The United Club Infinite Rewards Card offers a lounge access benefit that is more generous than the Delta SkyMiles Reserve card. The United credit card is also less expensive than the competing cards from Delta and American Airlines.

martin-dm/Getty Images

Each of the big-three legacy airlines offers a premium travel credit card that can get you into their airport lounges, but United customers might have access to the best deal. For the card’s $525 annual fee, the lowest among cards in this category, you can pick up the United Club℠ Infinite Card and get access to the United Club for yourself and either two traveling companions, or one companion and your children under 21.

The generous lounge access benefit is one reason this United Club access credit card makes our list of best airline credit cards. If you’re a United frequent flyer and consider Terminal 3 at SFO to be like a second home, there’s a good chance the United Club Infinite Card should be in your wallet.

United Club Infinite Card review

Highlights

- United Club membership included with the card.

- Get the first and second checked bags for free for you and a companion when traveling on United.

- Travel insurance benefits include baggage delay insurance, lost luggage reimbursement, trip delay reimbursement, and primary auto rental collision damage waiver.

- Earn four miles per dollar on United purchases.

- Earn two miles per dollar on all other travel, plus dining purchases.

- Earn one mile per dollar on all other purchases.

- No foreign transaction fees

United Club Infinite Card pros and cons

The United Club Infinite Card offers a lounge access benefit that is more generous than the Delta SkyMiles Reserve card. The United credit card is also less expensive than the competing cards from Delta and American Airlines.

Pros

- United Club membership included with the card allows two guests, or one guest plus children under 21.

- Includes a full suite of travel insurance protections, including baggage delay insurance, lost luggage reimbursement, trip delay reimbursement, and primary auto rental collision damage waiver.

- Checked bag benefit gives you and a traveling companion a first and second checked bag for free.

- Lowest annual fee among airline credit cards offering lounge access.

Cons

- No Priority Pass airport lounge access included.

- Checked baggage benefit only applies to one traveling companion. Other airlines’ cards extend the benefit to all travelers in your same reservation.

- Other travel cards like the Chase Sapphire Reserve offer more rewards on non-United travel purchases.

Current welcome offer

The United Club Infinite Card currently offers new cardmembers 80,000 bonus United MileagePlus miles after spending $5,000 on purchases within the first three months of having the card.

You are eligible to receive a welcome offer on this card if you do not currently have a United Club card and it has been 24 months since you have last received a new cardmember bonus for a United Club card.

How to earn rewards

With the United Club Infinite Card, you’ll earn rewards on every purchase, but the card offers its most generous rewards on purchases with United Airlines and travel. Here’s what the United Club Infinite Card earns:

- Four miles per dollar spent on United purchases

- Two miles per dollar spent on all other travel, including airfare, trains, transit, cruises, hotels, car rentals, taxis, rideshares, and resorts.

- Two miles per dollar spent on dining, including eligible delivery services.

- One mile per dollar spent on all other purchases.

How to redeem United MileagePlus miles

Award Travel

Most holders of airline travel cards redeem miles for award travel on their preferred airline. So it’s probably no surprise that the most common way for United Club Infinite cardholders to use miles is for airline travel. The MileagePlus miles you earn with your card can be used to book travel on United and its airline partners through United.com.

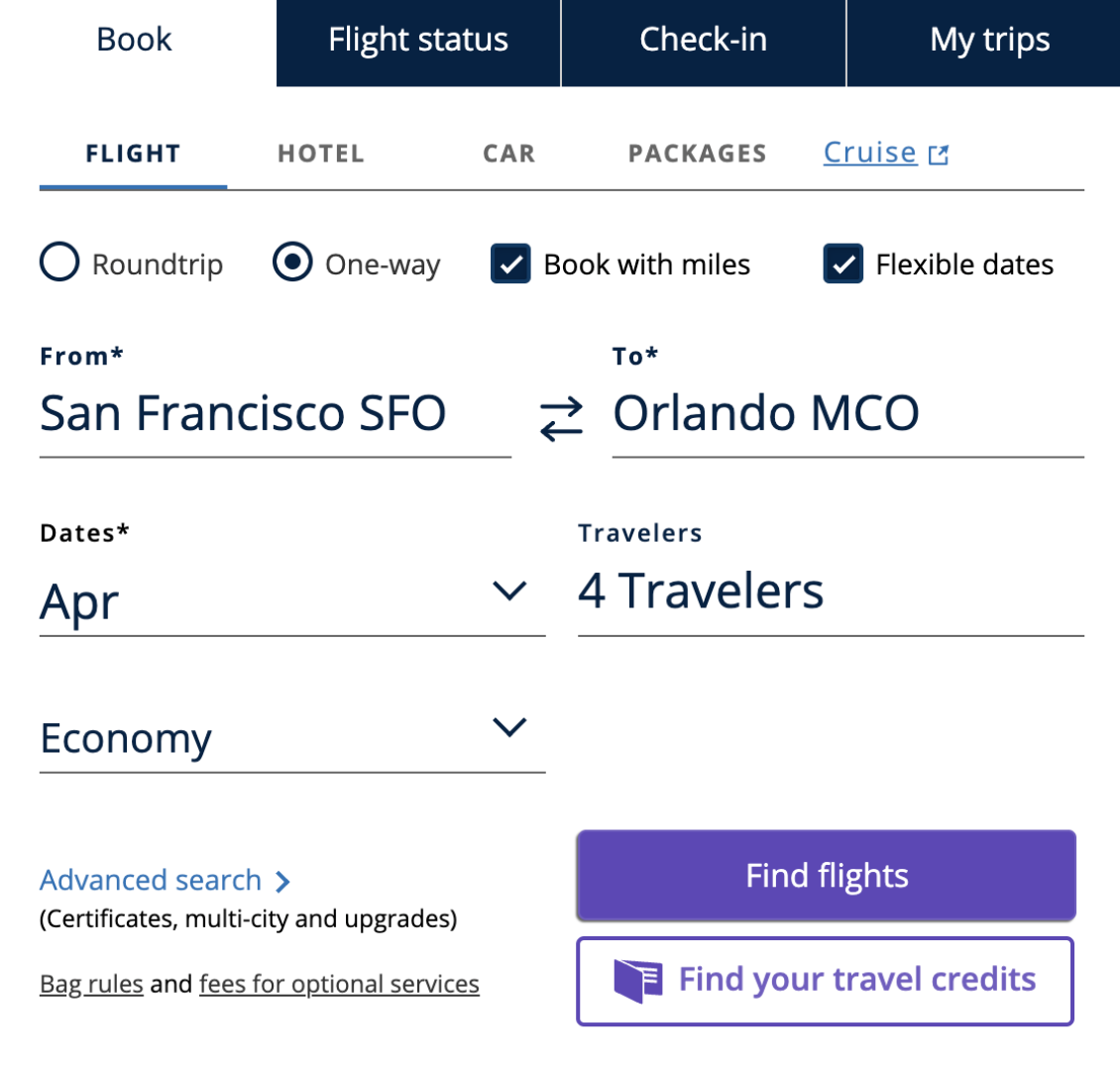

To search for award travel on United.com, simply search for a flight, but tick the box next to “Book with miles.”

The MileagePlus miles you earn with your card can be used to book travel on United and its airline partners through United.com.

Hearst

If you’re not already logged into the United website, you will be prompted to log in. You’ll eventually need to log into the website to book your ticket, but logging in early in the booking process can show you better pricing. United Club Infinite cardmembers save 10% on United Economy Saver Awards, but you need to be logged in when searching for flights to see the better pricing on United.com.

When you search for flights, you’ll see flight prices displayed in United MileagePlus miles, with a cash co-pay to cover certain taxes and fees.

Hearst

When you search for flights, you’ll see flight prices displayed in United MileagePlus miles, with a cash co-pay to cover certain taxes and fees. To hunt for the best price, you can use the week-long pricing calendar at the top of the page or click on “30-day calendar” to see a month-long calendar view of award pricing.

If you’re open to travel anywhere and looking for a deal, it might be worthwhile to check out United’s list of featured awards. At press time, United listed one-way flights from San Francisco to Los Angeles from 10,200 miles and from San Francisco to London from 34,000 miles.

Upgrade awards

If you like sitting up front, you can find plenty of value in your MileagePlus miles by using them to upgrade to a higher class of service. MileagePlus upgrades are available in most fare classes on both United flights and on Star Alliance flights you book through United. Basic Economy tickets are not eligible for upgrade awards.

Upgrade award prices vary based on your origin, destination, and fare class. For example, a deeply-discounted economy ticket between the United States and Europe can be upgraded to United First or Business class for 20,000 miles, plus a $550 co-pay. Complete information on upgrade award pricing is available on United’s website.

You can request an upgrade online. Just sign into your MileagePlus account, find your existing reservation, and request the upgrade online. You can also request an upgrade by calling United Reservations or see an agent at the airport within 24 hours of departure.

Other Redemption Options

Like most other airline programs, United MileagePlus offers a long list of additional redemption options. Most of these options offer less value than award travel or upgrade awards.

- Hotel awards let you use miles to book stays at boutique and brand-name hotels worldwide.

- Car awards are available if you want to use your miles to rent a car.

- Merchandise awards let you use your miles to shop for electronics, houseware, jewelry, and more.

- Apple allows you to use MileagePlus miles to purchase Apple products.

- The MileagePlus X app offers an option to use your miles for purchases at a variety of restaurants and retailers.

- MileagePlus Exclusives turn your miles into unique experiences.

- MileagePlus Event Awards can get you into live sporting events, concerts, and theater productions.

United Club credit card benefits

United Club membership

As a United Club Infinite Card holder, you receive a complimentary United Club airport lounge membership. United Club lounges offer amenities such as complimentary snacks and beverages, free Wi-Fi, and an exclusive space to rest or get some work done.

A United Club membership gets you access to United’s 45 United Club locations when traveling on your same-day United, Star Alliance, or United partner flight. As a United Club member, you are entitled to bring two guests with you into the club. Alternatively, you may bring one other adult and dependent children under 21 with you.

United Airlines perks

In addition to lounge access, here’s how the United Club Infinite Card elevates your entire experience when flying on United.

- Free checked bags – Receive a first and second checked bag for free for you and a traveling companion on United- and United Express-operated flights.

- Premier Access travel services – Get access to priority check-in, security screening, and baggage handling services.

- Save 10% on United Economy Saver Awards – Receive discounted pricing on United Saver Award tickets when traveling in Economy on United and United Express within the continental United States or between the United States and Canada.

- Get 25% back on United inflight and United Club purchases – Receive a statement credit for 25% of food and beverage purchases made onboard United flights or in United Clubs when you use your card.

Travel perks

The United Club Infinite Card offers many of the travel perks offered by premium travel cards like the Chase Sapphire Reserve.

- $100 Trusted Traveler credit – Receive up to a $100 statement credit once every four years when you pay your Global Entry, TSA PreCheck® or NEXUS application fee with your card.

- Auto rental collision damage waiver – Get primary coverage against theft and collision when you decline the car rental company’s collision damage waiver and charge your rental car to your card.

- Trip cancellation/interruption insurance – Be reimbursed up to $10,000 per person and $20,000 per trip for pre-paid non-refundable travel expenses if your trip is canceled or interrupted by sickness, severe weather, or other covered reasons.

- Baggage delay insurance – Receive up to $100 per day for up to three days for essentials like toiletries and clothing if your baggage is delayed.

- Trip delay reimbursement – When your travel is delayed by 12 hours or requires an overnight stay, you can be reimbursed for meals and hotel accommodations, up to $500.

- No foreign transaction fees – Pay no additional fees when you use your card abroad.

Other card benefits

Finally, the United Club Infinite Card offers a handful of benefits that protect the things you buy closer to home.

- Extended warranty protection – Extend the U.S. manufacturer’s warranty on items you purchase by an additional year, on eligible warranties of three years or less.

- Purchase protection – Cover your new purchases against damage or theft, up to $10,000 for 120 days from the date of purchase.

- Return protection – Get reimbursement for items a merchant won’t take back if you attempt to return them within 90 days of purchase. Receive up to $500 per item and $1,000 per year.

Who it’s good for

If you are a loyal United traveler and value a premium travel card with United Club Access, the United Club Infinite Card can offer plenty of value. In addition to getting access to United Clubs, you will earn more rewards on United flights than with almost any other card. Plus you’ll have a premium travel card that gives you travel insurance that will cover you if your flight is delayed, baggage doesn’t arrive, or something happens with your rental car. Your spending can also earn you up to 8,000 Premier Qualifying Points toward your United Premier status qualification.

Who should look elsewhere

The flagship feature of the United Club Infinite Card, access to the United Club, is the bulk of what you’re buying for the card’s $525 annual fee. If you don’t fly through airports with United Club locations or don’t fly United often enough to justify paying that much, consider one of the other United cards.

The United Explorer card offers a free checked bag, plus two United Club one-time passes for its $95 annual fee. United flyers looking to book a combination of cash and award travel could consider the United Quest Card, which offers a $125 annual statement credits toward United purchases and two 5,000 mile bonuses when you book your first two award tickets in a year.

Bottom line

If you want access to the United’s own airport lounges when traveling on United, the United Club Infinite Card is your ticket to the club. In addition to United Club membership, the card will get you free checked bags, earn you the most United miles on your purchases with the airline, and cover your travel with an extensive list of travel insurance protections.

Looking for another airline credit card? Start your search here.

Editorial Disclosure: All articles are prepared by editorial staff and contributors. Opinions expressed therein are solely those of the editorial team and have not been reviewed or approved by any advertiser. The information, including rates and fees, presented in this article is accurate as of the date of the publish. Check the lender’s website for the most current information.

This article was originally published on SFGate.com and reviewed by Lauren Williamson, who serves as Financial and Home Services Editor for the Hearst E-Commerce team. Email her at lauren.williamson@hearst.com.