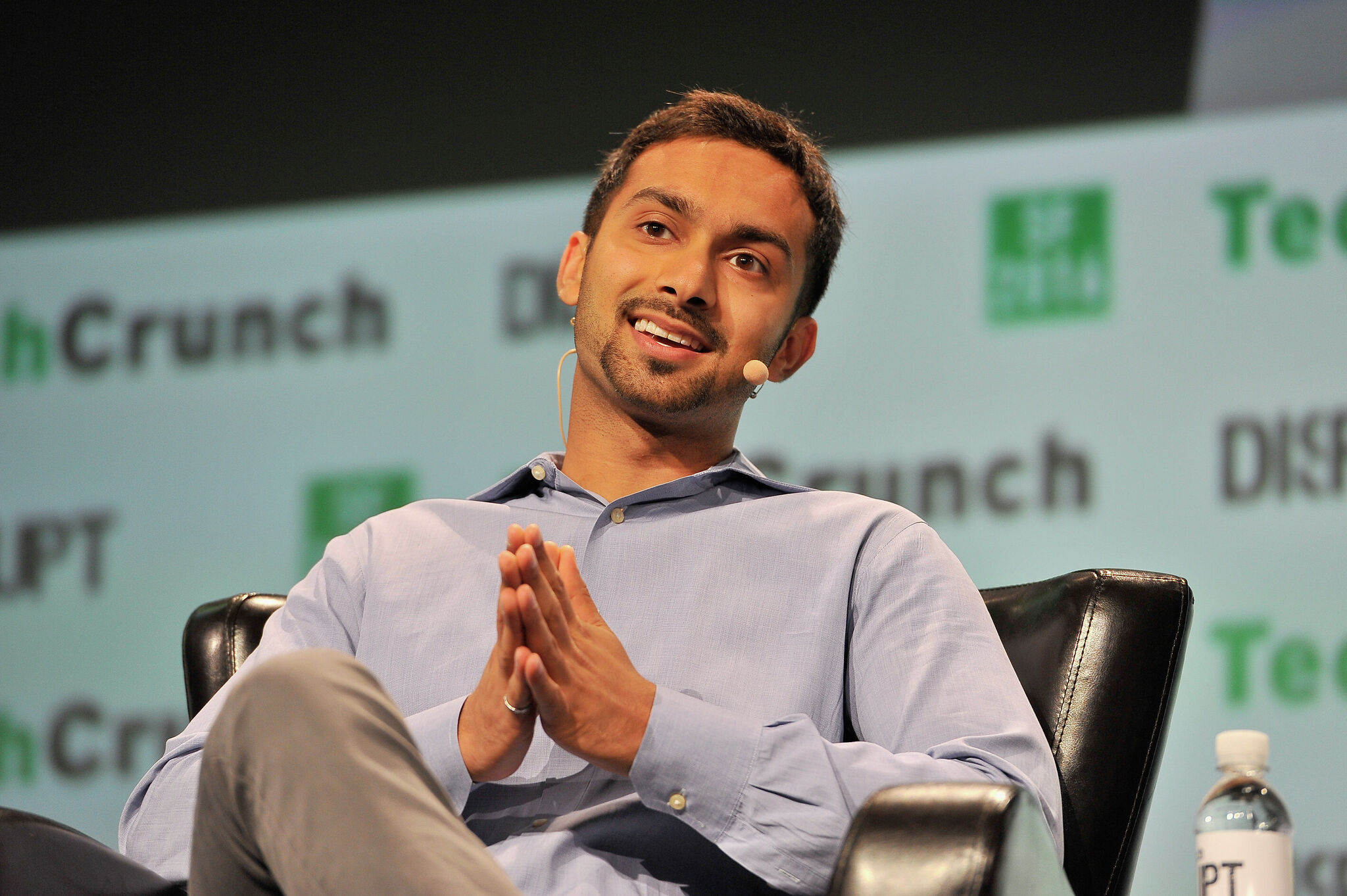

FILE: Instacart co-founder Apoorva Mehta speaks onstage during the TechCrunch Disrupt conference on Sept. 14, 2016, in San Francisco.

Steve Jennings

Instacart, long one of San Francisco’s most valuable startups, finally went public Tuesday, turning its theoretical price valuations into cold hard cash for many employees.

Apoorva Mehta, one of the grocery delivery app’s co-founders, is making off like a bandit. The 37-year-old owns 10% of Instacart, even after cashing out almost $20 million worth of shares in the initial public offering, according to a prospectus document filed with the Securities and Exchange Commission dated Sept. 18.

It’s the end of a yearslong road for Mehta, who co-founded the firm in 2012. He stepped down as Instacart’s CEO in 2021 but remained chair of the firm’s board of directors. Now, he’s resigning from that post and walking away with around $850 million in Instacart stock.

Advertisement

Article continues below this ad

Instacart confirmed the resignation and Mehta’s stock holdings in the SEC filing.

Around 1,000 Instacart employees celebrated at the company’s San Francisco headquarters Tuesday, the firm told Quartz. Celebrations of the IPO reverberated around the wider tech industry too. One of the classic startup exit models — turn founders and employees into multimillionaires by entering the company into the public market, allowing them to sell off their amassed shares once the business’s value has been established — has been all but blocked off since December 2021 due to faltering tech stocks and more profit-oriented investors. This IPO could pave the way for more private tech firms to once again contemplate trying their luck on the public markets.

While the offering was viewed as a success, it did see Instacart’s on-paper value cut by about three-fourths since 2021. The initial high was short-lived as well: Instacart’s first trading day saw the stock jump from $30 to $42 a share, though as of midday Wednesday, it had lost most of those gains and was trading at around $30.

Mehta posted on X, formerly known as Twitter, on Tuesday that the idea for Instacart came to him when he found his refrigerator nearly empty in his San Francisco apartment in 2012. He’d tried out 20 other startup ideas in the two years prior, he told the Los Angeles Times in 2017.

Advertisement

Article continues below this ad

Instacart turned out to be his big winner, a grocery delivery platform that built itself to profitability through a booming advertising business and the use of low-paid gig workers. When interest in delivery skyrocketed during the pandemic, it was a turning point for Mehta’s company; the firm’s valuation shot up, and he ceded the top job to Fidji Simo, a former Facebook exec.

Now, Mehta is fully cut loose from firm leadership but still holds on to a store of company stock larger than the entirety of what the firm put on the open market Tuesday. Mehta has 28,280,677 shares — at $30 a piece, which Instacart hovered around midday Wednesday, that’s a holding of around $850 million.

“A lot of people have said that perhaps I was pushed out of the company,” Mehta told Forbes in a story published Tuesday. But he said that he’s actually leaving to focus on his new startup, Cloud Health Systems. “The reality is, if I wanted to be the CEO of Instacart, I would be the CEO of Instacart.”

Mehta did not immediately respond to SFGATE’s request for comment.

Advertisement

Article continues below this ad

Hear of anything happening at Instacart or another tech company? Contact tech reporter Stephen Council securely at stephen.council@sfgate.com or on Signal at 628-204-5452.