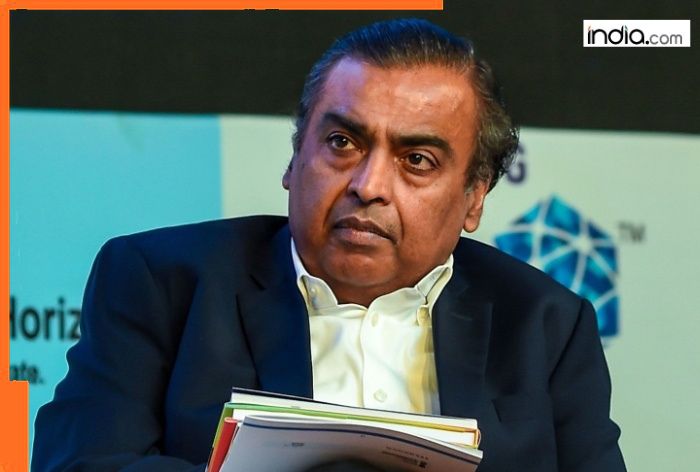

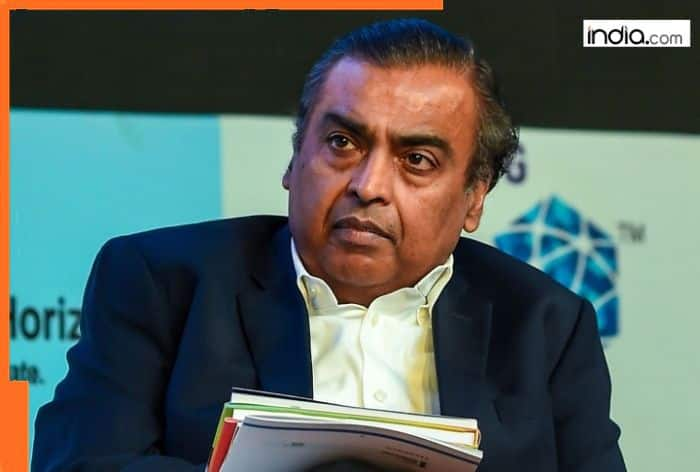

Earlier this year, Mukesh Ambani shook the soft-drink market with his Campa Cola brand, and used the same business strategy he used with the launch of Reliance Jio — by starting a price war.

Reliance Industries Chairman, Mukesh Ambani, the richest man in Asia, who is known for his shrewd business acumen, has set his sights on conquering India’s thriving FMCG market. According to reports, Reliance Consumer Products (RCPL), the FMCG arm of Reliance Retail Ventures, is gearing up to shake up the FMCG market by triggering a price war with major players, a tactic successfully used previously by Mukesh Ambani to capture the telecom sector.

RCPL is offering distributors with 6-8% margins, which is significantly higher than the industry standard of 3-5% given by other major players such as Britannia, Hindustan Unilever, Reckitt, Coca-Cola, Parle, and Nestle. Additionally, Mukesh Ambani-led RCPL is offering a 20 percent margin to retailers, compared to the usual 8-15 percent offered by other brands. The company is also offering a 2% performance-based incentive to distributors.

According to a report by Economic Times (ET), RCPL is eyeing to expand the distribution of its products in urban regions after carving a place in rural and semi-urban markets. Unlike its competitors, that are making a transition to quick commerce platforms, the company is focusing on distributing its goods via traditional kirana shops which account for around 90% of sales in tier-2 cities and smaller markets, the report said.

RCPL’s strategy of providing bigger margins to distributors and retailers is expected to shake up the market by raising the industry average, an effect already witnessed in the soft drink space, where market leaders Coca-Cola and PepsiCo have been forced to modify their business strategies to compete with the reduced prices of Reliance’s Campa Cola.

RCPL, which has introduced a wide range of products under the brands Alan Bugles (snacks), Glimmer (beauty soaps), Puric (hygiene soaps), Independence (edible oils, staples, and legumes), and Snactac (biscuits), are selling them at 20-40% lesser price than competitors, triggering a price war in the FMCG sector.

Earlier this year, Mukesh Ambani shook the soft-drink market with his Campa Cola brand, and used the same business strategy he used with the launch of Reliance Jio — by starting a price war. Ambani’s tactics have created a stir in the soft-drink industry, as he slashed the prices of Campa Cola soft drinks, essentially starting a price war in the space, which will inadvertently force its competitors to do the same.