Chase Bank has one of the largest branch networks in the U.S. Here’s our review.

PATRICK T. FALLON/AFP via Getty Images

JPMorgan Chase & Co. is a leading global financial services firm with $2.6 trillion in assets and operations worldwide. Its history dates back to 1799 when Aaron Burr founded the Manhattan Company (the same Burr who fatally shot Alexander Hamilton in a duel five years later). Today, the company serves millions of customers in the U.S. and many of the world’s prominent corporate, institutional, and government clients under its J.P. Morgan and Chase brands.

Chase Bank offers an extensive lineup of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business loans, and payment processing (this Chase Bank review focuses on savings, checking, and CD accounts). While Chase has more than 4,700 branches nationwide, it also offers all the tools you’ll need for online banking.

The best banks offer competitive rates, but as other Chase Bank reviews mention, you can find better savings interest rates elsewhere. Still, Chase is a worthy option if you aren’t shopping for the highest APY, prefer in-person banking, or want multiple financial accounts under one roof.

Chase Bank review

Pros and cons of Chase Bank

Pros

- Full range of financial products and services

- Over 4,700 branches and 15,000 fee-free ATMs nationwide

- User-friendly online and mobile banking tools

- Frequently offers generous bonuses to new customers

Cons

- Meager rates on savings accounts and CDs

- Overdraft and monthly service fees (though some can be waived)

- $3 out-of-network ATM fee in the U.S. and $5 abroad

Chase Bank accounts

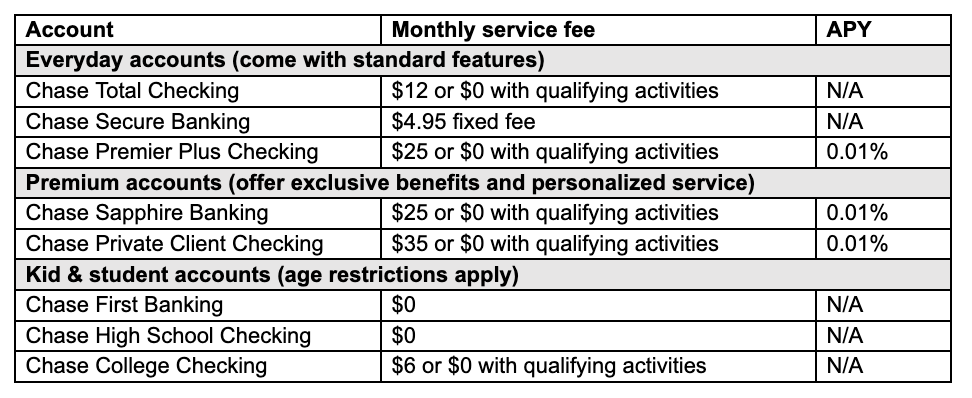

Chase Bank checking accounts

- A $0 minimum opening deposit and $0 to $25 monthly service fees, which are waived by meeting specific requirements.

- $34 overdraft fee, but there are ways to avoid it.

Chase offers a variety of checking accounts to meet different banking needs. Most have a monthly service fee that Chase will waive if you meet specific criteria. Each account comes with a debit card and access to mobile banking, including online bill pay, Zelle, mobile check deposit (“QuickDeposit”), and automatic transfers to your Chase savings account. Three checking accounts pay interest, but the 0.01% APY is well below the national average of 0.07%.

Basic overview of Chase’s checking accounts

Hearst

Chase Bank savings accounts

- 0.01% to 0.02% APY, very low rates compared with many online banks.

- A $0 minimum opening deposit and $5 to $25 monthly service fees, which are waived by meeting specific requirements.

Chase offers two savings accounts—Chase Savings and Chase Premier Savings—and both have poor APYs compared with many banks’ savings rates.

Chase Savings earns 0.01% APY across all balances, which means you’ll earn $1 a year on a $10,000 balance or $10 per year with $100,000. For reference, the national average savings rate is 0.45%, and the best savings accounts currently earn 5.00% APY or more. There’s a $5 monthly fee, which you can avoid by meeting one of the following monthly requirements:

- Have a minimum balance of $300 at the beginning of each day.

- Set up $25 or more in total Autosave or other repeating automatic transfers from your Chase checking account.

- Have a qualifying linked Chase bank account.

The standard Chase Premier Savings account earns 0.01% APY. Still, you can qualify for the 0.02% “premier relationship” rate when you link the account to a Chase Premier Plus Checking or Chase Sapphire Checking account and use it for at least five transactions per month. The monthly service fee is $25 — or $0 if you have one of the following each statement period:

- A minimum balance of $15,000 at the beginning of each day.

- A linked Chase Premier Plus or Chase Sapphire checking account.

Chase Bank CDs

- A $1,000 minimum deposit to open.

- 0.01% to 5.00% APY, with interest compounded daily.

Chase offers CDs ranging from one month to 10 years, but only a few offer attractive rates (the best CD rates are topping 5.00% APY right now). You’ll need a linked Chase checking account to access relationship rates, which are slightly higher than standard rates. The highest relationship rate is 5.00% APY for a 6-month CD, but there’s a $100,000 minimum deposit. Still, you can open any CD with a $1,000 minimum.

Depending on the CD term, you can choose to receive your interest either monthly, quarterly, semiannually, annually, or at maturity. Like most CDs, an early withdrawal penalty applies if you need your cash before the CD matures. The penalties vary by term, and you’ll pay:

- 90 days of interest for CDs less than six months.

- 180 days of interest for CDs from six months to less than 24 months.

- 365 days of interest for CDs of 24 months or longer.

Other Chase Bank products

Chase is a full-service financial institution whose product lineup extends beyond checking and savings accounts. It also offers financial products and services like:

- Credit cards

- Auto loans

- Home mortgage loans

- Home refinancing

- Home equity lines of credit (HELOCs)

- Wealth management and investment planning

- Business banking

- Commercial banking

Chase Bank customer service

Chase has a network of 4,700+ branches where you can access in-person banking and customer service. Otherwise, you can contact customer service through social media (X and Facebook), live chat in the Chase mobile app, or by phone 24/7.

Chase Bank fees

Many online banks have eliminated account fees, but Chase isn’t one of them. Here’s a rundown of the fees you might pay as a personal banking customer:

- $12 monthly service fee for Total Checking and $25 for Premier Plus Checking (or $0 if you meet specific requirements

- $5 monthly service fee for Chase Savings and $25 for Premier Savings (or $0 if you meet specific requirements)

- $34 overdraft fee (up to three per day) with no fee for overdrafts of $5 or less—or for Chase Overdraft Assist customers overdrawn by $50 or less

- $3 ATM fee in the U.S.

- $5 ATM withdrawal and $3 for inquiries and transfers at ATMs outside the U.S.

- $5 excess transaction fee

- $0 to $5 money order fee

- $0 to $50 wire transfer fee

How easy is it to get your money at Chase Bank?

With over 4,700 branches and 15,000 fee-free ATMs nationwide — plus robust online and mobile banking tools — Chase offers numerous convenient ways to access your cash. For example, you can:

- Get cash from an ATM

- Use your debit card to make purchases

- Send and receive payments through Zelle

- Receive direct deposits

- Write checks

- Send and receive wire transfers

- Set up a digital wallet.

- Use electronic funds transfers.

- Send payments via online bill pay

- Deposit checks using your smartphone

- Automate your savings

- Lock your card if you think it’s been compromised

Who Chase Bank is good for

Chase Bank is a good option if you’re content with lower rates and can meet the requirements to avoid monthly fees. It also makes sense if you prioritize in-person banking and want the option to have multiple financial accounts (such as banking, credit cards, and a mortgage) under one roof.

Who should look elsewhere

Chase’s APYs are low compared with many other online banks and credit unions, so you should look elsewhere if getting a competitive rate is a priority. Similarly, Chase’s monthly fees are on the high side. So, consider other options if you won’t meet the monthly requirements to avoid the fee.

Bottom line

Chase doesn’t have the best rates or lowest fees, but it offers convenience. As a full-service financial institution, Chase lets you have numerous financial accounts under one roof. It also provides easy access to your funds through an extensive network of branches and ATMs and robust online banking tools.

Chase Bank is an FDIC-member bank, so cash held in deposit accounts is federally insured up to $250,000 per depositor, per account ownership type. Chase may be a solid option for your personal banking needs if you’re not looking for the highest rates and can avoid the monthly fees.

Editorial Disclosure: All articles are prepared by editorial staff and contributors. Opinions expressed therein are solely those of the editorial team and have not been reviewed or approved by any advertiser. The information, including rates and fees, presented in this article is accurate as of the date of the publish. Check the lender’s website for the most current information.

This article was originally published on SFGate.com and reviewed by Lauren Williamson, who serves as Financial and Home Services Editor for the Hearst E-Commerce team. Email her at lauren.williamson@hearst.com.