New Delhi: The Supreme Court Thursday ordered the liquidation of Jet Airways, bringing an end to the revival efforts of India’s once-largest airline. A bench led by Chief Justice D.Y. Chandrachud set aside the National Company Law Appellate Tribunal (NCLAT) decision, which had previously allowed the airline’s ownership to be transferred to a consortium formed by the UK’s Kalrock Capital and UAE-based entrepreneur Murari Lal Jalan.

ThePrint brings you a timeline of events that led to the permanent grounding of the airline.

1992-1993: Jet Airways was founded by Naresh Goyal shortly after India liberalised its economy, allowing private investment across industries, including airlines. Goyal, who initially worked at a travel agency, launched operations a year later with a fleet of four Boeing 737-300 aircraft.

2003-2005: On the back of rapid growth—Jet Airways by now operated over 250 flights daily—the company went in for an Initial Public Offering (IPO) to raise capital for further expansion. The IPO received strong investor interest and was oversubscribed 18.7 times. Priced at Rs 1,100 per share, Jet Airways raised Rs 1,899.35 crore and was listed on the Bombay Stock Exchange (BSE) on 14 March, 2005.

2005-2007: In the mid-2000s, several low-cost carriers were launched, including IndiGo, SpiceJet and GoAir. Offering cheaper fairs and launching on previously unserved routes, the new airlines began eating into Jet Airways’ market share.

Fresh with capital from its IPO, Jet Airways began to expand aggressively. The company’s purchase of Air Sahara in 2007 for around Rs 1,450 crore was seen by experts as the start of its financial troubles. Goyal, however, saw it as an answer to budget carriers and rebranded it “JetLite”, but the new airline proved to be a drain on company resources and the entire investment was written off in 2015.

Several experts blamed Goyal’s poor management during this period, specifically his leading of a single team to manage both the full-service and budget carriers.

The Economic Times reported that the “deal reduced Jet’s ability to spend extra money to take on the competition effectively” and “wasted IPO funds that remained after placing plane orders”.

In the same year, Jet Airways also added a mixed fleet of aircraft—Airbus A330s and Boeing 777s. This resulted in a further drain on resources, as its maintenance and operations costs increased.

Also read: India’s aviation sector set to boom under Modi 3.0 but ‘emerging duopoly’ could hurt consumers

2013: To stem the tide, Jet Airways sold a 24 percent stake to Etihad Airways for $379 million. Etihad was the first beneficiary of the Indian government’s relaxation of Foreign Direct Investment (FDI) norms in the aviation industry.

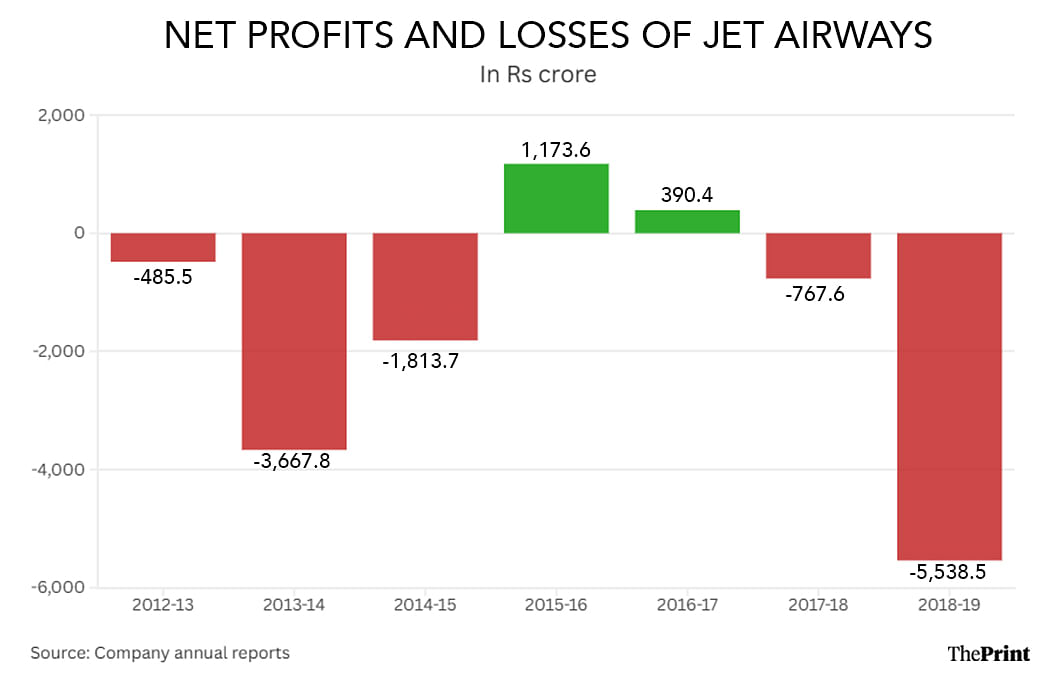

2013-2018: Jet Airways went through a turbulent period on account of a rise in crude oil prices, a depreciating rupee and stiff competition from budget carriers. The company’s net loss for the financial year 2018-19 stood at Rs 5,538 crore, up from a net loss of Rs 485 crore in 2012-13.

2019: In March 2019, Naresh Goyal and his wife Anita Goyal stepped down from the board of directors of the company. In April, the airlines suspended all flights as it had finally run out of cash for operations. Jet had reportedly not paid any salaries since January of that year. The company approached banks for a loan of Rs 983 crore but was refused.

The State Bank of India (SBI) was appointed to lead rescue efforts of the airline, which initially approached Etihad to increase their stake. Etihad was reluctant to invest additional funds with Goyal at the helm, and instead preferred to exit the airline altogether.

In June 2019, a consortium of lenders led by SBI finally decided to refer the company to the National Company Law Tribunal (NCLT) for the initiation of bankruptcy proceedings.

2020: After initially failing to attract any bidders, the NCLT approved a resolution plan worth Rs 4,873 crore by the Jalan-Kalrock Consortium (JKC).

2021-2023: The troubled airline underwent several legal battles while also trying to obtain a renewal of its Airport Operator Certificate (AOC).

JKC, as per its resolution plan, was to infuse Rs 350 crore as the first tranche of payment along with paying off the airline’s creditors. The NCLT allowed the consortium to adjust the first tranche of payment against a Performance Bank Guarantee (PBG) of Rs 150 crore.

In parallel, the lenders wanted the top court to invoke its extraordinary powers under Article 142 to liquidate the airline. Their belief was that the JKC resolution plan was not sustainable.

Meanwhile, problems for Goyal continued when he was arrested in September 2023 by the Enforcement Directorate (ED) in an alleged fraud of Rs 538 crore.

2024: When the dispute reached the Supreme Court in 2024, the court set aside the NCLAT’s directive of a PBG and directed JKC to deposit Rs 150 crore by the end of January. According to the media, the court directed NCLAT to dispose of all appeals in the case by March 2024.

In March, the NCLAT upheld the resolution plan and approved the transfer of ownership of the airline to JKC. It further ordered that this transfer of ownership be completed within 90 days.

The lenders were ultimately not happy with the progress being made and appealed against the NCLAT’s decision in the Supreme Court, which is what finally resulted in the liquidation decision passed down by the top court on 7 November, 2024.

Udit Hinduja is a graduate of the inaugural batch of ThePrint School of Journalism and an intern with ThePrint.

(Edited by Zinnia Ray Chaudhuri)

Also read: Indian aviation industry likely to log Rs 3,000-4,000 crore net loss in FY25, says ICRA