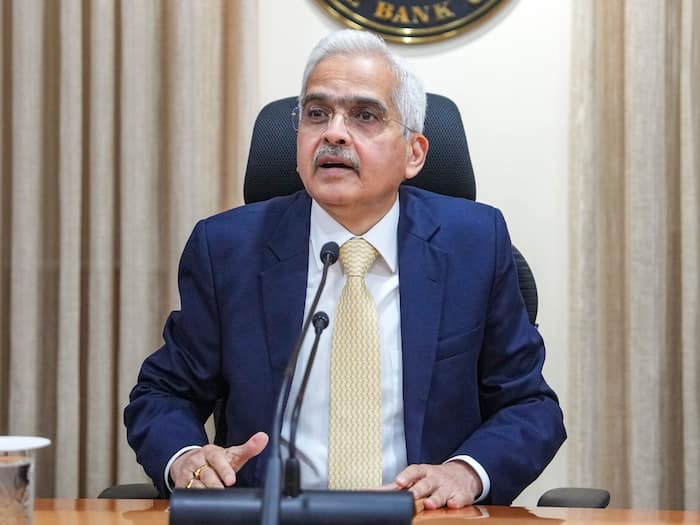

RBI Governor Shaktikanta Das said that India presents a different picture on account of its fiscal consolidation and faster GDP growth.

Mumbai: RBI governor Shaktikanta Das on Friday made RBI Monetary Policy announcements and Projected India’s GDP Growth at 7% For FY 2025. He further said that the growth of the country continues to sustain momentum.

RBI Governor Shaktikanta Das said that India presents a different picture on account of its fiscal consolidation and faster GDP growth. Turning to domestic growth, domestic economic activity continues to expand at an accelerated pace, supported by fixed investment and an improving global environment.

“The second advance estimates placed the real GDP growth at 7.6% for 2023-24, the third successive year of 7% or higher growth,” he said.

Shaktikanta Das further added that the growth of the country has continued to sustain its momentum, surpassing all projections.

“Headline inflation has eased to 5.1% during both January and February, and this has come down to 5.1% in these two months from the earlier peak of 5.7% in the month of December… Looking ahead, robust growth prospects provide the policy space to remain focused on inflation and ensure its descent to the target of 4%,” he added.

Notably, the RBI has kept the repo rate unchanged for the last six consecutive MPC meetings and according to experts it is likely to maintain the status quo on interest rates this time too.

The repo rate, is the interest rate at which banks draw funds from RBI to overcome short-term liquidity mismatches.

Monetary Policy Committee was constituted under the Reserve Bank of India Act, 1934. MPC is a six-member committee comprising three members from RBI including Governor Shaktikanta Das and three members appointed by the Central government.

The three-day review meeting of the MPC that commenced on April 3 concludes today.

The RBI had maintained the status quo on policy rates and stances in its last review, which was held in February 2024. The decision however was not unanimous and one member has recommended a rate cut of 25 basis points and policy change stand to neutral.

Since the last policy, rating agencies have revised India’s growth forecast upwards. Finance Minister Nirmala Sitharaman, recently said that India will grow over 8 per cent in FY24.

Inflation has dropped and has remained under the range of comfort zone. Consumer Price Index inflation was 5.1 per cent in February 2024, up from over 5.5 per cent in December 2023.

The core CPI inflation, excluding food and beverages, was at a low of 3.5 per cent in February 2024. However, food inflation at above 7 per cent was a concern, but with a recent cut in the prices of petrol, diesel and LPG, it is likely to further fall in March and may come below 5 per cent.