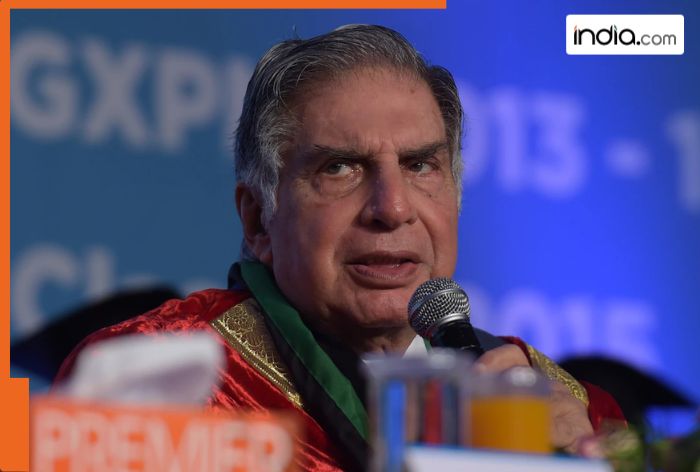

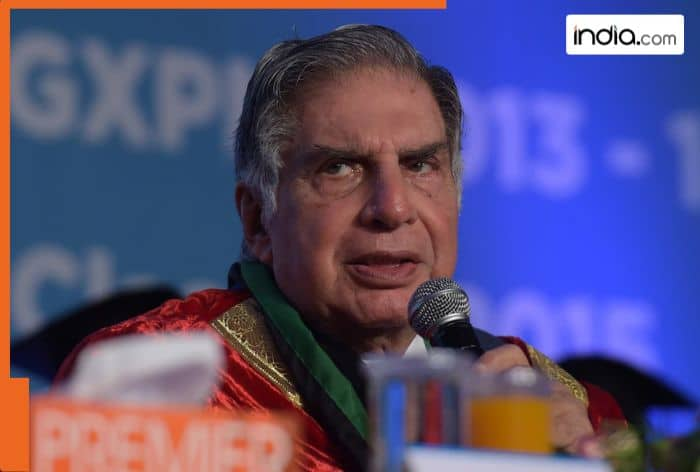

Ratan Tata, the legendary industrialist and Chairman Emeritus of Tata Sons passed away on October 9 in Mumbai’s Breach Candy Hospital. The

New Delhi: Ratan Tata, the legendary industrialist and Chairman Emeritus of Tata Sons took his last breath on October 9 in Mumbai’s Breach Candy Hospital. The final rites were performed with full state honors on Thursday evening. Among those who paid respects to the business tycoon are Union Home Minister Amit Shah, Union Minister Piyush Goyal, Maharashtra CM Eknath Shinde, Deputy CM Devendra Fadnavis, Gujarat CM Bhupendra Patel, and industrialist Mukesh Ambani. Tata was one of India’s most internationally recognised business leaders. The Tata Group is one of India’s largest companies, with annual revenues in excess of USD 100bn.

Ratan Tata’s successor as Tata Trusts chairman was announced within two days after the patriarch passed away. Putting all speculation to rest around his successor, 67-year-old Noel Naval Tata, half brother of Ratan Tata, has been named chairman of Tata Trusts and all trusts covered under it.

The unanimous decision, coming into immediate effect, was made at an hour-long meeting of the trustees of Tata Trusts here on Friday. The Tata Trusts has a 66 percent stake in Tata Sons, the parent company of the $165-billion salt-to-software conglomerate.

How much stake did Ratan Tatal hold in Tata Sons?

The Tata group was founded by Jamsetji Tata in 1892. The trust spent massively on education and healthcare. Two main trusts owned 66 percent of Tata Sons: Sir Dorabji Tata Trust and Sir Ratan Tata Trust, which own 27.98 percent and 23.56 percent, respectively.

A long distance away is the third largest trust–JRD Tata Trust–which controls 4.01 percent in Tata Sons. Others hold much lower stakes–RD Tata Trust at 2.19 percent, Tata Education Trust 3.73 percent and Tata Welfare Social Trust also 3.73 percent.

Tata Trusts Received Highest Ever Dividend In 2024:

Tata Trusts received its highest-ever dividend of Rs 933.4 crore from Tata Sons in the fiscal year ended 2024. This is more than double what the company earned in FY 23. The trusts allocate their dividend income to various charitable initiatives, including healthcare, water access, rural development, and education.

According to the Tata Trusts’ 2023 annual report, the Trusts distributed 48.5 percent of their funds for healthcare, 16.9 percent for rural upliftment, and 16.5 percent for education. Another 10.4 percent of the funds were allocated to institutions, and the rest for water, urban poverty alleviation, and energy.