The forecast of an above-normal monsoon and expected improvements in agricultural production could help ease food inflation in the coming months.

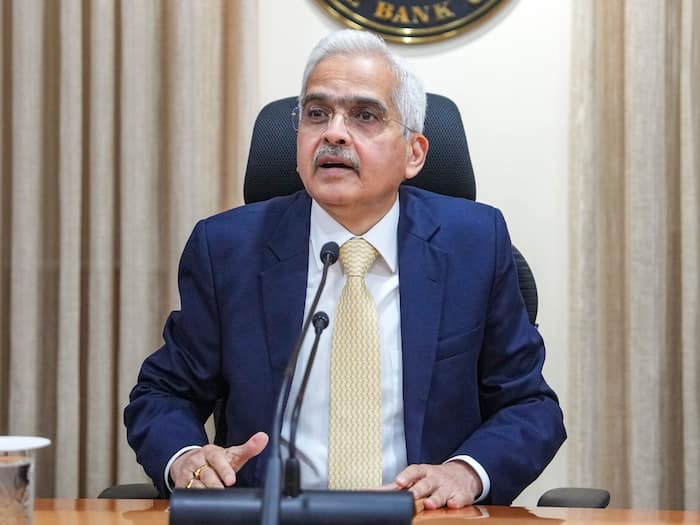

The Monetary Policy Committee (MPC), chaired by Governor Das, has been convening in Mumbai this week to deliberate on key policy decisions amidst a challenging economic landscape. RBI Governor Shaktikanta Das said that the MPC has decided to keep the policy repo rate unchanged at 6.50 per cent.

He added that RBI will remain focused on withdrawal of accommodation to ensure inflation continues to moderate to RBI’s target levels and ensure anchoring of inflation expectation and fuller transmission. RBI maintained FY25 consumer inflation forecast at 4.5%

The central bank’s stance on the benchmark interest rate has garnered significant attention, particularly given the persistent inflationary pressures, especially in the food sector.

The RBI’s repo rate, currently held at 6.5 per cent since its last increase in February 2023, is widely anticipated to remain unchanged for the eighth consecutive bi-monthly policy review.

(With inputs from agencies)