The Supreme Court dismissed a plea by SEBI to impose Rs 25 crore penalty on Mukesh Ambani over alleged share manipulation in Reliance Petroleum Ltd in 2007.

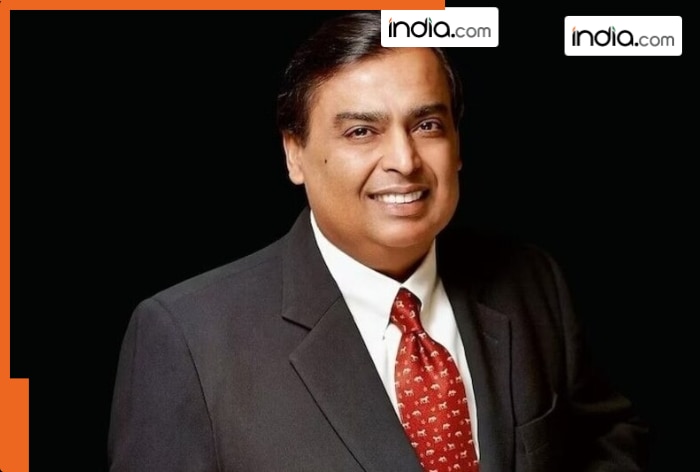

In a major relief for billionaire Mukesh Ambani, the Supreme Court on Monday rejected the Securities and Exchange Board of India’s (SEBI) plea concerning the imposition of a Rs 25 crore penalty on the Reliance Chairman in connection with alleged share manipulation involving Reliance Petroleum Ltd (RPL) in November 2007. Notably, Reliance Petroleum was merged into RIL in 2009. The two-judge bench included Justices J.B. Pardiwala and R. Mahadevan. After hearing both sides, the judges agreed to review the case on December 2 but expressed reservations about holding Ambani accountable for the alleged actions. “There is no question of law raised in the case. Dismissed,” the judges stated.

SEBI’s Plea

Securities and Exchange Board of India challenged an order of Securities Appellate Tribunal from December last year regarding overturning penalties of Rs 70 crore on RIL, , Ambani, Navi Mumbai SEZ, and Mumbai SEZ.

Supreme Court’s take on SEBI’s Plea

Upholding SAT’s decision, the Apex Court agreed that the penalties should be set aside. The court also supported the Board’s pre-2019 interpretation of Section 27 (SEBI Act), which refrained from imposing indirect liability on a person unless he/she was directly involved in or aware of corporate violations.

The interpretation was changed in March 2019 with an amendment which introduced vicarious liability for key personnel.

Before The Amendment

Before the update, SEBI didn’t consider vicarious liability, the principle that holds individuals responsible for a company’s actions unless evidence of direct involvement or awareness was demonstrated. However, this changed with the enactment of a new amendment whereby directors, senior management, and other officers can now be held accountable for their company’s breaches. Despite this, the Securities Appellate Tribunal (SAT) highlighted that this new rule cannot be enforced retrospectively, thereby sparing Ambani from any potential culpability in the legal matter from 2007.

SEBI’s Action On RP

It all started with the Board’s probe into RPL trading activities in 2007, alleging that RIL manipulated the market by hiring agents to take short positions in RPL futures while trading its shares in the market.

SEBI claimed that RIL’s trades caused a major decline in RPL’s share price in the final minutes of trading in November 2207. Sebi directly held Mukesh Ambani responsible for the alleged actions.

SEZs in Navi Mumbai and Mumbai have been blamed by Sebi for financially assisting agents tied to an alleged scheme, drawing suspicion of their involvement in the underhanded activities. However, the Securities Appellate Tribunal (SAT) overturned these fines, chiding Sebi for dragging its feet over a ten-year period before issuing any sort of formal warning. SAT posited that Sebi could have concurrently launched adjudication procedures while the Section 11B proceedings were in play, rather than awaiting their conclusion. The tribunal believed that Sebi faltered on natural justice norms by not providing critical documents to the SEZs in Navi Mumbai and Mumbai. As a result, SAT deemed the charges to be more conjecture than factual, owing to a lack of substantial evidence. Consequently, the charges were dismissed.