My top 10 things to watch Tuesday, Sept. 26

1. U.S. stocks edge lower in premarket trading, with the S&P 500 down 0.57%, while government bond yields continue to hold steady. Is there any relief from the bond market’s tyranny? It’s been a remarkable rally in yields for the 20-year Treasury, which is at nearly 4.8% and is almost un-inverted. I have told Club members that it would un-invert for more than a year now. And it looks like it’s happening, as long rates go up to levels not seen since the economy was very inflationary in 2006.

2. Is the world ready for 7% interest rates? JPMorgan CEO Jamie Dimon ponders whether the Federal Reserve could raise rates that high in an interview with The Times of India. He’s been a ‘6 percenter’ for a while. The central bank last week left the fed funds rate in a targeted range of 5.25%-5.5%, but indicated rates could stay higher for longer.

3. The U.S. dollar has climbed more than 2% since the start of September, according to the ICE U.S. Dollar Index — another bad signal for the economy.

4. Only the wealthiest 20% of Americans still have excess savings from the Covid-19 pandemic, while 80% have less cash on hand than they did at the start of the crisis, according to the Fed’s latest study of household finances.

5. Russia has managed to evade Western oil sanctions over its invasion of Ukraine by developing new trade ties with the global south, including China, Russian oligarch Oleg Deripaska tells the Financial Times.

6. The collapse of Chinese real estate firm Evergrande could result in a $30 billion restructuring, as the company faces fresh government investigations. Of course, the stock is still trading, which is nutty. It makes things more complicated because that stock is probably worthless.

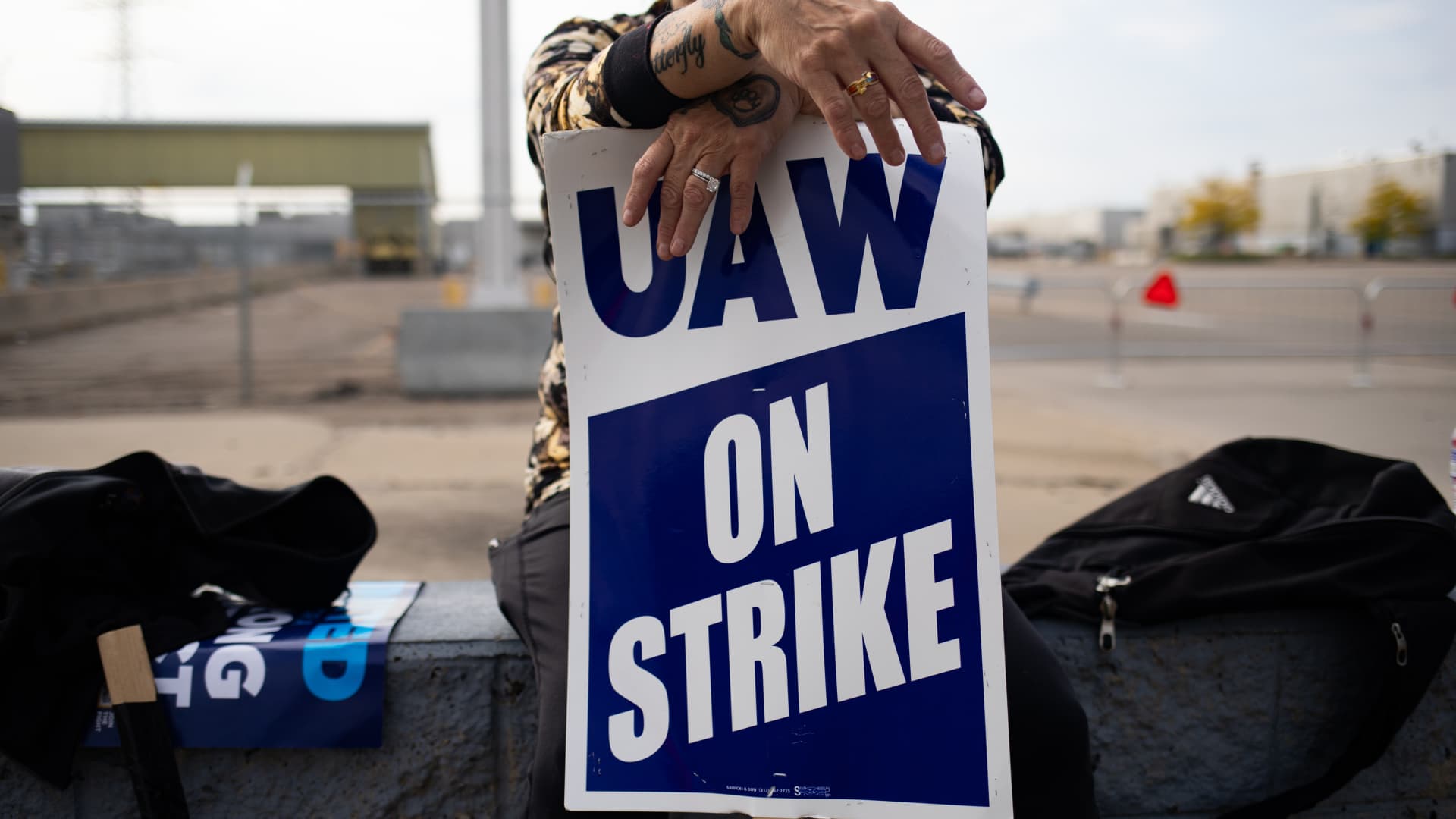

7. Club name Ford Motor (F) halts production on its $3.5 billion electric-vehicle battery plant in Michigan amid ongoing negotiations with the the United Auto Workers union. Ford is playing hardball as UAW strikers double down.

8. President Joe Biden is set to join UAW members on the picket line in Michigan on Tuesday. This is unheard of and certainly a huge negative for automakers Ford, General Motors (GM) and Stellantis (STLA).

9. Macy‘s (M) sees a sharp rise in delinquencies in June and July, with Bank of America calling the development “worse than we expected.” Kohl’s (KSS) and Nordstrom (JWN) should see that, too. BofA lowers its price target on Kohl’s to $22 a share, down from $25, and its price target on Nordstrom to $13 a share, from $14.

10. Stifel lowers its price target on Target (TGT) to $130 a share, down from $145, while maintaining a hold rating on the stock. The firm cites an ongoing pullback in spending on discretionary items.

Sign up for my Top 10 Morning Thoughts on the Market email newsletter for free.

(See here for a full list of the stocks at Jim Cramer’s Charitable Trust.)

As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade.

THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY, TOGETHER WITH OUR DISCLAIMER. NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.