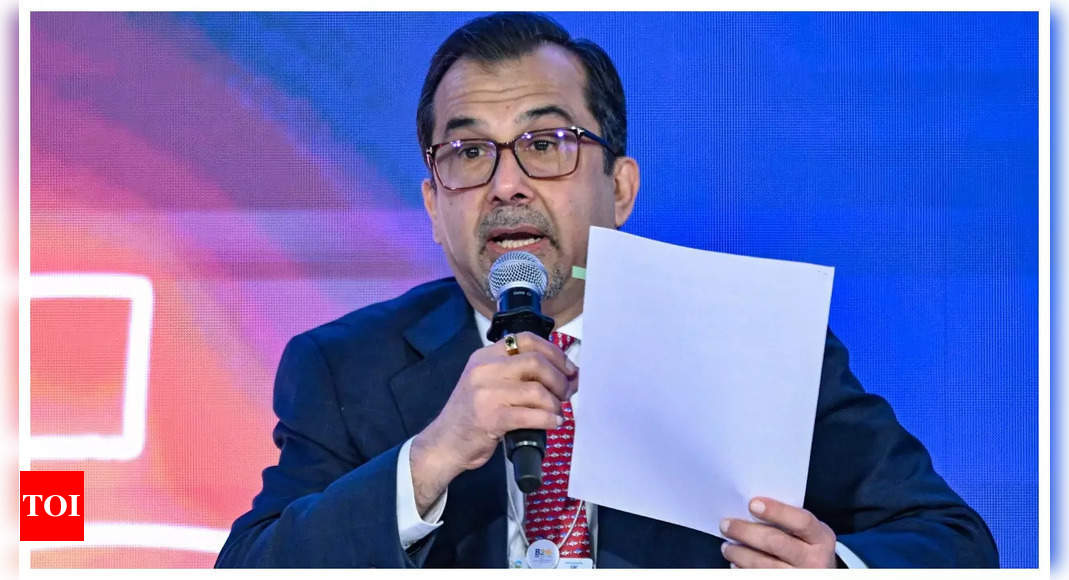

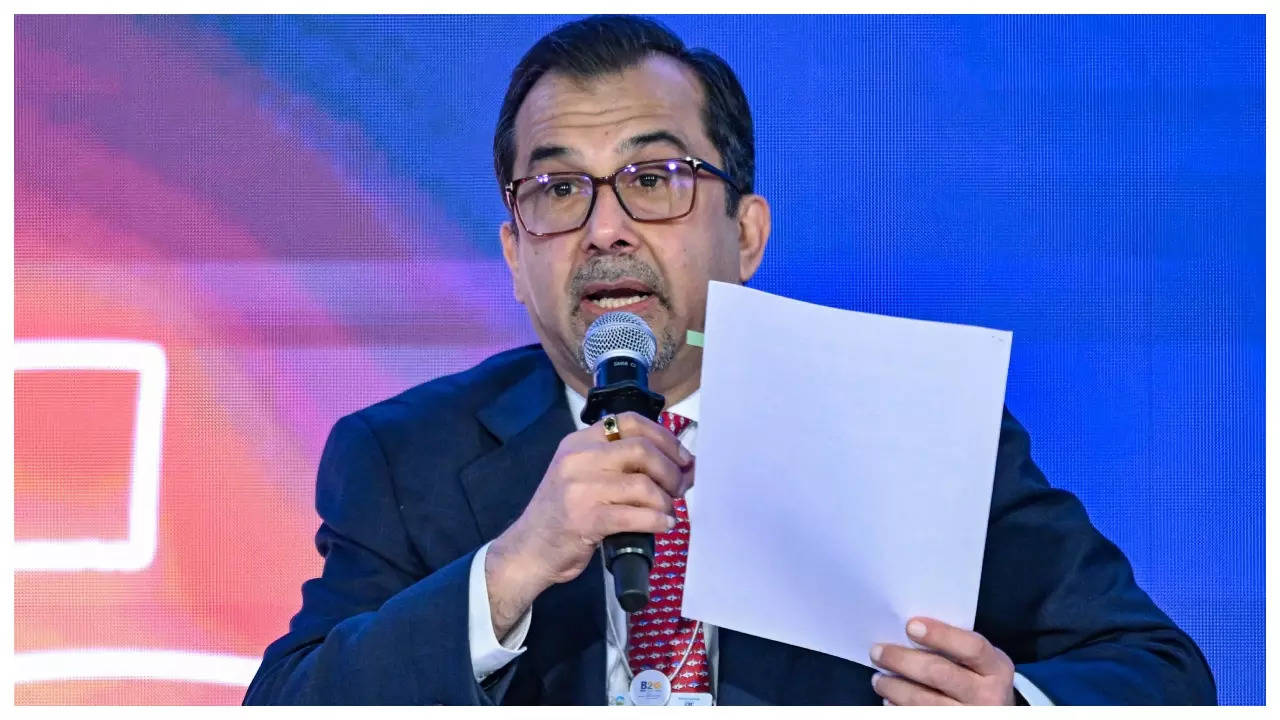

NEW DELHI: As inflation is moderating, diversified group ITC is seeing green shoots of volume growth and expects the momentum to continue sequentially, its chairman and managing director Sanjiv Puri said on Sunday.

This will certainly lead to improvement in volume, but it will not happen overnight, said Puri here on the sidelines of the B20 Summit organised by the CII.

Over the ITC’s plan for the demerger of its hotel business, Puri said it is going to benefit the existing shareholders by incorporating a wholly-owned new subsidiary ITC Hotels Ltd.

“It will be a pure-play, focused on hospitality, which can leverage the institutional strengths of ITC. And ITC in turn will be able to leverage the synergy on its hospitality business, or its FMCG businesses,” Puri told PTI.

It is a “very robust” model, which will help the business to make the hotel business accelerate progress, whilst retaining synergies and it will improve the financial metrics of ITC, he added.

Over inflation, Puri said this is mainly on account of two factors – the bigger one is more of the external factors in the geopolitical environment and the second is on account of the issues of climate change.

“However, now, India is much better placed in the rest of the world and I would like to compliment the government for stewarding management of inflation and being extremely proactive in taking the right steps to control that,” he said.

In the recently concluded June quarter, ITC and several other FMCG makers reported volume gains and improvement in margins. ITC has 25 brands including Aashirvaad, Bingo, Sunfeast, YiPPee, Fiama, Vivel, Savlon etc.

When asked about the revival of consumer sentiments and volume growth, especially in the rural market, Puri said, “So we are already seeing green shoots of pickup on volumes as inflation is moderating. I think as inflation moderates, we are also seeing the prices in the market growing or climate is improving.”

He expressed concerns that the operating environment continues to remain volatile on the weather front.

“Right now, the El Nino is the monitorable. The rains in August have not been very encouraging. That’s the facet we need to be watchful about. But overall, I think we have been able to manage it quite well,” said Puri.

The Kolkata-headquartered firm reported a 16.08 per cent rise in consolidated net profit to Rs 5,180.12 crore in the June quarter. However, its revenue was down 6 per cent to Rs 18,639.48 crore, impacted by its agribusiness division.

Its revenue from the FMCG-others segment, which houses businesses such as staples, snacks, meals, dairy and beverages, apparel, education and stationery products, and personal care products was up 16 per cent to Rs 5,172.71 crore.

Over the agribusiness, Puri said, India has “tremendous” potential for the agriculture sector and the opportunity is immense.

“We have the largest arable land, we account for just about 3 per cent of the global trade on agriculture and because of… headroom to grow by vertical growth activity, and huge headroom to go through value addition and opportunities events, because by 2050, it is estimated that the world would need 70 per cent more agri produce to meet the needs of the entire planet,” he said.

So it is an area of opportunity and we need to “improve productivity, improve market linkages, and build resilience” in the agriculture value system, he said.

“And those are really the three things that need to be done. In ITC, We are trying to contribute towards climate-smart agriculture and the first part on productivity and quality or market linkages to the ITC Mars system.

ITC expects the public listing of its hotel business, to take place in the next 15 months. Its hotels business clocked its best-ever Q1 at Rs 600 crore in FY24.

Under the scheme of demerger, ITC Hotels will issue equity shares directly to the shareholders of ITC in a manner that about 60 per cent stake is held directly by ITC shareholders, proportionate to their shareholding in ITC and the remaining about 40 per cent stake to continue with ITC.

This will certainly lead to improvement in volume, but it will not happen overnight, said Puri here on the sidelines of the B20 Summit organised by the CII.

Over the ITC’s plan for the demerger of its hotel business, Puri said it is going to benefit the existing shareholders by incorporating a wholly-owned new subsidiary ITC Hotels Ltd.

“It will be a pure-play, focused on hospitality, which can leverage the institutional strengths of ITC. And ITC in turn will be able to leverage the synergy on its hospitality business, or its FMCG businesses,” Puri told PTI.

It is a “very robust” model, which will help the business to make the hotel business accelerate progress, whilst retaining synergies and it will improve the financial metrics of ITC, he added.

Over inflation, Puri said this is mainly on account of two factors – the bigger one is more of the external factors in the geopolitical environment and the second is on account of the issues of climate change.

“However, now, India is much better placed in the rest of the world and I would like to compliment the government for stewarding management of inflation and being extremely proactive in taking the right steps to control that,” he said.

In the recently concluded June quarter, ITC and several other FMCG makers reported volume gains and improvement in margins. ITC has 25 brands including Aashirvaad, Bingo, Sunfeast, YiPPee, Fiama, Vivel, Savlon etc.

When asked about the revival of consumer sentiments and volume growth, especially in the rural market, Puri said, “So we are already seeing green shoots of pickup on volumes as inflation is moderating. I think as inflation moderates, we are also seeing the prices in the market growing or climate is improving.”

He expressed concerns that the operating environment continues to remain volatile on the weather front.

“Right now, the El Nino is the monitorable. The rains in August have not been very encouraging. That’s the facet we need to be watchful about. But overall, I think we have been able to manage it quite well,” said Puri.

The Kolkata-headquartered firm reported a 16.08 per cent rise in consolidated net profit to Rs 5,180.12 crore in the June quarter. However, its revenue was down 6 per cent to Rs 18,639.48 crore, impacted by its agribusiness division.

Its revenue from the FMCG-others segment, which houses businesses such as staples, snacks, meals, dairy and beverages, apparel, education and stationery products, and personal care products was up 16 per cent to Rs 5,172.71 crore.

Over the agribusiness, Puri said, India has “tremendous” potential for the agriculture sector and the opportunity is immense.

“We have the largest arable land, we account for just about 3 per cent of the global trade on agriculture and because of… headroom to grow by vertical growth activity, and huge headroom to go through value addition and opportunities events, because by 2050, it is estimated that the world would need 70 per cent more agri produce to meet the needs of the entire planet,” he said.

So it is an area of opportunity and we need to “improve productivity, improve market linkages, and build resilience” in the agriculture value system, he said.

“And those are really the three things that need to be done. In ITC, We are trying to contribute towards climate-smart agriculture and the first part on productivity and quality or market linkages to the ITC Mars system.

ITC expects the public listing of its hotel business, to take place in the next 15 months. Its hotels business clocked its best-ever Q1 at Rs 600 crore in FY24.

Under the scheme of demerger, ITC Hotels will issue equity shares directly to the shareholders of ITC in a manner that about 60 per cent stake is held directly by ITC shareholders, proportionate to their shareholding in ITC and the remaining about 40 per cent stake to continue with ITC.

Denial of responsibility! Todays Chronic is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – todayschronic.com. The content will be deleted within 24 hours.