![]()

Japanese retail analyst firm BCN+R recently investigated the rapidly changing video camera market and has now set its sights on the compact camera segment, asking, “Is the compact camera dead?”

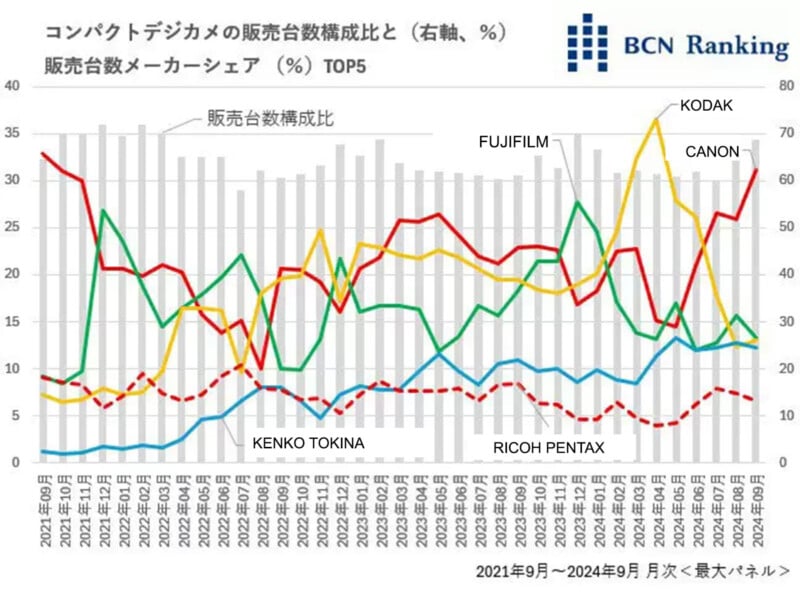

Amid fears that smartphones would utterly destroy the compact camera market, BCN+R analyst Ichiro Michikoshi writes, “Compact cameras still account for more than 60% of the number of cameras sold,” showing that no, the compact camera is not dead.

However, within BCN+R’s retail network, the compact camera market has definitely changed in recent years. One of the most significant changes has been the players involved. Casio, once a big name in the camera space, is gone. Other veteran camera makers like Canon, Fujifilm, Nikon, and Sony have increasingly shifted their attention away from compact cameras.

At this point, it is worth noting that the Fujifilm X100 series, including the über popular X100VI, may not move the needle of charts like this much because the chart below shows sales volume by units, not total revenue. A more expensive camera like the X100VI may benefit Fujifilm’s bottom line considerably, but will never sell as much as cameras that cost a fraction as much.

Over the past three years, from September 2021 through September 2024, the order of the top five compact camera manufacturers has gone through significant upheaval. Few companies have experienced the roller coaster like Kodak, who started the period between five and 10 percent market share before peaking at over 70 percent earlier this year, only to drop below 30 percent by September.

This matches BCN+R sales data PetaPixel reported back in May, which showed that a resurgence in demand for compact point-and-shoot cameras, which quickly outpaced supply, led many to look at Kodak cameras, despite their very aging technology.

While this surge in demand for Kodak cameras was partly driven by their low prices, Michikoshi explains that the average cost of compact cameras has risen quite a bit in the past four years, mirroring the trend observed with interchangeable lens cameras. The proportion of cameras priced over 50,000 yen, around $330 at current exchange rates, rose from 6.8% of total units sold in September 2021 to 33.2% by September 2024. This reflects inflation to a degree but also shows how camera manufacturers — and consumers — have shifted toward more expensive products that promise superior quality. Michikoshi cites the Canon PowerShot SX740HS and PowerShot G7 X Mark II, and Panasonic’s Lumix FZ85D (FZ80D in North America) as notable models in this higher price bracket. The high-zoom FZ85D was released this summer, one of only a handful of new cameras in the category.

Although Ricoh Pentax is sitting squarely in fifth place in the rankings, as it has almost every month for the past four years, it is worth noting that the company has carved out a strong niche in the segment with its GR-series cameras. BCN+R adds that the company even opened the GR Space Tokyo showroom in August, a considerable contrast to what Kodak and Kenko Tokina are doing despite being higher in the rankings. Those latter two companies have essentially withdrawn from manufacturing altogether, even though people are still buying existing cameras at relatively low prices.

If Ricoh were able to produce enough GR III cameras to meet demand, it’s a safe bet they would move up the rankings, or at least grab a larger piece of the pie.

While smartphone imaging capabilities have eclipsed some of the compact cameras on the market today, there remains a demand for the photographic experience only dedicated cameras can offer, although Apple is even targeting that, too.

Image credits: Featured image created using an asset licensed via Depositphotos.