In view of the potential threat, Tata Sons have already initiate the process with the Reserve Bank of India to de-register itself as a core investment company.

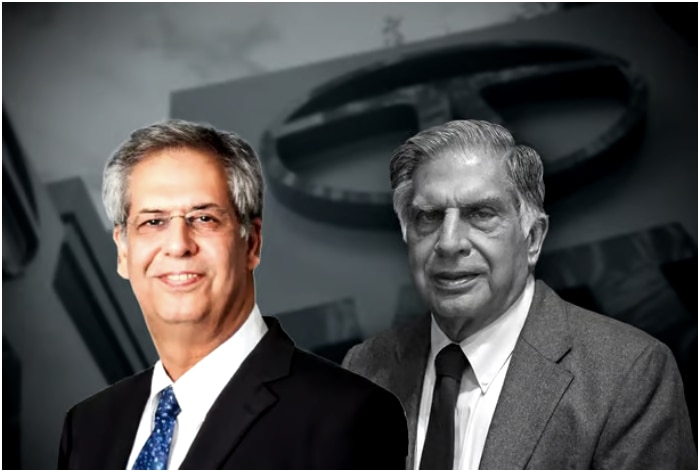

With Ratan Tata’s half-brother Noel Tata now chairman of Tata Trusts, the Shapoorji Pallonji group is reportedly eager to push for a Tata Sons listing, while the Tata Group is doing everything to keep it unlisted, The Hindu Business Line reported citing sources. The Tata group is doing everything possible to keep Tata Sons private, and it will never be listed, said sources.

Tata Sons Initiates De-Registration Process

In view of the potential threat, Tata Sons has already initiated the process with the Reserve Bank of India to deregister itself as a core investment company. The company has applied for the voluntary surrender of its Core Investment Company registration certificate and to function as an ‘unregistered Core Investment Company’ Instead. It has settled the majority of its debts. Given that it isn’t dependent on public funds, there’s no compulsion for it to register with the Reserve Bank of India as a Core Investment Company.

According to sources, the SP Group has not changed its stand and favours listing the company. It’s still early days, but signs are hinting at increased attempts to push forward with the listing.

However, both Tata Sons and the SP Group remained silent, refraining from making any statements or issuing any clarifications.

Financial Woes

The SP Group has been grappling with financial woes for quite some time now. Taking its shares in Tata Sons public could be a game-changer in alleviating these monetary hiccups. As part of its fund-raising exercise, the SP Group has decided to make some of its vital offshoots go public, with Afcons Infrastructure being the first to set this tone by going public just now.

Following close on heels, we expect SP Real Estate to make its public debut but this is likely to be in the pipeline for the next couple of years. Furthermore, last year saw the group letting go part of its stake in PNP Port to the JSW group.

Goswami Infratech, a promoter entity, extended an interest repayment date which was set for September 30, and now it will be due on the 31st of December, 2024. Notably, Tata Sons is also expected to refinance the debt it took on in order to get a slice of the promoter-level entity, Sterling Investment Corporation, a key stakeholder in Tata Sons.

Noel Tata’s Relation With SP Group

With Noel Tata leading the Tata Trusts, which holds a majority stake in Tata Sons (66 percent), the dynamics between the two groups is expected to improve which had been affected during the tenure of Cyrus Mistry. As per sources, SP groups expect that things will be favourable for it as Noel is related to the promoter family by marriage.

Non-Banking Financial Company

In September of 2022, Tata Sons earned the status of a Tier-1 Non-Banking Financial Company (NBFC) according to the Reserve Bank of India’s recently launched rules for NBFCs. This regulation is applicable to NBFCs that hold significant systemic importance, warranting a level of oversight on par with banks. An intriguing term of this classification is a time frame of three years, within which these organisations need to go public.

Notably, the scale-based regulations are based on complexity, liabilities nature and size, leverage, financial interconnectedness, segment penetration and lastly group structure.

According to experts, the top ten NBFCs in terms of assets will always find themselves in the highest tier, regardless of any other factors. If an NBFC makes it into this upper tier, it will have to comply with rigorous regulations for at least five years from the moment it earns that spot. This is the case even if it falls short of maintaining the initial criteria in the subsequent years.