Christine Lagarde, president of the European Central Bank (ECB), at a rates decision news conference in Frankfurt, Germany, on Thursday, Sept. 14, 2023. The ECB raised interest rates again, acting for the 10th consecutive time to choke inflation out of the euro zone’s increasingly feeble economy.

Bloomberg | Bloomberg | Getty Images

The central banks of some of the world’s biggest economies are now widely considered to have reached, or be at the brink of reaching, the highest level they will take interest rates.

The European Central Bank last week signaled that its Governing Council feels rates may have got there.

Following a long deliberation over its updated forecasts for inflation and economic growth and what they should mean for monetary policy, the ECB hiked its key rate to a record high of 4%. While its accompanying statement by no means ruled out further hikes completely, it said rates were at levels that if “maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.”

The short-term inflation outlook remains grim, and set to hit households hard. ECB staff macroeconomic projections for the euro area now see inflation averaging 5.6% this year, from a prior forecast of 5.4%, and 3.2% next year, from a previous forecast of 3%.

But the forecast for 2025, one of its most closely watched metrics measuring the medium-term outlook, was nudged down from 2.2% to 2.1%.

Discussion will now shift to how long rates will plateau at the current level, economists including Berenberg’s Holger Schmieding, said following the anouncement.

Analysts at Deutsche Bank said they saw no cuts before September 2024, implying a 12-month pause at 4%.

Challenges to this remain, however, with one being the prospect of significantly higher oil prices. Crude futures recently climbed to a 10-month high, which could impact goods costs and inflation expectations in Europe as well as the U.S.

Raphael Thuin, head of capital markets strategies at Tikehau Capital, said that despite consensus around the end of the ECB hiking cycle, “an alternative and less optimistic scenario remains possible: inflation is surprisingly strong and resilient, and appears to be structural.”

“Recent disinflationary factors (goods and commodity prices) seem to be running out of steam … There is a risk that, in the absence of a more convincing downward trend in prices, the ECB will consider its battle against inflation unfinished, with the risk of further rate hikes on the horizon,” Thuin said in a note.

“In this respect, macroeconomic data developments over the coming weeks will be decisive.”

Federal Reserve

Fed Chair Jerome Powell made clear last month that further hikes were on the table, and the central bank is deeply concerned about inflation experiencing a fresh acceleration if financial conditions ease.

In its June forecast, which is likely to be revised in an updated projection this week, it did not see inflation reaching 2.1% until 2025.

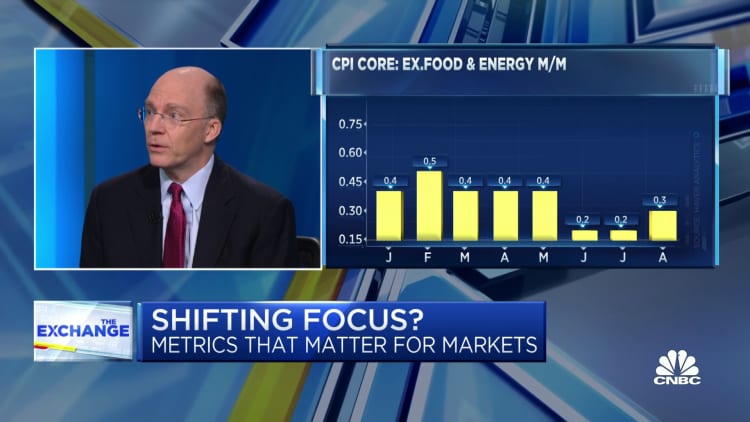

Monthly data shows continuing price pressures. The consumer price index rose at its fastest monthly rate this year in August, mainly driven by energy prices, and was 3.7% year-on-year. Core inflation came in at 0.3% on a monthly basis and 4.3% on an annual basis, while producer price inflation showed the biggest monthly gain since June 2022.

But markets are all-but certain the U.S. Federal Reserve will hold rates steady in September, and are split on whether another hike will be delivered this year. In a Reuters poll of economists, 20% expected at least one.

“Given the relatively strong economic data and sticky inflation, [the Fed] will maintain a hawkish bias,” economists at J. Safra Sarasin said in a note.

The Federal Open Market Committee “will probably leave a final hike by year end in its updated dot plot, even though we don’t think they will follow ultimately through with it.” The dot plot refers to the interest rate projections released quarterly by Fed policymakers.

Markets continue to expect Fed rate cuts next year, though some argue this may be premature. In the same Reuters poll, 28 economists expected a first cut in the first quarter, while 33 put it in the second.

Bank of England

Expectations for the Bank of England are for one final hike in September, as it weighs up inflation of 6.8%, with signs of stresses on the economy and renewed talk of a “mild recession.”

In its August report, the Monetary Policy Committee said it expected inflation to hit 5% by the end of the year, to halve by the end of next year, and reach its 2% target in early 2025.

“The Bank is no longer in a clear space where interest rate hikes are unequivocally necessary,” said Marcus Brookes, chief investment officer at Quilter Investors, pointing to weak gross domestic product data for July.

Analysts at BNP Paribas said they expected a final “dovish hike” in September, as wage growth and inflation pressures combine with softening activity indicators.

Wage growth figures for May to July held steady at 7.8%, maintaining their record high level, but there have also been signs of a cooling jobs market, with unemployment rising 0.5 percentage points in the same period.

The mortgage market is another area of weakness, with payments in arrears spiking to a seven-year high in the three months to June.

James Smith, developed markets economist at ING, noted expected price growth and expected wage growth had both fallen, while fewer firms reported struggling to find staff.

“A November hike is possible, but assuming we’re right about the direction of the dataflow and on the basis of recent BoE comments, we think a pause is still more likely at that meeting,” Smith said.