The 10-year Treasury yield recently hit its highest level since 2007. Here’s what you need to know.

Mo Semsem /Getty Images/iStockphoto

A Treasury note, or T-note, is a U.S. government security that pays a fixed interest rate for two, three, five, seven, or 10 years. You receive regularly scheduled interest payments until maturity, at which time the government pays back the amount you originally invested (the principal). Like Treasury bills and bonds, T-notes are a low-risk investment backed by the full faith and credit of the United States.

The 10-year Treasury note — and its yield in particular — has received much attention since climbing to 4.88%, the highest level since 2007. The spike has triggered investor anxiety, partly because “it’s a little bit perplexing what is driving [the yields] to go up as much as they have in recent months,” said Minneapolis Federal Reserve President Neel Kashkari during a town hall hosted by Minot State University.

Whether you’re considering a low-risk investment or following mortgage rates, it’s essential to understand the 10-year Treasury yield and why it matters.

The 10-year Treasury yield is the annualized rate of return you would earn on a 10-year Treasury note if you held it to maturity. The yield serves as a baseline interest rate for the U.S. financial markets — and a key interest rate and economic indicator worldwide. Generally, falling yields signal caution about the global economy, while rising yields indicate economic confidence.

Investors monitor many numbers, but the 10-year Treasury yield is one of the most closely watched. With a maturity that falls in the middle of all Treasurys, the 10-year yield indicates investor sentiment about where the economy is headed in the midterm. The 10-year Treasury yield is also important because it:

- Is used as a reference rate for many financial valuations. For example, it’s often used with discounted cash flow calculations, which estimate an investment’s value today based on projections of its future income.

- Can impact the stock market by creating volatility. High yields make investors less likely to invest in riskier stocks, which can draw capital away from the stock market.

- Can make borrowing more (or less) expensive for companies. High yields and high borrowing costs can weigh on corporate earnings and make it difficult for businesses to grow, innovate, or stay in business.

- Serves as a proxy for mortgage rates. When the 10-year Treasury yield increases, mortgage rates rise, which can slow borrowing and spending. When the yield declines and mortgage rates fall, the housing market strengthens, boosting the economy.

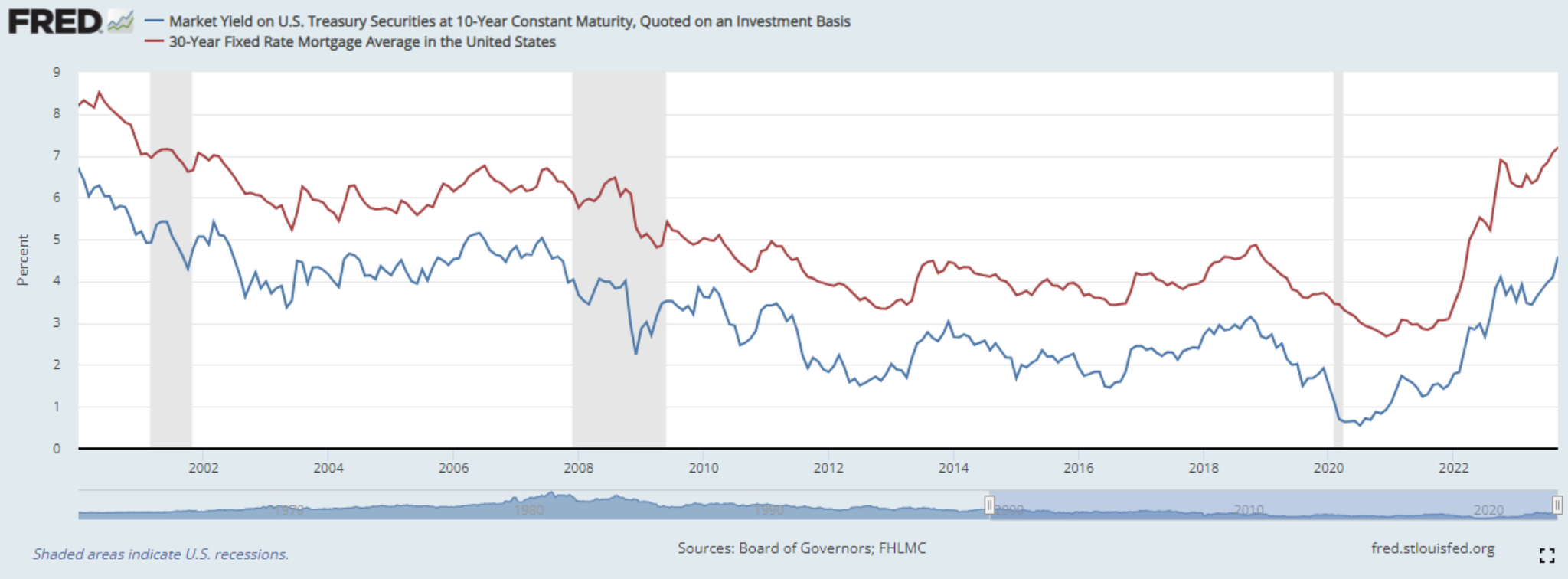

The chart below illustrates the close correlation between the 10-year Treasury rate (shown in blue) and the 30-year fixed-rate mortgage average (in red).

The close correlation between the 10-year Treasury rate (shown in blue) and the 30-year fixed-rate mortgage average (in red).

Image courtesy of the Federal Reserve Bank of St. Louis.

Ultimately, the 10-year Treasury yield is driven by supply and demand. When the economy slows and the financial markets are volatile, investors often flock to Treasurys because they’re relatively safer than stocks (remember that Treasurys are one of the safest investments in the world because they’re backed by the full faith and credit of the United States). The increased demand can push prices higher because investors are willing to pay more for the security Treasurys offer. This, in turn, leads to lower Treasury yields, as bond prices are inversely related to yield.

The opposite is also true. When the economy is thriving, there’s usually less demand for Treasurys as investors are confident about putting their money into higher-risk investments. The decreased demand can push Treasury prices down, leading to rising yields and eventually attracting more investors back to the bond market.

Treasurys are attractive because they provide a guaranteed income, and your investment is safe no matter what happens in the stock market or the broader economy. They’re also tax-friendly: Earnings aren’t subject to state or local taxes, though you’ll still be on the hook for federal taxes.

Treasurys, including 10-year notes, can also help you diversify your investment portfolio. A general rule of thumb is to subtract your age from 120 to determine the percentage of your portfolio that should be in stocks versus other assets (the starting point used to be 100, but the formula has been updated to reflect rising healthcare costs and longer lifespans. At age 50, you might have 70% of your portfolio in stocks and 30% in bonds and cash.

Remember that 10-year Treasury notes aren’t the only Treasury marketable securities. You might also consider T-notes of different maturities, Treasury bonds, Treasury bills, Treasury Inflation Protected Securities (TIPS), and Floating Rate Notes (FRNs). Here’s how they compare:

TIP: “Marketable” means you can transfer the security to someone else or sell it before it matures. Non-marketable securities are registered to one person’s Social Security number and can’t be transferred or sold to another person.

You can buy Treasury bills and other marketable securities through TreasuryDirect or your bank or broker. Alternatively, if you don’t want to invest directly, consider an index fund or exchange-traded fund (ETF) offering exposure to fixed income with varying risk levels.

Wondering if 10-year Treasury notes are right for you? Working with a qualified financial advisor can remove some of the guesswork and help you choose the best investments to reach your financial goals.

Editorial Disclosure: All articles are prepared by editorial staff and contributors. Opinions expressed therein are solely those of the editorial team and have not been reviewed or approved by any advertiser. The information, including rates and fees, presented in this article is accurate as of the date of the publish. Check the lender’s website for the most current information.

This article was originally published on SFGate.com and reviewed by Lauren Williamson, who serves as Financial and Home Services Editor for the Hearst E-Commerce team. Email her at lauren.williamson@hearst.com.