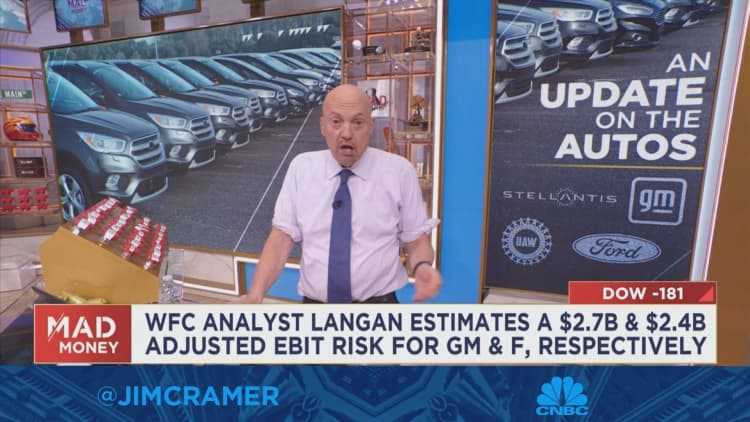

CNBC’s Jim Cramer on Wednesday examined the ramifications a strike by the United Auto Workers union would have on the big three U.S. automakers.

The UAW, one of the largest unions in North America, and its new president, Shawn Fain, started officially bargaining in June, focusing on pay increases, pensions and job security. The union will vote on whether to strike next week, and if they decide to do so it could cost automakers billions.

But Cramer said he doesn’t think investors should rush to sell off their auto shares, saying he feels the strike is a one-time cost that these companies can bounce back from. Wall Street, he said, cares about the future more than the past, and he doubts the federal government would allow a strike involving an essential industry to drag on for long.

“If you already own the automakers, don’t panic and sell these stocks that are already well off their recent highs, because I think most of the bad news is already baked in,” he said. “There’s only so hard the UAW can push before the White House is likely to step in and force a compromise.”

Cramer noted that auto stocks are already down from their highs in a short period of time. According to FactSet, Ford is down 23% in the last month and a half, General Motors is off about 19% since mid-July, and Stellantis is down more than 13% in the last two weeks or so. Cramer also said he doubts the agreement UAW would eventually reach with automakers will be at the level of Fain’s current demands.

“The way I see it, look, that’s just Fain’s way of playing hardball, which is exactly what negotiators do — you start by asking for the world, then you cut a deal,” Cramer said.