‘What is the problem if we increase 2.5 percent LTCG on shares?’ Asked Finance Secretary.

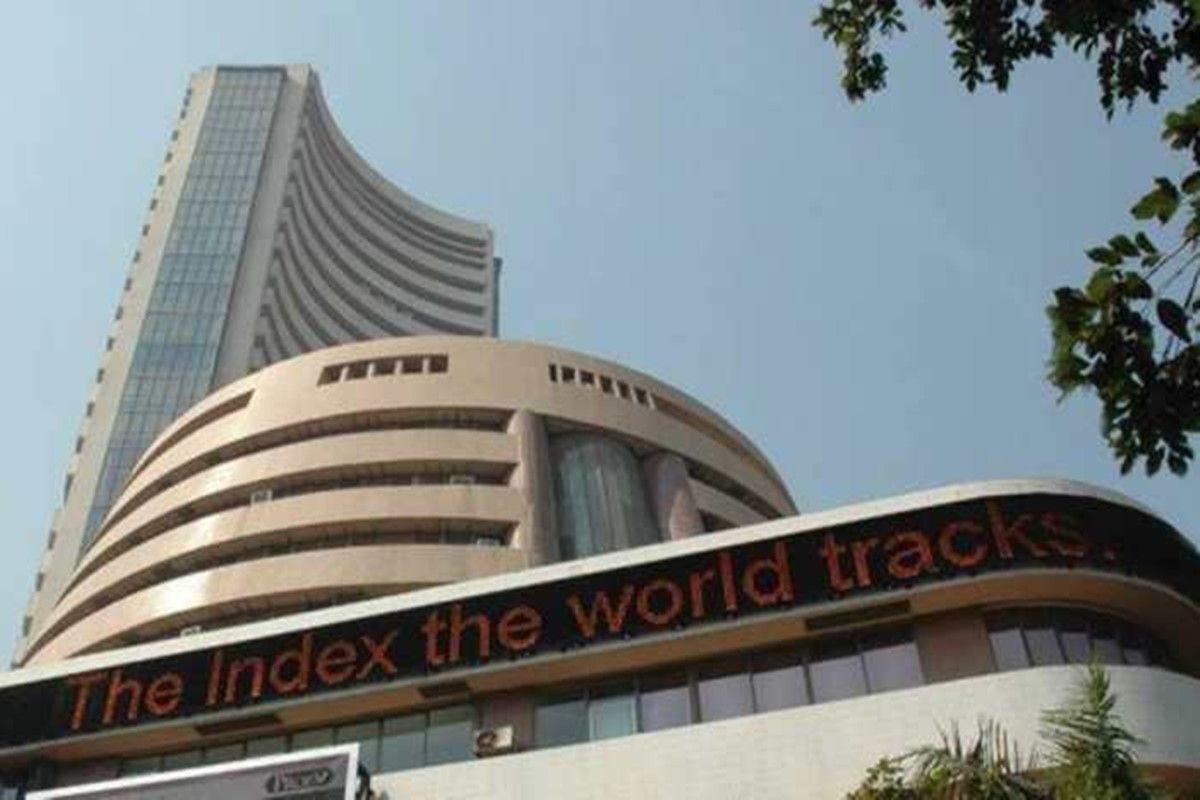

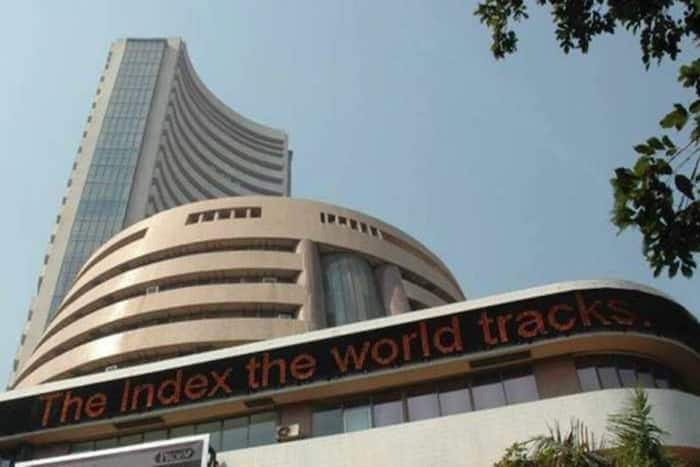

After 5 days of fall down, Equity market benchmark indices Sensex and Nifty rebounded in early trade on Friday after staying on the back foot for the past five straight sessions, helped by value buying at lower levels and rally in blue-chips Infosys, Tata Consultancy Services and Reliance Industries.

The 30-share BSE Sensex climbed 235.23 points to 80,275.03 in early trade. The NSE Nifty went up 86.6 points to 24,492.70.

On 25th July, After a sharp fall in intra-day trade, the 30-share BSE Sensex managed to recover some of the lost ground to settle 109.08 points or 0.14 percent lower at 80,039.80, as a sharp rally in Tata Motors and Larsen & Toubro restricted its fall. During the day, it tanked 671 points or 0.83 per cent to 79,477.83.

Amid concerns over the correction in the stock market due to the increase in capital gains tax on shares, Finance Secretary TV Somanathan on Thursday asserted that the fall in the stock market is not a cause of concern for the government.

Finance Secretary On Stock Market Correction

In an exclusive interview with ANI, Somanathan said, “I think these are temporary phenomena, and the stock market responds to various factors. Taxation being raised from 10 to 12.5 percent I don’t think is a major issue, and it’s not a source of concern.”

Domestic equity investors had expressed their disappointment over the change in LTCG (long-term capital gains) in the Union Budget, which has been raised to 12.5 percent from 10 percent, with immediate effect.

Apart from this short-term capital gains tax was also increased to 20 percent from 15 percent and the sharp increase in STT on futures and options trades, also added into the fears in the equity market.

He argued, “If a businessman is paying far more taxes if we compare to taxes in the stock market, then what is the problem if we increase 2.5 percent LTCG on shares? The Indian stock market is still one of the lowest taxed globally.”

Finance Secretary On Capital Gain Tax

For the benefit of the lower and middle-income classes, it was proposed to increase the limit of exemption of capital gains on certain listed financial assets from Rs 1 lakh to Rs 1.25 lakh per year.

Clarifying on the Lon Term Capital Gains on property of 12.5 percent without indexation, Somanathan explained that earlier it was 20 percent with indexation.

“Indexation means that the cost at which you bought the property could be adjusted for inflation, which was normally in the range of 4-5 percent per year. However, most properties appreciate at least 15 percent per annum.”

“Nobody buys a property to get the same rate as a fixed deposit, they buy property because the interest is more. It has been calculated that for most people, even after removing indexation, the new regime will be better because the tax rate has been drastically reduced from 20 to 12.5 percent without indexation,” he said.

Justifying the new LTCG regime, Somanathan said, “The increase from 10 percent to 12.5 percent for long-term rates on shares is not in isolation. It is done to simplify the entire tax system. Earlier, we had multiple rates and terms for different asset classes. We have tried to simplify it. Now, all long-term capital gains on all assets will be at 12.5 percent without indexation. The holding period will be one year for all listed assets and two years for all other assets. This simplified system will, in the long run, be very beneficial for taxpayers.”

(With Inputs From Agencies)