CNBC’s Jim Cramer admitted it’s been hard to “parse this economy,” but on Tuesday he pointed to signs that it is slowing down, looking at several recent weak earnings reports and new U.S. manufacturing and services data.

Cramer referred to these factors as “brown shoots” that are disrupting U.S. economic growth.

“When you combine the anecdotal evidence with the empirical — the PMI report — you can see that right now, at this moment, the brown shoots are infecting the green,” he said. “And that’s exactly what we need for the Fed to justify cutting rates.”

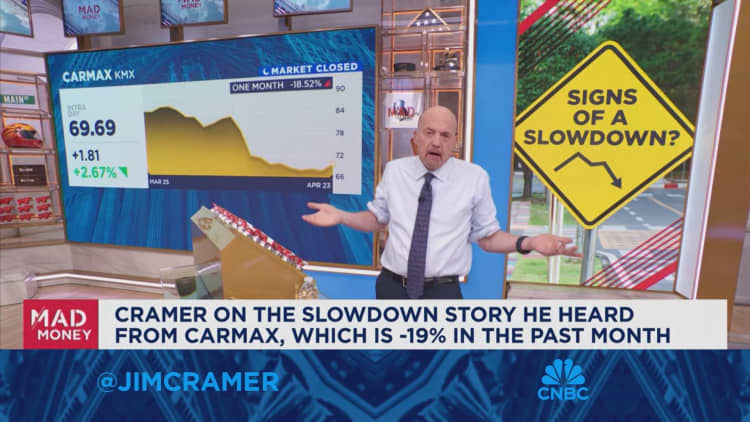

While some companies are posting positive financial reports, Cramer said earnings have become “spotty.” He attributed used car dealer CarMax‘s weaker-than-expected earnings in part to high financing charges. He also said home furnishing retailer RH‘s business was hurt by high rates and a lack of new home sales.

But to Cramer, the S&P Global Flash US composite purchasing managers index data is crucial to getting a sense of the current economy. The index showed lower-than-expected readings for manufacturing and services, with the former at its lowest reading in four months. Cramer said the data may have put a “near-term Fed rate cut back on the table” and specifically pointed to a section of the report that suggested a workforce reduction in services.

“Excluding the opening wave of the Covid-19 pandemic, the decline in services staffing levels in April was the most pronounced since the end of 2009,” the report said.

“Real bad news for the economy,” Cramer said. “But remember, we need bad news for the economy because that’s what cools off inflation — something that’s also noted in this PMI report.”

CarMax and RH did not immediately respond to requests for comment.