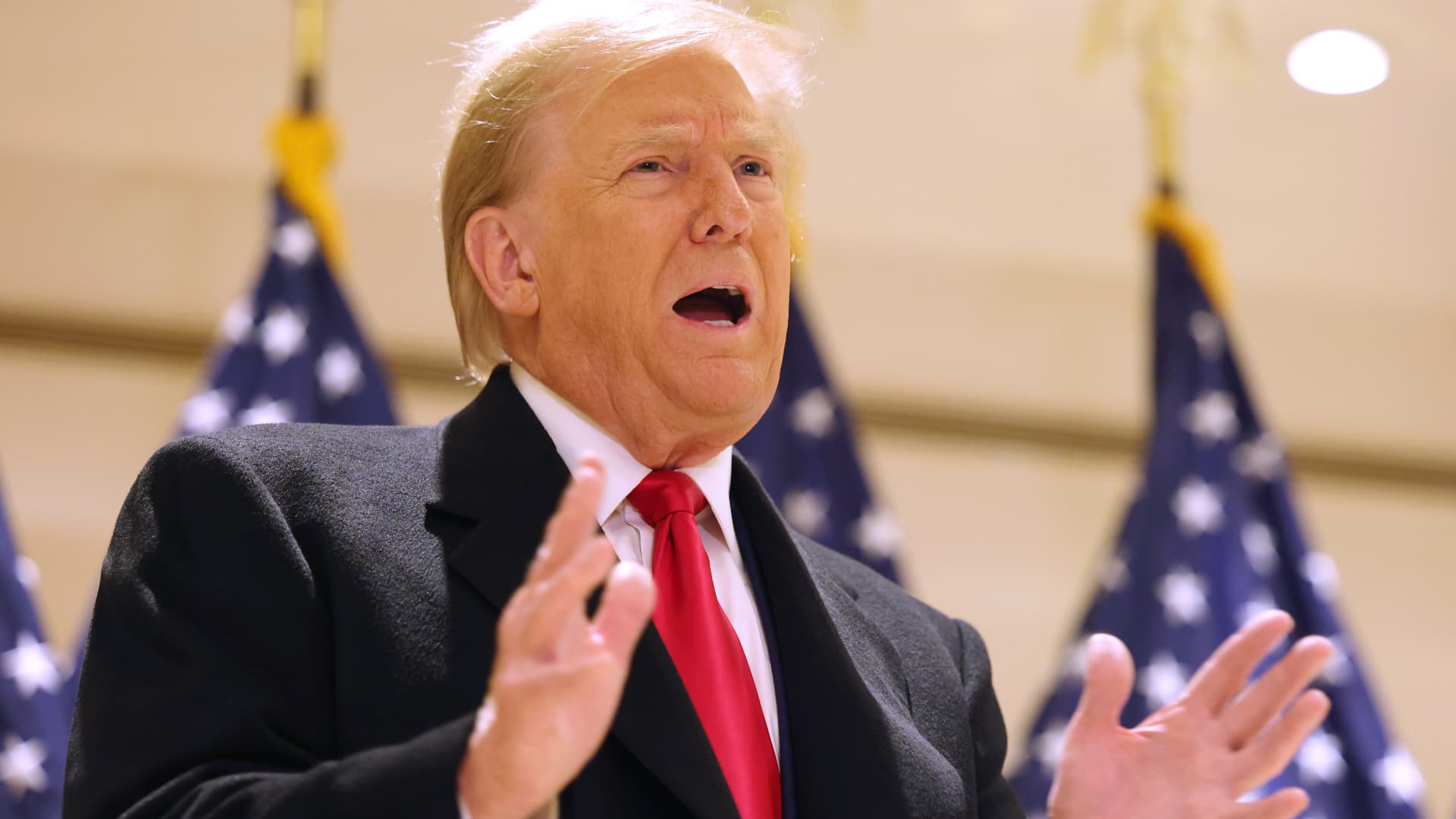

Former President Donald Trump speaks during a press conference at 40 Wall Street on March 25, 2024 in New York City.

Michael M. Santiago | Getty Images

A New York appeals court on Monday paused for 10 days a massive civil business fraud judgment against Donald Trump — and sharply reduced to $175 million the bond amount he will have to post to obtain a longer stay of that award.

The ruling came the same day New York Attorney General Letitia James could start seizing the former president’s real estate assets and bank accounts to satisfy a $454 million and rising judgment after he failed to obtain an appeal bond.

James is prevented from doing so — for now — due to the order from the five-judge panel in Manhattan Supreme Court’s appellate division, which did not give a reason for cutting the bond threshold by about 60%.

“We’ll post whatever is necessary, whether it be cash or security or bonds” Trump told reporters after leaving a hearing in the same court, where his trial on criminal business records charges related to a hush money payment to a porn star was set for April 15.

Earlier Monday, he had raged in a Truth Social post that he might be forced to sell his “babies” — real estate assets — to satisfy the judgment while he appeals a judge’s verdict that he and other defendants for years fraudulently inflated the stated value of properties while obtaining loans.

Trump’s lawyers previously asked that the appeal bond in the case be set at $100 million.

In a court filing last week, those attorneys said it was “impossible” for Trump to get an appeal bond for $454 million after having approached more than 30 surety companies without success. Trump’s two adults sons, his company the Trump Organization and two executives who all were co-defendants in the case owe a total of about $10 million in additional damages.

None of the surety companies were willing to write a $464 million bond without Trump posting cash or some other liquid asset, the attorneys wrote in their filing with the appellate division.

Because of the size of the fraud judgment, the companies insisted that Trump show “cash reserves approaching $1 billion,” according to his lawyers. But neither Trump nor the Trump Organization company has that amount of cash on hand, the filing said.

While Monday’s appeals court ruling lowers the size of the required appeal bond, it does not reduce the size of the judgment in the case, which resulted from a lawsuit filed by James.

If Trump and the other defendants lose their appeal, they would be on the hook for the full judgment, unless the appeals court cuts it.

“The ruling today represents a great first step towards the ultimate reversal of a baseless and reckless judgment,” said Trump’s lawyer, Charles Kise, in a statement.

“The [appellate division] no doubt recognized the rule of law must triumph over the political agenda of the Attorney General,” Kise said. “President Trump looks forward to a full and fair appellate process which overturns the judgment and ends the Attorney General’s abuse of power and tyrannical pursuit of the front running candidate for President of the United States.”

A spokesperson for James said, “Donald Trump is still facing accountability for his staggering fraud.”

“The court has already found that he engaged in years of fraud to falsely inflate his net worth and unjustly enrich himself, his family, and his organization,’ James’ spokesperson said.

“The $464 million judgment – plus interest – against Donald Trump and the other defendants still stands.”

In its order Monday, the appeals court also stayed trial Judge Arthur Engoron’s decision that had barred Trump from serving as an officer or director of a New York company for three years, and that had barred him and the corporate defendants from applying for loans from New York lenders for the same period.

The order also stayed Engoron’s ruling that had barred Trump’s sons, Donald Trump Jr. and Eric Trump, from serving as officers and directors of New York companies for two years.

But the appeals court panel rejected a request to block enforcement of Engoron’s order extending and enhancing the role of a financial watchdog the judge had installed to monitor the Trump Organization’s finances. The panel also allowed to stand Engoron’s order installing an independent director of compliance at Trump’s company.

Engoron, who conducted a bench trial for the suit, in February ruled against the Trump defendants, saying they had submitted “blatantly false financial data” to boost Trump’s financial statements and obtain better terms on loans.

Trump has condemned the verdict, the judge and James, saying he is the victim of a politically motivated attack designed to harm his chances of defeating President Joe Biden in November’s election.

More than a week ago, Trump obtained a $91.6 million appeal bond from a subsidiary of the Chubb insurance company to secure a Manhattan federal civil court defamation judgment against him in favor of E. Jean Carroll, a writer who had accused him of rape.

That bond, which was collateralized by a brokerage account of Trump’s, will keep Carroll from collecting on a judgment of more than $83 million from Trump while his appeal is pending.

Chubb had discussed issuing Trump a second bond, for his fraud case, and initially was willing to consider a mix of liquid assets and real property as collateral, according to Alan Garten, an attorney for the Trump Organization.

But Chubb backed out of those talks last week, Garten said in the court filing Monday. Chubb’s exit came after it was publicly revealed that Trump obtained his bond in Carroll’s case from the company.

Chubb CEO Evan Greenberg last week wrote a letter to investors, customers and brokers who had raised concerns about the Carroll-related bond.

“When Chubb issues an appeal bond, it isn’t making judgments about the claims, even when the claims involve alleged reprehensible conduct,” Greenberg wrote.

“As the surety, we don’t take sides,” he said.

“It would be wrong for us to do so and we are in no way supporting the defendant. We are supporting and are part of the justice system plumbing included in this case.”

— CNBC’s Kevin Breuninger contributed to this article.