New Delhi: The narrative-driven surge in the stock prices of defence companies has now waned, with several of these stocks falling 20-40 percent in just a few months. Analysts say that the sharp rise in these stocks post the COVID-19 pandemic was driven by ‘newbie’ investors seeking to jump on the bandwagon of a booming stock market, and who were led to invest in these stocks by social media influencers.

These investors are now facing the reality of project delays and low profitability among defence companies.

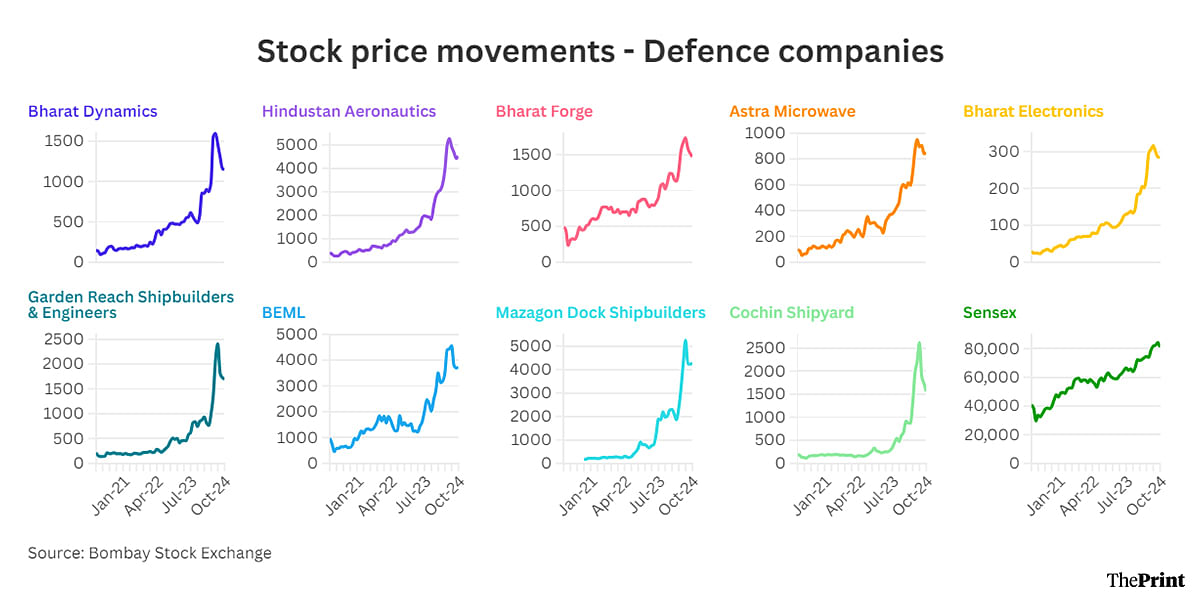

Data from the Bombay Stock Exchange (BSE) shows the nine defence stocks ThePrint has analysed grew an average of 606 percent between January 2020 and April 2024, with some outliers like Hindustan Aeronautics (881 percent) and Mazagon Dock Shipbuilders (1,308 percent) exceeding this by a very large margin.

A large part of this rally in defence stocks was driven by a perception and narrative that the Indian government’s decision to increasingly source its defence procurement from the domestic industry would result in immediate gains for these companies.

This narrative-led stock market enthusiasm has been reported on before by ThePrint in a multi-indicator analysis that pointed to a bubble forming in India’s stock market.

At play, according to stock market analysts, was a surge in the number of new and inexperienced investors entering the market since the COVID-19 pandemic, their relative gullibility in the face of the investment advice from social media influencers, and a fear of missing out (FOMO) on the ongoing stock market boom.

However, what this meant was that these new and often young investors ignored sector-specific factors that impact the profitability of defence companies, such as the distinct possibility of cost and time overruns on projects, and the dependence of these companies on a single buyer—the government.

As project delays became apparent and new orders to defence firms started flagging, investors began to lose interest—a trend that has led to the recent sharp fall in the stock prices of several defence companies over the last few months.

Also read: Public sector bank stocks fall 20-30% from peak as investors face reality of falling profitability

A narrative losing steam & delays foiling plans

Of the defence-related stocks, the shipbuilders have faced the brunt of the changing investor sentiment. Kochi-based shipbuilding and repair company Cochin Shipyard saw the biggest fall over the past few months, falling more than 40 percent from its peak in July this year. Kolkata-based shipbuilding firm Garden Reach Shipbuilders & Engineers saw its stock price fall nearly 30 percent since then.

“In segments like shipping, there are execution challenges,” V.K. Vijayakumar, chief investment strategist at Geojit Financial Services, explained. “Shipbuilding is very capital intensive, and it takes months and, perhaps, years for an order to be executed. There can be cost and time overruns.”

He added that the market was ignoring all these challenges, particularly with the “newbies” in the market just buying these stocks because there is news that the company has received an order, or because a “finfluencer told them to”.

Kunal Shah, senior research analyst at Carnelian Asset Management & Advisors reiterated this, saying that, in defence, “because of the narrative, there were a lot of expectations built in way ahead of what could actually happen in the form of numbers and order books”.

The analysts also pointed out that investors ignored the basic structure of the defence sector which leads to low profitability.

“The defence sector is a monopsony, where there is a single buyer, which is the government,” Vijayakumar said. “And the government is not likely to buy at premium prices, so the profit margins of defence companies are slim. But the new investors don’t look at all that.”

ICICI Securities, in a note released earlier this month, also pointed to the underperformance of defence stocks and linked this to delays in orders.

“Defence stocks have not fared well over the last couple of months, mainly due to a relative dearth of fresh orders and delay in expected orders,” it said, adding that new orders have “fallen short of expectations”.

That is now being sensed by the markets.

Shah explained this in terms of the “FOMO” phenomenon, a factor driving people to buy stocks, which now seems to be ebbing.

“What happens is that first FOMO plays out, and then it fades,” he explained. “The narrative gets built, then there’s FOMO when everyone is getting into it, and then things start fading out.”

In other words, the heady growth in the stock prices of defence companies over the past few years induced new investors to jump on this bandwagon. However, as sector fundamentals asserted themselves, this FOMO effect petered out.

Another factor that could be playing out is the manipulation of stock prices in those companies that have low levels of floating stock—the amount that is open for the public to buy and sell.

“When you have low floating stock, it is possible for a cartel of operators to buy excessively,” Vijayakumar explained. “In such cases, there won’t be commensurate selling, because the bulk of the holdings are with the government. So, this buying during low supply pushes the price up.”

These market manipulators can then choose to sell when the price is high, flooding the market with their holdings, resulting in profits for them, but also a sharp fall in the stock price.

“However, that doesn’t take away the structural long-term story in defence, which is something we are still very convinced about,” Shah concluded. “But one must certainly be aware of overvaluations, which are now getting rationalised, and which have further scope for rationalisation as well.”

Also read: Individuals, businesses are increasingly defaulting on microloans. Both lenders & borrowers at fault