Witthaya Prasongsin | Moment | Getty Images

If your tax refund or bill is bigger than expected, it could be time to adjust your paycheck withholding — and a simple calculation could help, experts say.

Typically, you get a refund when you overpay taxes throughout the year, and you owe money when you don’t pay enough. Many workers contribute via paycheck withholdings based on a completed form called a W-4.

But the form is “very confusing,” according to certified financial planner and enrolled agent John Loyd, owner at The Wealth Planner in Fort Worth, Texas. “You’re checking these boxes, but you really don’t know how much the IRS is going to withhold.”

How paycheck withholdings work

When you start a new job, you fill out Form W-4, which tells employers how much to withhold from each paycheck for federal income taxes. The form asks about your filing status, other income, dependents and more, which affect the percentage withheld.

“If you answer it properly, you probably will get a good outcome,” said JoAnn May, a Berwyn, Illinois-based CFP at Forest Asset Management. She is also a certified public accountant.

“The problem is that form is so foreign to people,” she said. “They see it and their eyes glaze over.”

You also need to tell your employer about life changes — such as marriage, divorce, having a child or adding a second job — to make the necessary Form W-4 adjustments. After updating Form W-4, it’s important to double-check your paystubs for these changes, Loyd said.

Experts suggest reviewing your withholdings periodically to avoid a larger-than-expected tax bill or refund.

Calculate last year’s ‘effective tax rate’

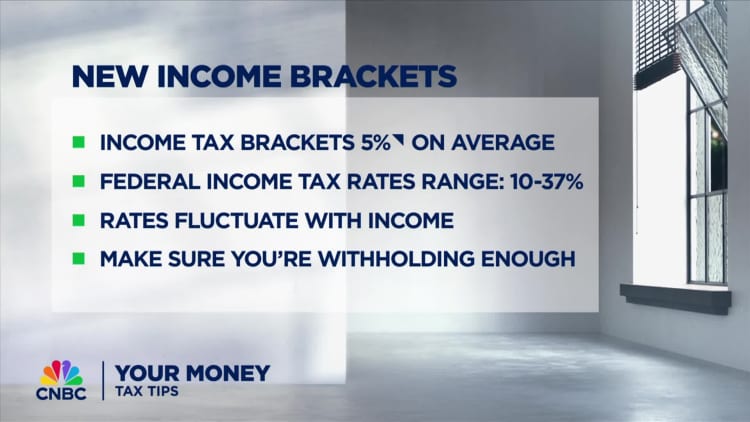

While Form W-4 can be daunting, Loyd said you can check your withholding by calculating the previous year’s “effective tax rate,” or the percent of taxable income you pay in levies. This is different from your marginal tax bracket.

Start by reviewing last year’s tax return. You calculate your effective tax rate by dividing your total tax (line 24) by taxable income (line 15).

“A person may be in the 22 percent bracket, but the rate they’re actually paying on everything may be 12 percent,” Loyd said.

If your 2024 earnings are similar to 2023, you’ll want your federal paycheck withholdings at roughly last year’s effective tax rate, Loyd said.

For example, if your gross paycheck is $1,000 and last year’s effective tax rate was 12%, you’ll want about $120 withheld in federal taxes, he said. Of course, this withholding could change if you have earnings from another job.

Don’t miss these stories from CNBC PRO: