For small business owners who travel, the Chase Ink Business Preferred Credit Card offers more points, more redemption opportunities, and better travel protections than almost any other small business travel credit card — all with a relatively low $95 annual fee.

SBDIGIT/Getty Images

But if you’re a small business owner who stays closer to home, the card has plenty for you as well. In addition to its 3x rewards on travel, the Ink Business Preferred offers equally generous rewards in other business-relevant categories, including shipping, internet, cable, phone services, and online advertising.

Here’s what you need to know about the Ink Business Preferred.

Chase Ink Business Preferred review

Highlights

- Earn three points per dollar on the first $150,000 spent each year (counted from your approval date) on shipping, advertising purchases made with social media sites and search engines, internet, cable and phone services, and travel.

- Redeem points for 1.25 cents each toward travel through Chase Ultimate Rewards.

- Travel insurance benefits, including auto rental collision damage waiver insurance, trip delay reimbursement, baggage delay protection, and lost luggage reimbursement.

- Transfer points to airline and hotel partners, including Air Canada Aeroplan, Air France/KLM Flying Blue, British Airways Executive Club, Southwest Airlines Rapid Rewards, United Airlines MileagePlus, and Hyatt.

- No foreign transaction fees.

- $95 a year annual fee.

Pros and cons

The Chase Ink Business Preferred offers generous rewards in business categories, but larger businesses take note: The amount is capped at $150,000 in spending a year.

Pros

- 3x rewards on several useful business categories.

- Points can be redeemed for travel through Chase Ultimate Rewards for 25% more value.

- Ultimate Rewards offers many easy-to-use transfer partners, including Air Canada Aeroplan, Air France/KLM Flying Blue, British Airways Executive Club, Southwest Airlines Rapid Rewards, United Airlines MileagePlus, and Hyatt.

Cons

- 3x rewards are capped at $150,000 in spending annually.

- When renting a car within your country of residence, the auto rental collision damage waiver insurance only kicks in as primary insurance when renting for business purposes.

- Trip delay protection requires a delay of at least 12 hours or overnight.

Current welcome offer

New cardmembers can earn 100,000 bonus points after spending $8,000 on purchases within the first three months of opening the card.

The Ink Business Preferred earns Ultimate Rewards Points, which can be transferred to one of Chase’s 15 airline and hotel transfer partners.

How to earn rewards

The Chase Ink Business Preferred card earns three points per dollar on the first $150,000 in combined spending in the card’s business categories. Eligible business spending categories include:

- Shipping purchases.

- Advertising purchases made with social media sites and search engines.

- Internet, cable, and phone services.

- Travel.

Once you’ve exceeded the $150,000 in combined purchases, your spending in the card’s bonus categories will earn one point per dollar.

All other purchases earn one point per dollar, with no limit on the number of points you can earn.

How to redeem Ink Business Preferred rewards

You’ll find no shortage of ways to redeem your Ultimate Rewards points, but some options offer more value. Here are the best ways to use your rewards.

Travel through Chase Ultimate Rewards

If you’re a business owner who travels often, you’re likely earning plenty of rewards from your Chase Ink Business Preferred card. Fortunately, travel is also one of the most lucrative ways to redeem your points. When you use your points to book flights, hotels, car rentals, activities, or cruises through Chase Ultimate Rewards, you’ll get 1.25 cents in travel out of each of your points..

Booking travel through Chase Ultimate Rewards works much like booking travel through an online travel agency like Orbitz or Expedia. In most cases you’ll be able to select from the same flights, at the same prices that you would if you booked directly with the airline. You’ll see the price in points alongside the cash price when you search for travel.

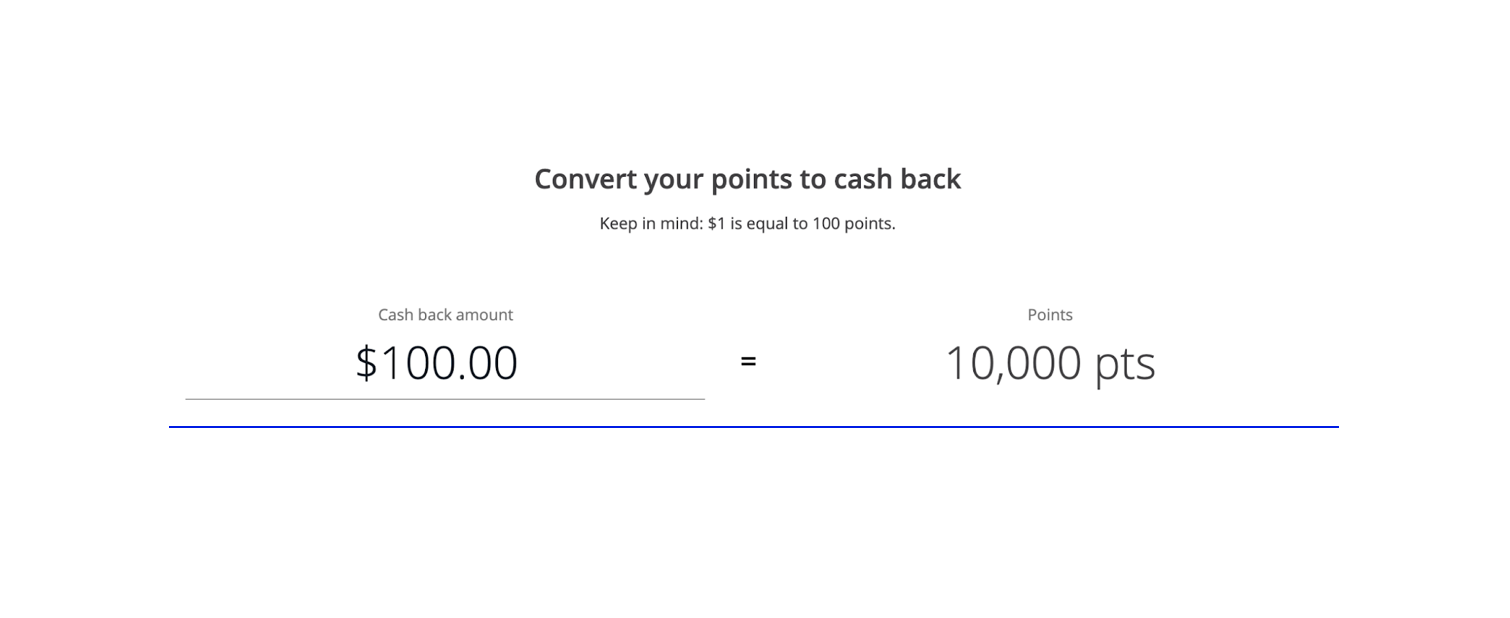

Cash back

Your Ultimate Rewards points are worth one cent each when you redeem them for a cash back award. This award can be redeemed easily through the Chase website. Cash back redemptions take up to three business days to post to your account.

Your Ultimate Rewards points are worth one cent each when you redeem them for a cash back award. This award can be redeemed easily through the Chase website.

Hearst

Transfers to travel partners

Chase offers point transfers to 12 airline frequent flyer programs. Many of these programs offer award sweet-spots, allowing you to book business or first class flights for a relatively low number of points.

Here are Chase’s airline transfer partners:

- Aer Lingus Avios

- Air Canada Aeroplan

- Air France KLM Flying Blue

- British Airways Avios

- Emirates Skywards

- Iberia Avios

- JetBlue

- Qatar Privilege Club Avios

- Singapore Airlines KrisFlyer

- Southwest Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

Of Chase’s 12 airline transfer partners, Air Canada Aeroplan, Air France/KLM Flying Blue, British Airways Executive Club, United Airlines MileagePlus offer the most opportunities to get more than 1.5 cents per point of value out of each point.

Ultimate Rewards can also be transferred to three hotel transfer partners, however only transfers to Hyatt are likely to yield more value than you could get from booking travel through Chase Ultimate Rewards.

Here are Chase’s hotel transfer partners:

- Hyatt

- IHG

- Marriott Bonvoy

Gift cards

Most of the time, redeeming your Chase Ultimate Rewards points for gift cards doesn’t offer more value than cash back awards. But Chase does frequently run sales on gift card redemptions, allowing you to get more than one cent of value out of each of your points.

Chase does frequently run sales on gift card redemptions, allowing you to get more than one cent of value out of each of your points.

Hearst

Other redemption options

These other redemption options rarely offer more value than cash back redemptions:

- Pay yourself back allows you to use your points to cover select categories of purchases. In very limited cases, this might offer an opportunity to get more than one cent of value out of each point. Through December 31, 2023, you can redeem points to offset donations to select charities at 1.5 cents each.

- Apple on Ultimate Rewards lets you use points to pay for part or all of your purchase with Apple.

- Pay with Points lets you use your points to pay for purchases at Amazon or with merchants that accept PayPal. Often this option yields less than one cent of value per point.

Benefit highlights

Travel insurance protections

The Ink Business Preferred can be a great choice for booking travel because it offers some of the most important travel insurance benefits. Travel insurance protections apply to both business and personal trips. Here are the travel insurance benefits offered by the Ink Business Preferred.

- Trip cancellation insurance – Get up to $5,000 of reimbursement to cover nonrefundable prepaid tours, trips, or vacations if you’re unable to travel for a covered reason.

- Trip interruption insurance – If your trip is cut short, you can get the unused portions of prepaid land and sea transportation reimbursed, up to $5,000.

- Auto rental collision damage waiver – When you rent a car for business purposes using your Ink Business Preferred card, you get primary insurance against damage to or theft of your rental vehicle. Having primary coverage means you don’t have to file a claim to your personal auto insurance. Coverage is secondary when using the card for a personal car rental within your country of residence.

- Baggage delay insurance – If your baggage is delayed by more than six hours, you can be reimbursed for essentials like toiletries and clothing, up to $100 per day for five days.

- Lost luggage reimbursement – Get reimbursed for the value of your luggage, up to $3,000, if an airline or other common carrier loses your luggage.

- Trip delay reimbursement – When your flight, train, ferry, or bus is delayed by more than 12 hours or overnight, you can receive up to $500 in reimbursements for meals, hotel costs, and other essentials.

Other perks/benefits

The Ink Business Preferred card includes benefits like purchase protection and extended warranty that can give you some additional protection on the things you buy for your business. The card also offers protection for your cell phone when you pay your bill with your card.

- Cellular telephone protection – If you damage your cell phone or someone steals it, you can get up to $600 to repair or replace your phone. Chase will cover up to three cell phone protection claims per year. Cell phone protection has a $100 deductible.

- Extended warranty protection – Get one additional year of coverage equivalent to the U.S. manufacturer’s warranty. Coverage applies on eligible items with manufacturer’s warranties of three years or less.

- Purchase protection – If a new purchase is damaged or stolen within 120 days, you can be reimbursed to repair or replace the item, up to $10,000.

Who the Ink Business Preferred card is good for

The Ink Business Preferred card is great for a small business owner who travels. If that’s you, you’ll enjoy increased point earnings on your travel purchases, plus a decent set of travel insurance benefits. While the suite of travel insurance benefits isn’t as extensive as what Chase offers on the Chase Sapphire Preferred and Chase Sapphire Reserve, it includes essentials like an auto rental collision damage waiver, baggage delay insurance, and trip delay reimbursement.

The card is also a good choice for small business owners who spend heavily in the card’s bonus categories. If you spend more than $10,000 in these categories annually, the rewards you’re earning over a card that earns 2% cash back everywhere will more than pay for the card’s annual fee.

Small business owners looking to truly maximize credit card rewards could consider the two other Ink cards in addition to the Ink Business Preferred. The Chase Ink Business Cash can get you 5% on office supplies and telecommunications services, plus 2% on gas and at restaurants. And the Chase Ink Business Unlimited makes a great “everywhere else” card that earns 1.5 points per dollar.

Who should look elsewhere

Bottom line

If you travel and are a small business owner, there are few cards as rewarding as the Ink Business Preferred. The card offers three points per dollar on up to $150,000 of spending in select business categories, including travel. Plus, you can redeem your rewards points for 25% more value when you use them to purchase travel through Chase Ultimate Rewards.

Explore other business credit cards here.

Editorial Disclosure: All articles are prepared by editorial staff and contributors. Opinions expressed therein are solely those of the editorial team and have not been reviewed or approved by any advertiser. The information, including rates and fees, presented in this article is accurate as of the date of the publish. Check the lender’s website for the most current information.

This article was originally published on SFGate.com and reviewed by Lauren Williamson, who serves as Financial and Home Services Editor for the Hearst E-Commerce team. Email her at lauren.williamson@hearst.com.