New Delhi: Public sector oil marketing companies (OMCs) saw their profits quadruple in the financial year 2023-24, which ended on 31 March, largely driven by their decision to keep fuel prices unchanged at a relatively high level through the fiscal, even though international oil prices have cooled off now.

In other words, OMCs have seen their profits swell, while the common man has felt no relief with respect to fuel prices. Consequently, the government will also receive a bonanza, with each of these companies promising to pay dividends that are multiple times the amount paid in FY 2022-23.

The three state-run oil marketing companies — Indian Oil Corporation (IOCL), Bharat Petroleum Corporation (BPCL), and Hindustan Petroleum Corporation (HPCL) — saw their collective net profits rise to Rs 80,986 crore in 2023-24, more than four times higher than the amount in 2022-23.

While IOCL and BPCL are directly owned by the government, HPCL is a subsidiary of another state-run company, Oil and Natural Gas Corporation (ONGC).

The core activity of an oil marketing company is to buy crude oil, process it into petroleum products, such as petrol, diesel, naphtha and lubricants, and then sell those in the market.

So, the two factors that have an immense impact on the profitability of OMCs are the price of oil and the price at which they sell the petroleum products.

Also Read: How fuel prices become mysteriously stable just before elections. Here’s data since 2020

Protecting consumers by freezing fuel prices

Data from the Ministry of Petroleum and Natural Gas’ Petroleum Planning and Analysis Cell (PPAC) shows that the price at which India buys oil peaked in June 2022 at $116 per barrel in the immediate aftermath of the Russia-Ukraine war.

The months following Russia’s invasion of Ukraine saw the price of petrol sold in India soar to around Rs 110 per litre, and average at about Rs 105 per litre in April 2022.

In response to the price hike, India’s OMCs in June 2022 had decided to abandon their daily price revision mechanism, and instead freeze fuel prices at Rs 96.7 per litre for petrol and Rs 89.62 per litre for diesel in Delhi, the reference market for the country.

This protected Indian consumers from the high oil prices, which remained above $100 a barrel for almost the entirety of the March-August 2022 period. However, this protection didn’t come free, and had a significant impact on the profitability of the OMCs. They had to buy expensive oil, but absorb this cost instead of passing it on to the customers.

Also Read: India’s GDP to grow at 6.9% in 2024 — UN agency revises its January projection of 6.2%

Quick return to profitability, but no fuel price cut

However, a previous analysis by ThePrint found that the financial hit from having to absorb high oil prices was short-lived. It showed that while the OMCs saw two quarters of losses from April-September 2022, they were able to move back to profits thereafter.

In fact, the three state-run OMCs ended FY 2022-23 with profits of Rs 19,086 crore, albeit significantly lower than the profit of Rs 39,355 crore in the previous year. This meant that the profits they had made in the last two quarters of the financial year more than made up for the losses they had incurred in the first two.

The reason for this quick return to profitability was the fact that oil prices began to fall quite sharply from the highs of June 2022. By June 2023, the price of oil had fallen by more than 35 percent compared to the previous year. However, none of this benefit was passed on to the consumers. Fuel prices remained unchanged.

Since then, oil prices have risen somewhat, in response to the Israel-Hamas conflict that broke out in October 2023, but are still about 28 percent lower than the $116 peak, when fuel prices were frozen. However, apart from a Rs 2 per litre reduction in March 2024, fuel prices have still remained unchanged.

Dividend bonanza for government

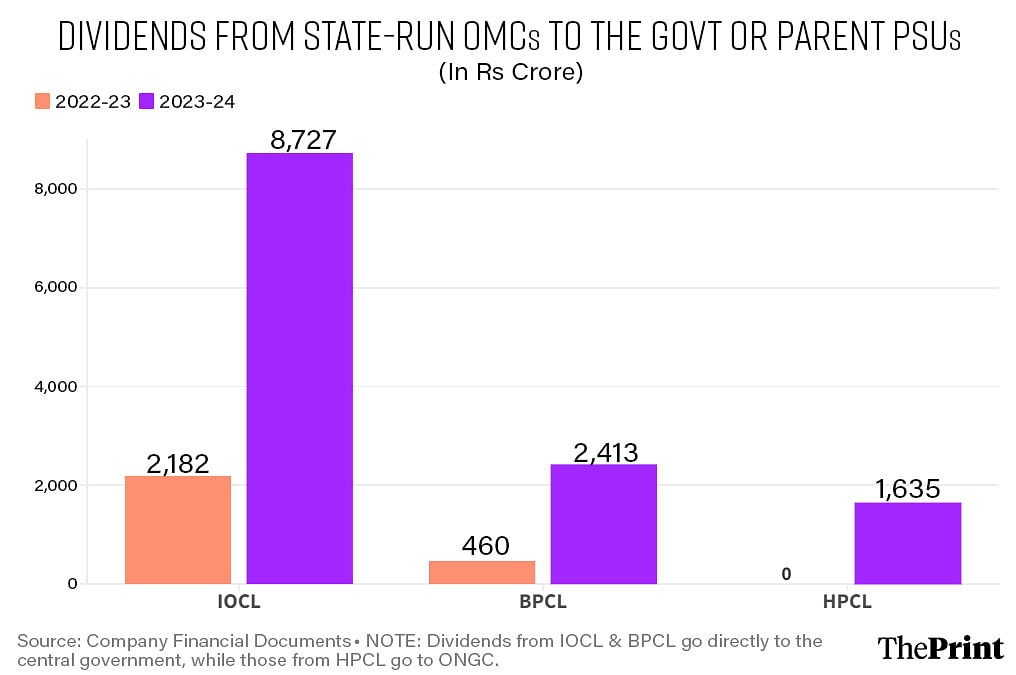

The increased profitability of the OMCs has resulted in their commitment to pay significantly higher dividends from 2023-24, versus 2022-23. The amount of dividend to be transferred is decided keeping all shareholders in mind, but given that these are state-run companies, their largest shareholder is the Government of India.

IOCL’s board, for example, has decided to pay out dividends at a rate that works out to Rs 8,726.5 crore for the government for FY 2023-24, 300 percent higher than what it transferred in 2022-23.

Similarly, BPCL’s board has recommended a dividend transfer that works out to Rs 2,413 crore for 2023-24, up 425 percent from the previous year.

HPCL’s board has decided to transfer what amounts to Rs 1,635 crore to ONGC in 2023-24, after no dividends in the previous year. ONGC, for its part, has decided to transfer Rs 1,852 crore to the government for 2023-24.

(Edited by Mannat Chugh)

Also Read: Coal now makes up less than 50% of India’s installed capacity but renewable output still lags