If you’re a higher earner and looking to boost tax-free retirement savings, there’s a lesser-known strategy that could be worth considering.

While Roth individual retirement accounts offer tax-free growth and other benefits, some investors earn too much for direct contributions. For 2024, the adjusted gross income limits for Roth IRA contributions are $161,000 for single filers or $240,000 for married couples filing jointly.

However, so-called mega backdoor Roth conversions — which shift after-tax 401(k) contributions to a Roth account — can sidestep Roth IRA income limits for contributions.

It’s a “no-brainer” after maximizing other tax-advantaged options, assuming you don’t need the cash for other goals, said certified financial planner Brian Schmehil, managing director of wealth management at The Mather Group in Chicago.

More from Personal Finance:

Why the minimum wage and some tax breaks don’t budge despite inflation

IRS free tax filing program to be available nationwide starting in 2025

37% of Americans paid a late fee in the last 12 months, report finds

A mega backdoor Roth conversion makes sense for higher earners who otherwise would have invested their extra money in a brokerage account, which is subject to yearly taxes on capital gains and dividend distributions, Schmehil said.

How mega backdoor Roth conversions work

Generally, mega backdoor Roth conversions are for investors who have already maxed out their pretax 401(k), according to CFP Ashton Lawrence, director at Mariner Wealth Advisors in Greenville, South Carolina.

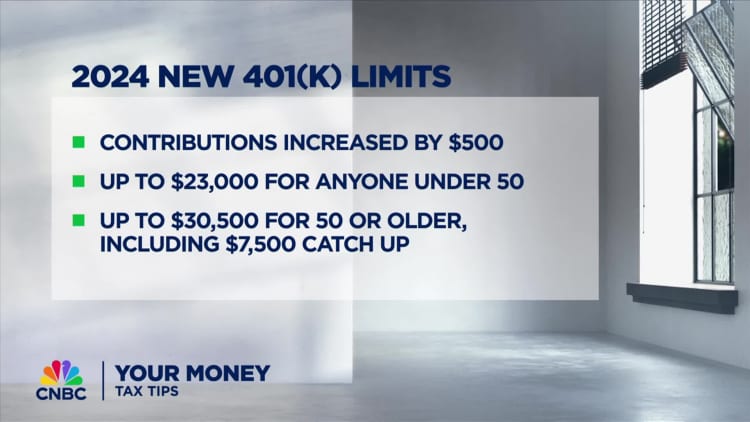

For 2024, the pretax or Roth 401(k) deferral limit is $23,000, plus an extra $7,500 for savers age 50 and older.

Some employees can also make after-tax 401(k) contributions above the yearly deferral limits and transfer those funds to Roth account to kickstart tax-free growth. The max 401(k) limit is $69,000 for 2024, which includes deferrals, employer matches, profit sharing and other deposits.

“It can be huge for a high-income earner,” Lawrence said.

However, not all 401(k) plans allow this strategy. At the end of 2023, only about 11% of 401(k) plans permitted mega backdoor Roth conversions, according to data from Fidelity Investments.

Before making after-tax contributions, experts recommend reviewing your 401(k) documents to understand your plan’s features and restrictions.

While you won’t owe taxes on converted after-tax contributions, there could be levies on growth.

Watch for taxes on after-tax growth

One of the differences between Roth and after-tax 401(k) contributions is the tax treatment of growth. While Roth contributions grow tax-free, after-tax investments are tax-deferred, which means you’ll owe regular income taxes on withdrawals in retirement.

Experts recommend converting after-tax funds regularly to minimize upfront taxes on the conversion. Otherwise, you’ll need to plan for taxes on after-tax growth.

“By doing this right, you can essentially avoid taxation on all growth,” CFP Dan Galli, owner of Daniel J. Galli & Associates in Norwell, Massachusetts, previously told CNBC. “And that’s where the magic is.”