The central bank left its inflation forecast for this fiscal year unchanged at 5.4%, despite uneven monsoon showers and as outlook on food prices remain on edge amid a spike in global crude oil prices. The panel now sees inflation for Q2, Q3 and Q4 at 6.4%, 5.6% and 5.2%, respectively.

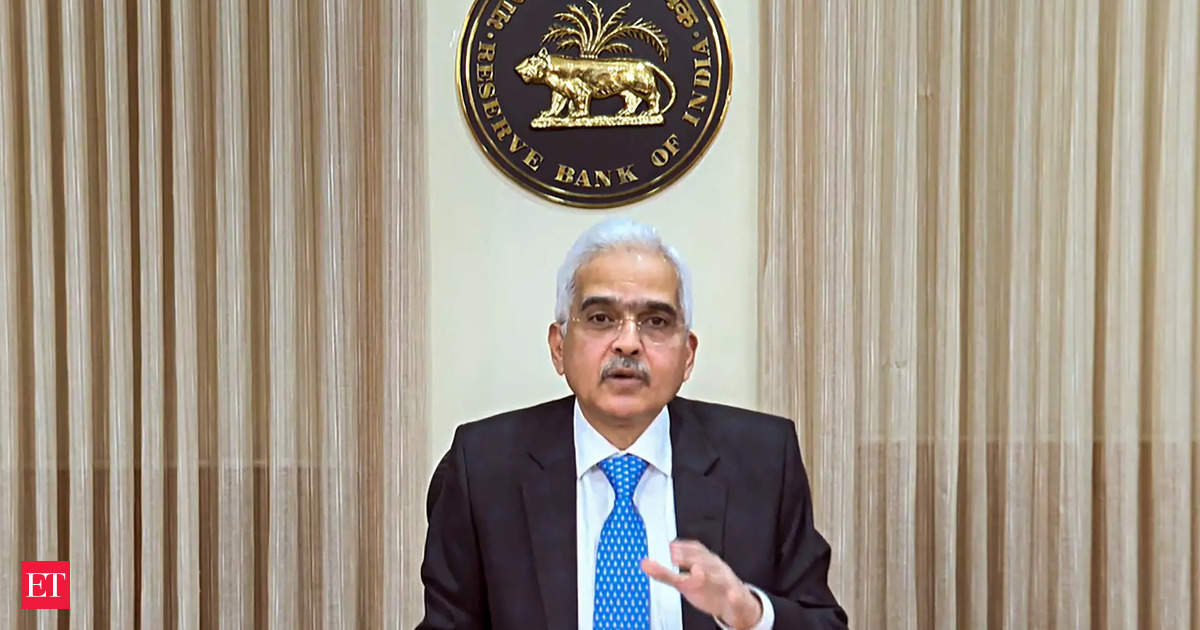

“The need of the hour is to remain vigilant and not give room to complacency. Lessons from the past one and a half decades and from living through the global financial crisis and the taper tantrum tell us that risks and vulnerabilities can grow even in good times,” said RBI Governor Das during the announcemnt.

“The overall inflation outlook, however, is clouded by uncertainties from the fall in kharif sowing for key crops like pulses and oilseeds, low reservoir levels, and volatile global food and energy prices. The MPC observed that the recurring incidence of large and overlapping food price shocks can impart generalisation and persistence to headline inflation,” Das added.

A look at all the key decisions and views:

- Repo rate unchanged at 6.5%

- GDP forecast for FY24 unchanged at 6.5%.

- GDP: Q2 at 6.5%, Q3 at 6% and Q4 at 5.7%

- MPC remains focused on the ‘withdrawal of accommodation’

- FY24 Inflation forecast unchanged at 5.4%

- Inflation: Q2 at 6.4 %, Q3 at 5.6 % and Q4 at 5.2 %

- CPI inflation for Q1FY25 projected at 5.2 %

- Limit for gold loans under the Bullet Repayment scheme increased to Rs 4 lakh from from Rs 2 lakh

- The panel also announced the introduction of New Channels for Card-on-File Tokenisation (CoFT)

- “The Indian banking system continues to be resilient, backed by improved asset quality, stable credit growth and robust earnings growth,” Das said.