The Capital One VentureOne Rewards Credit Card gives you miles with every purchase. Your miles can be used to book travel or offset travel charges. You can even transfer your miles to one of Capital One’s many transfer partners — a relatively rare benefit on a card with no annual fee.

Vladimir Sukhachev/Getty Images/iStockphoto

The Capital One VentureOne Rewards Credit Card gives you miles with every purchase. Your miles can be used to book travel or offset travel charges. You can even transfer your miles to one of Capital One’s many transfer partners — a relatively rare benefit on a card with no annual fee.

However, the VentureOne Rewards card isn’t the best way to maximize your rewards, if that’s what’s most important to you. For most people, 1.25 miles per dollar will provide less value than other cards with no annual fee, which may offer 2% cash back on all purchases or 3% back on categories like travel purchases.

Here’s what you need to know about the VentureOne Rewards Credit Card from Capital One.

Capital One VentureOne Rewards Credit Card review

Highlights

- Earn 1.25 miles per dollar on every purchase.

- Earn five miles per dollar on hotels and car rentals booked through Capital One Travel.

- Points can be redeemed for statement credits to offset travel purchases or transferred to one of Capital One’s travel loyalty program partners.

- Secondary auto rental collision damage waiver.

- Extended warranty protection.

- No foreign transaction fees.

Pros and cons

Pros

- Transferable points on a card with no annual fee.

- No foreign transaction fees.

Cons

- Points cannot be redeemed for cash back at full value — cash back redemptions get only 0.5 cents of value per point.

- Five points per dollar is only offered on hotel and car rental bookings through Capital One Travel.

- 1.25 points per dollar on all purchases is less than the 2% rewards offered on some other cards

Capital One VentureOne Rewards Credit Card credit limit

When you apply for the VentureOne Rewards card, Capital One will give you a VentureOne Rewards Credit Card credit limit based on your credit score. Unfortunately, there is no way to know what credit limit you might qualify for before you submit your application.

Generally, Capital One issues the VentureOne Rewards card to applicants with excellent credit. If you apply and don’t qualify for the VentureOne Rewards card, Capital One may consider you for the VentureOne Rewards for Good Credit. If Capital One considers you for the VentureOne Rewards for Good Credit, the bank will only check your credit score once and you’ll have an opportunity to accept or decline the offer for this alternate card.

Current welcome offer

The VentureOne Rewards Credit Card offers new cardmembers 20,000 bonus miles after spending $500 on purchases within the first three months of opening an account.

How to earn rewards

The VentureOne Rewards Credit Card earns 1.25 Capital One Venture Miles per dollar on every purchase.

You can earn additional miles by booking your travel through Capital One Travel. Hotel and car rental bookings made through the bank’s portal earn 5 miles per dollar.

How to redeem rewards

You can redeem the miles you earn with the Capital One VentureOne Rewards card for a variety of travel, experience, and cash back options.

Redeem miles for travel

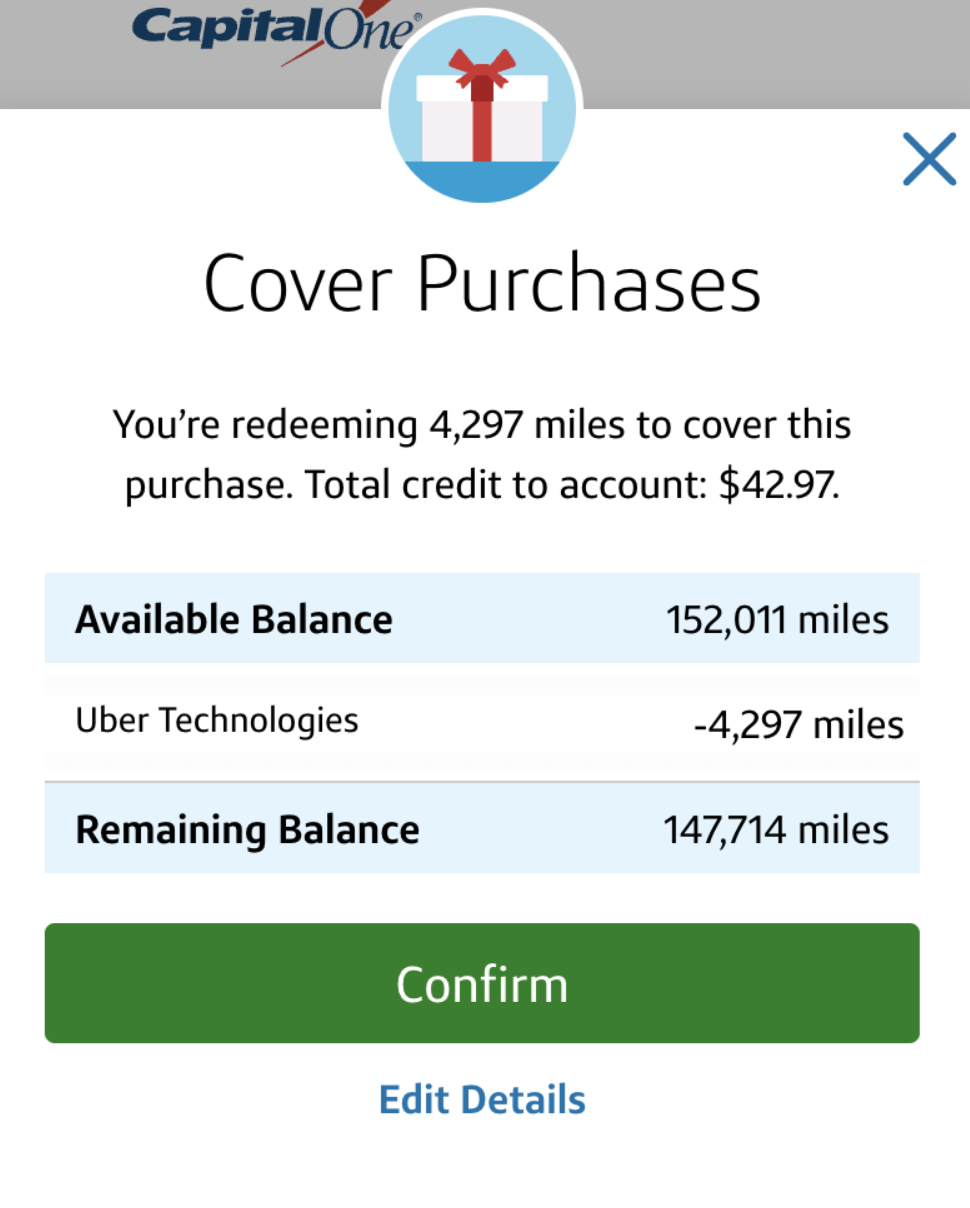

The easiest way to redeem your Venture miles for travel is to pay for travel purchases using your card and trade in your miles for statement credits to offset your travel purchases. You’ll get one cent of value out of each of your miles when you redeem them this way.

The easiest way to redeem your Venture miles for travel is to pay for travel purchases using your card and trade in your miles for statement credits to offset your travel purchases.

Hearst

You can also use miles to pay for travel purchases through Capital One Travel, but you’ll lose out on earning additional miles if you redeem them this way.

As an example, if you redeem 50,000 miles for a $500 hotel booking through Capital One Travel, you will earn no miles for that booking. But if you book your hotel through Capital One Travel and charge it to your card, you’ll earn miles for your hotel booking. Once the charge posts to your card, you can use your miles for a statement credit. You’ll have gotten the same value from your miles, but you will have earned an extra 2,500 miles from your Capital One Travel booking.

Point transfers to airline and hotel partners

If you want to get the most value from your miles, you’ll want to transfer them to one of Capital One’s 18 airline and hotel transfer partners. While point transfers can offer outsized value through point redemptions for business class flights, you’ll have to learn how to use travel program sweet spots and have a bit of luck — most airlines only release business class award tickets on a small number of routes and dates.

Capital One’s transfer partners don’t include any U.S.-based airlines, but they do include several relatively easy-to-use programs. The transfer partners most useful to consumers in the United States are Air Canada Aeroplan, Avianca LifeMiles, British Airways Executive Club, and Flying Blue.

Capital One Entertainment

Redeeming miles through Capital One Entertainment gets you access to a wide variety of concerts, dining experiences, and sporting events — over 500,000 events in total. Not every offer through Capital One Entertainment is a great value, but Major League Baseball fans can find a good deal on seats, which start at 5,000 points each.

Other redemption options

Finally, you can redeem your points for cash or gift cards. These redemption options offer less value than travel redemptions. You’re going to only get half a cent out of each of your miles when you redeem for cash and you’re likely to get similar value through gift card redemptions.

Benefit highlights

Capital One issues the VentureOne Rewards Credit Card as a Visa Signature card to qualified applicants. If your card is issued as a Visa Signature, it will come with the following essential benefits.

- Extended warranty – Doubles the warranty on the items you buy with your card, up to one additional year, on eligible warranties of three years or less.

- Purchase assurance – Protects your new purchases against damage or theft within 90 days of the date of purchase.

- Auto rental collision damage waiver – When you rent a car with your VentureOne card and decline the car rental company’s collision damage waiver, you can be covered against damage and theft of your rental vehicle. Coverage is secondary to your personal auto insurance.

- Lost luggage reimbursement – Get up to $3,000 in reimbursements to replace your luggage if it is lost by a common carrier, such as an airline.

Who it’s good for

If you have a specific reason for using Capital One’s transfer partners and want a card that earns transferable points with no annual fee, the Capital One VentureOne Rewards Credit Card might be a good fit. It’s the only one of Capital One’s Venture cards, other than the Capital One VentureOne Rewards for Good Credit, without an annual fee, which makes it a low-cost option well-suited to budget travel enthusiasts.

But if you’re interested in Capital One Venture miles and can afford the annual fee, the Venture Rewards card offers two miles per dollar on all purchases, plus a generous welcome bonus and lounge access passes. If you travel often, the Venture X adds additional benefits like travel credits, a cardmember anniversary bonus, and unlimited airport lounge visits through PriorityPass.

Who should look elsewhere

Most likely, you can find more value with another card. Unless you plan to transfer to partners, a card that offers more generous cash back rewards can get you more in rewards — and without the need to offset travel purchases with statement credits. The Wells Fargo Autograph card is a good choice if you’re looking to earn rewards on travel — the card offers three points per dollar on travel, among other categories. And one of the 2% cash back credit cards: Citi Double Cash, the Wells Fargo Active Cash Card, American Express Blue Business Cash.

Bottom line

The Capital One VentureOne Rewards Credit Card is a credit card that features transferable miles with no annual fee. While this combination is relatively rare, the card is light on value — it earns only 1.25 miles on every purchase and most consumers who can afford the annual fee would be better off with a 2% cash back card.

Not the right credit card for you? Explore other options here.

Editorial Disclosure: All articles are prepared by editorial staff and contributors. Opinions expressed therein are solely those of the editorial team and have not been reviewed or approved by any advertiser. The information, including rates and fees, presented in this article is accurate as of the date of the publish. Check the lender’s website for the most current information.

This article was originally published on SFGate.com and reviewed by Lauren Williamson, who serves as Financial and Home Services Editor for the Hearst E-Commerce team. Email her at lauren.williamson@hearst.com.