An activist at the offices of Rep. Michelle Park Steel in Cypress, California, on Feb. 24, 2023

Araya Doheny | Getty Images

Social Security is essential to older Americans’ financial security, yet there always seems to be a new headline about how the benefits are at risk.

Douglas Boneparth, a certified financial planner and president and founder of Bone Fide Wealth in New York, said clients ask him how they can prepare for their retirement if Social Security benefits are slashed — or even eliminated.

“We work with a relatively young clientele, and they aren’t too confident today’s system will be the one they inherit when they retire” Boneparth said. “They want to hedge their bets.”

CNBC asked Boneparth, a member of CNBC’s Advisor Council, if he could provide an example of how much more people would need to save if they have to fund their retirement with a smaller Social Security benefit, or none at all.

Workers would need to triple savings

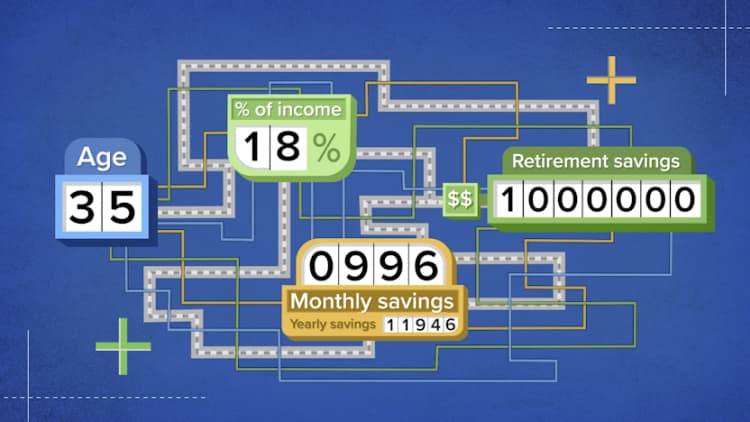

CFP Clifford Cornell, an associate financial advisor at Bone Fide Wealth, provided a scenario of a 30-year-old woman who earns $75,000 a year and already has $20,000 saved for retirement. The woman plans to leave the workforce at age 65 and to spend about $40,000 a year in retirement. Her life expectancy is 90.

In order not to run out of money in retirement, she’d need to save $375 a month in her workplace 401(k) plan — if the Social Security program remains fully in place. Cornell assumed a 6% annual return before retirement and 4% after.

More from Personal Finance:

Biden ESG rule survives challenge in court

IRS to target ‘unscrupulous’ tax preparers amid new crackdown

White House moves ahead with new plan to cancel student debt

If Social Security benefits were cut in half, she would need to save $750 a month to not run out of money in retirement, or double the amount based on a fully funded program.

If the program were completely done away with, she’d need to save $1,125 a month, or triple the amount.

Social Security is the main source of income for Americans age 65 and older. With the benefits, about 10% of older adults already live in poverty, according to the Center on Budget and Policy Priorities. The share of older people living in poverty would swell to nearly 40% without the benefits. The average retired worker receives about $1,840 a month.

“The old-age poverty rate would soar if Social Security benefits were cut,” said Richard Johnson, a senior fellow at the Urban Institute. “Millions of seniors would be unable to afford basic needs, like food, shelter and health care. Many seniors would have to turn to their children for financial help.”

The future of Social Security

The Social Security program has been weakened by a rise in people retiring and the fact that people are living longer. About 10,000 baby boomers retire every day on average. Since beneficiaries are living longer, the program has been paying recipients over a longer period of time. The share of workers paying into the system — via payroll taxes — has been falling relative to the number of beneficiaries, creating an imbalance.

As a result, without any action from lawmakers, the trust fund that supports Social Security benefits for retirees is estimated to run dry in 2033.

If the trust fund is depleted, it doesn’t mean benefits would go away entirely.

Workers would continue to pay Social Security payroll taxes, and those collected funds would still be payable to retirees. However, there would be cuts. About 77% of promised benefits would be payable if the trust fund runs out, according to the Social Security Administration.

Congress will almost surely tweak Social Security to fix the solvency problem.

Potential fixes might include reducing benefits, delaying the “full retirement age,” raising taxes on benefits, increasing the financial penalties for claiming Social Security before full retirement age or a combination of these and other factors.

It’s likely to be a “last-second compromise” and “there are going to be losers,” said David Blanchett, head of retirement research at PGIM, the asset management arm of Prudential Financial, in September on “This week, your wallet,” an audio program produced by CNBC’s personal finance team.

Older people and current retirees likely won’t see a change to their benefits, Blanchett said. However, “I do believe younger Americans — if you’re maybe in your 40s — should count on a lower benefit,” he said.

— Additional reporting by CNBC’s Greg Iacurci.