New Delhi: The amount of revenue the government has “lost” by providing tax incentives to companies and individuals has ballooned since 2014, but the Union budget data shows the bulk of these benefits are now going to individual taxpayers rather than the corporates.

Under the Congress, most of these tax exemptions went to the corporates and a smaller portion were used by individual taxpayers, the data added.

These findings assume significance against the backdrop of the Congress party’s frequent attack on the Modi government for it being a “suit-boot ki sarkar”, in reference to its apparent pro-corporate policies.

Each Union Budget since 2006 has carried a statement on the expected revenue the government would have earned had it not provided tax exemptions. Till Budget 2015, it was named the ‘Statement of Revenue Foregone’, and thereafter, it has been called the ‘Statement of Revenue Impact of Tax Incentives under the Central Tax System’.

According to the government, the analysis of such tax incentives, their trends, and the impact they have on revenue collections is an important tool to gauge the direction and intention of government policy.

“The tax incentives provided by the government have a significant impact on its revenue,” said the statement included in the latest budget presented in February this year, adding, “It may also be perceived as an indirect subsidy to the preferred taxpayers and is referred to as ‘tax expenditures’.”

The statement said that, in a democratic set-up, the tax policy ought to be not only efficient but also sufficiently transparent.

“It requires an elaborate analysis and explicit presentation of tax incentives and the entailed programme planning intended to address the specific policy goals of the government,” it added.

ThePrint has analysed the exemptions given under direct tax — that is, corporate tax and income tax. Indirect tax exemptions have been left out as the introduction of the Goods and Services Tax (GST) complicates this analysis.

Also Read: Rich can make full use of exemptions, not poor — new tax regime better, says finance secretary

Ballooning exemptions, falling share in taxes

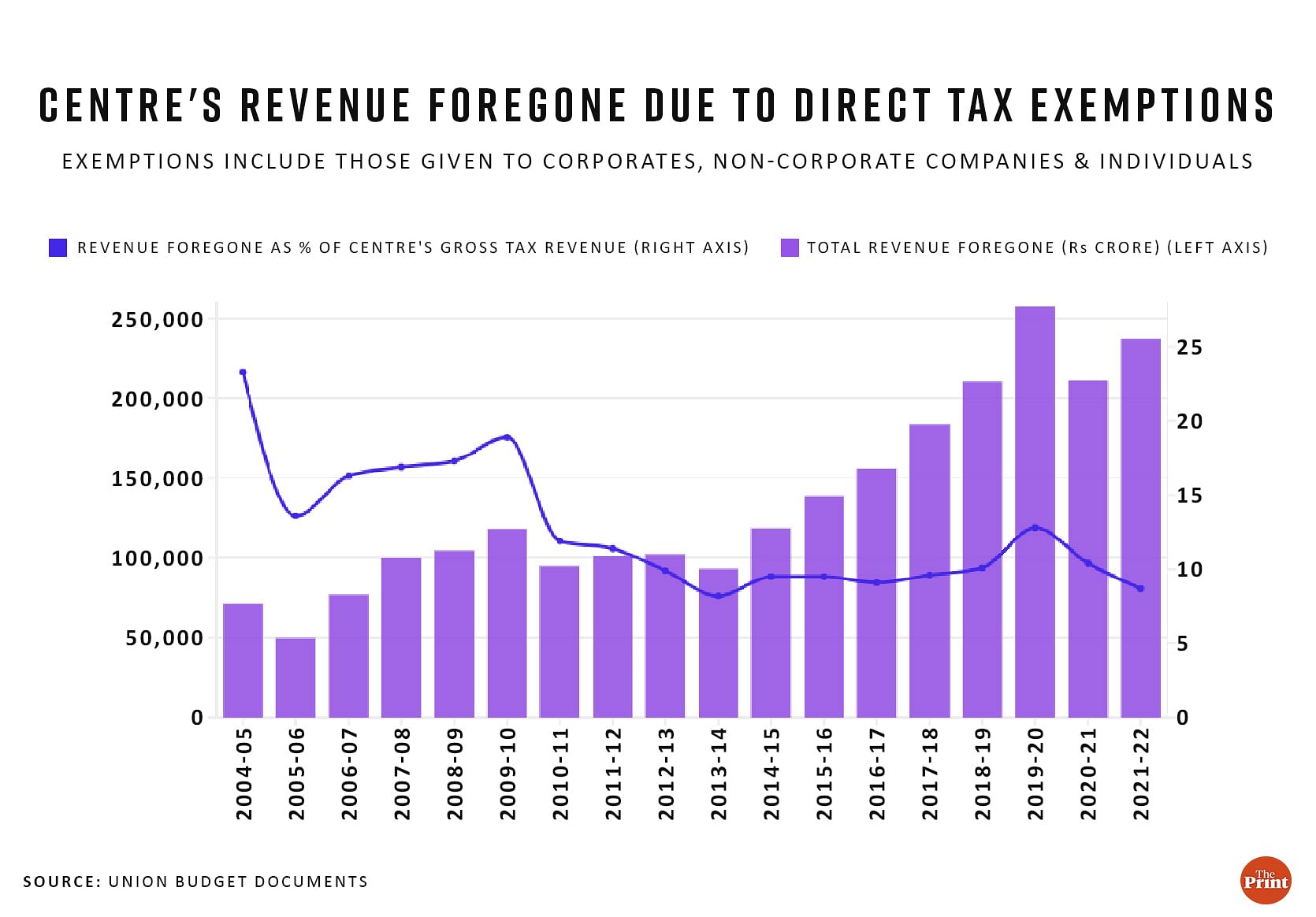

The data shows that the ‘revenue foregone’ due to direct tax exemptions has risen to Rs 2.37 lakh crore in 2021-22 from Rs 71,081 crore in 2004-05 — the first year for which data is available. Data for more recent years will be included in the Budget presented in February 2024.

Looking deeper, it becomes clear that the quantum of revenue lost to tax incentives remained largely stable throughout the United Progressive Alliance (UPA) government’s term from 2004 to 2014. That is, the revenue foregone increased by just 31 percent over the 10 years of the UPA government.

In contrast, the revenue foregone by the Modi government grew 100 percent in just eight years till 2021-22.

There are broadly two reasons for an increase in the revenue foregone — either more exemptions are being given, or the tax base is increasing and so more people and companies are making use of the exemptions.

According to tax experts and the data itself, it seems the sharp increase in revenue lost under the Modi government has more to do with the increase in the tax base since the government has been removing exemptions.

“Most of the tax exemptions that were granted to corporates have been taken away, and of the ones that remain, most have a sunset clause,” Dinesh Kanabar, CEO of Dhruva Advisors, a tax and regulatory consultancy, told ThePrint.

A sunset clause refers to a particular timeframe after which the exemption will be withdrawn.

“Further, choices have been given to the corporates whether they want to avail a lower rate of tax of 25 percent and give up all exemptions, or pay a significantly higher rate of tax with exemptions,” he explained.

The lower rate he is referring to is the 2019 decision by the government to lower corporate tax rates to 22 percent from around 30 percent “subject to the condition that they will not avail any exemption/incentive”.

On the other hand, Dinesh Kanabar further explained, that the tax base was growing and that the number of taxpayers was increasing.

“If tax collections are growing at 20-21 percent a year, then the quantum of exemptions will also go up,” he said.

The data shows that although the amount of revenue lost due to tax exemptions has grown in absolute terms under the Modi government, it has remained about the same as a proportion of the central government’s gross tax collections.

In fact, that proportion has been falling in the last two years under review, which means tax collections have grown faster than the exemptions being used.

Also Read: Govt decision to remove tax on drugs & food to treat rare diseases could benefit 70-90 million Indians

Benefits now go to individuals

With allegations that it goes out of its way to benefit corporates at the expense of the common man, the Congress has made the term “suit-boot ki sarkar” popular in reference to the Modi government.

For example, in October 2019, just months after the government announced its tax cuts for corporates, Congress leader Rahul Gandhi spoke in the Lok Sabha, calling the Modi government “udyogpatiyon ki sarkar”, “bade logon ki sarkar” and “suit-boot ki sarkar” (a government of capitalists, rich people, and of those dressed in suits and boots).

This wasn’t the first time he had used the “suit-boot sarkar” jibe, nor was it the last. However, the data paints a different picture.

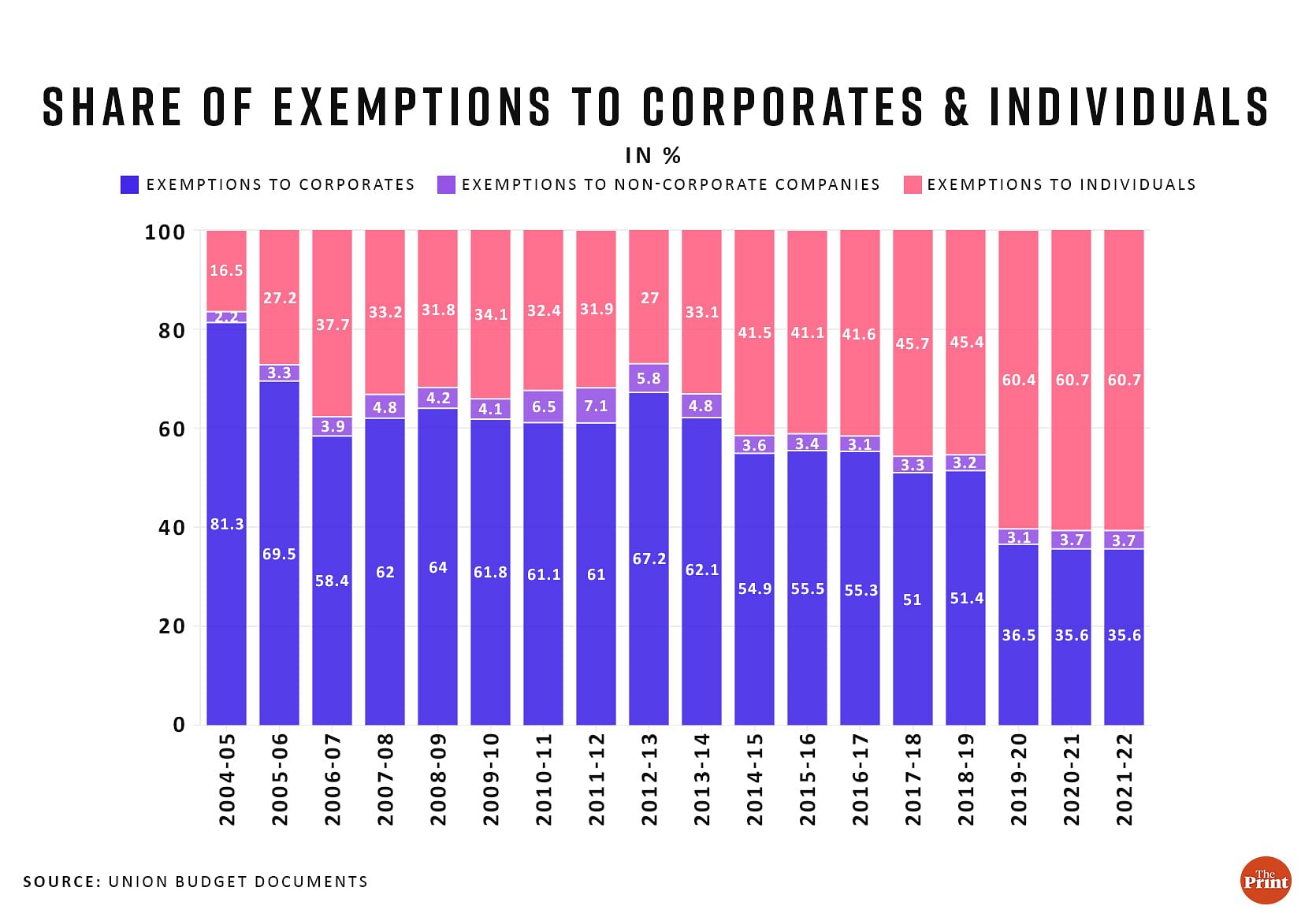

It reveals that in 2004-05 — the first year of the UPA government — an overwhelming 81 percent of the direct tax exemptions went to corporates and only 16.5 percent of the benefits accrued to individuals.

This situation did improve considerably over the UPA tenure, with corporates accounting for 62 percent of the direct tax exemptions availed in 2013-14 and individuals making up 33 percent.

However, the flip in shares of exemptions being availed happened under the Modi government.

From a situation where corporate exemptions made up the bulk of direct tax exemptions in 2013-14, the latest data for 2021-22 shows exemptions to individuals (61 percent) make up the majority.

“Earlier, there were a lot of tax holidays for corporates, whether you take software, infrastructure, or manufacturing-related tax exemptions, and a lot of companies were availing these,” Samir Kanabar, partner at EY India explained to ThePrint.

“That’s why the corporates’ share was higher,” he said.

Samir Kanabar added that, while many corporates have chosen to give up exemptions in favour of the lower tax-rate regime introduced in 2019, individuals have also been given this choice, but many still prefer to opt for the regime that offers tax exemptions.

“Since 2017, all these tax holidays have been discontinued for the corporates, and then in 2019, they brought in a system with reduced tax rates if the remaining exemptions were also given up,” he said.

“For individuals also, there is a new tax rate but they are still debating between the new regime and the old one,” he added.

(Edited by Richa Mishra)

Also Read: Tax India’s corporates and super-rich more. They can and will take it