![]()

Camera companies are notoriously secretive. While companies share revenue and profit info and are happy to claim the number one spot in specific categories, they don’t say how many actual cameras they sell. However, new 2023 sales data sheds some much-needed light on the matter.

Before diving into the information, an important caveat is required. The data, published by Nikkei in its annual industry report, comes from Techno Systems Research Co., Ltd., a Japanese market consultation firm. This means that the unit sales data does not come directly from the manufacturers, which is unsurprising but essential to note.

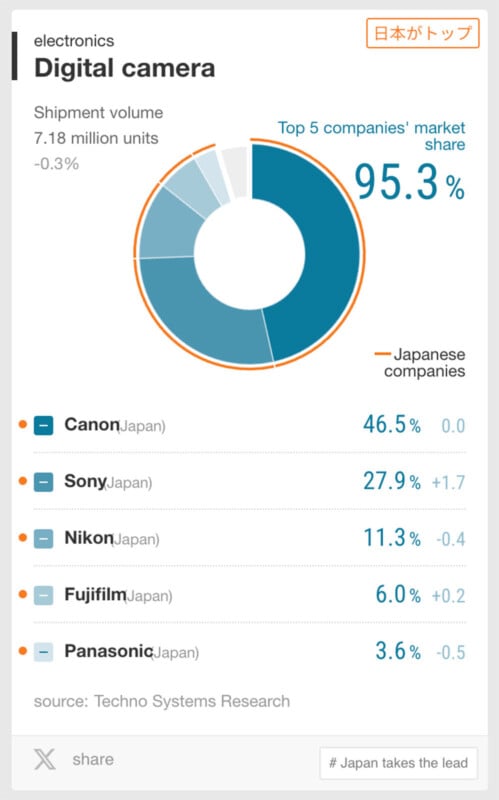

Since the data comes from reputable sources, it is worth discussing, and there are some fascinating things to note. The report, which was also reported by Digital Camera World, notes that the top five camera companies own a dominant 95.3% market share. Of these, Canon has the largest market share, selling 46.5% of all units sold in 2023, which works out to just over 3.3 million units of a total of 7.18 million.

In second place is Sony, selling two million units (27.9%) in 2023. Nikon follows at 810,000 units (11.3%), while Fujifilm and Panasonic round out the top five with 430,000 and 260,000 unit sales, respectively. As noted by Japanese photo blog DC Life, OM Digital and Ricoh Imaging occupy the sixth and seventh positions, with 2.5% and 0.8% market share.

Compared to the prior year, Canon stayed steady while Sony and Fujifilm rose by 1.7 and 0.2 percentage points, respectively. Nikon took a slight dip, dropping 0.4 percentage points, while Panasonic slid 0.5 points. Broadly, digital camera unit sales fell 0.3%.

It’s worth noting that unit sales are just general sales numbers and say nothing about the value of the cameras sold. The data also doesn’t differentiate between different types of cameras, including DSLRs, mirrorless bodies, and all-in-one models.

As smartphones have continually improved, the entry-level camera market has shrunk, and traditional camera makers have increasingly relied upon mid- to high-end camera sales. Numerous companies have cited strong demand for high-end cameras as a significant revenue driver in recent years as the camera market has shifted away from inexpensive models.

Just recently, Nikon’s president, Muneaki Tokunari, credited his company’s emphasis on mid- to high-end models as a major success, while simultaneously saying that current smartphones are expected to transition to dedicated cameras in the coming years.

Image credits: Header photo licensed via Depositphotos.