Following this withdrawal, and according to the media L’Informé, L Catterton, the LVMH investment fund, has acquired a minority stake in Polène.

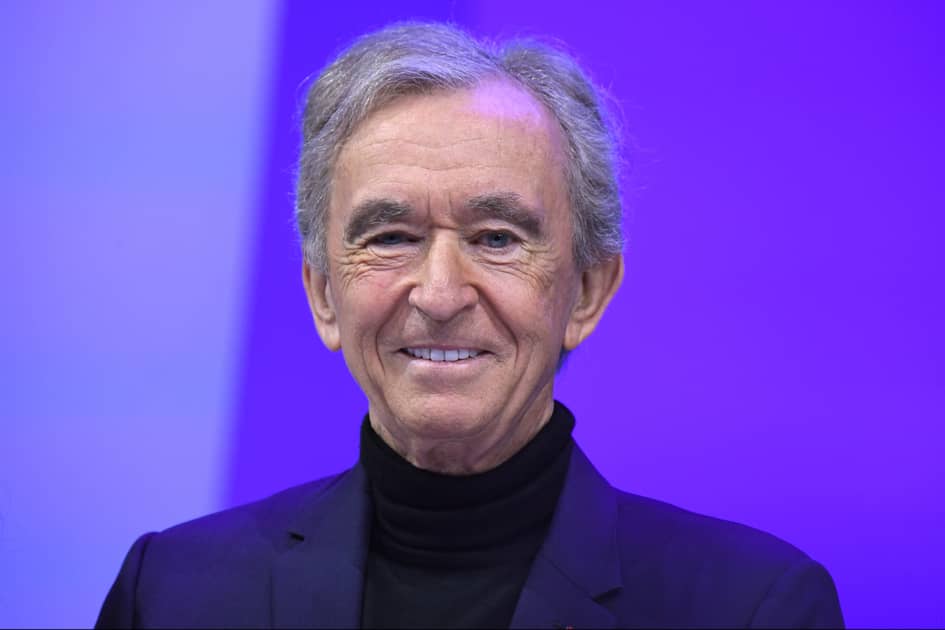

On July 11, the French media outlet Les Echos reported the exit of Otium Capital from the Polène shareholding. According to information disclosed in August by L’Informé, the management company Eutopia, born within the Otium Capital umbrella, sold its minority stake to L Catterton. This investment fund was founded in 2016 from the association of Catterton with the luxury group LVMH and the Arnault group, the family holding company of Bernard Arnault.

The interest of luxury giant LVMH in Polène is likely explained, in part, by the presence of Cyril Guenoun, who has been active in the Polène journey since its beginnings. In 2016, the co-founder and general partner of Aglaé Ventures (the venture capital fund of Groupe Arnault) and advisor to the LVMH group, had already acquired (as a representative of the company Sarl WMC Gestion) a minority share in the capital of the leather goods company, alongside the companies Sa Wexford and DNA.

Contacted by FashionUnited, Otium Capital declined to comment on its withdrawal.

The French brand Polène is a luxury label born in 2016 and founded by three siblings: Elsa, Mathieu and Antoine Mothay, also grandchildren of the creator of the ready-to-wear brand Saint James. Famous for its minimalist designs, Polène is very successful and has notably been seen in the series Emily in Paris. Its products are manufactured in Ubrique, Spain, and it also operates a corner at Bon Marché Rive Gauche as well as boutiques in Paris, Tokyo, Seoul, and New York.

Polène will soon open a boutique in London and in Hamburg later in 2025.