RBI Repo Rate: Experts said the RBI’s decision to maintain the key policy repo rate at 6.5% for the seventh consecutive time instills confidence across both residential and commercial real estate sectors.

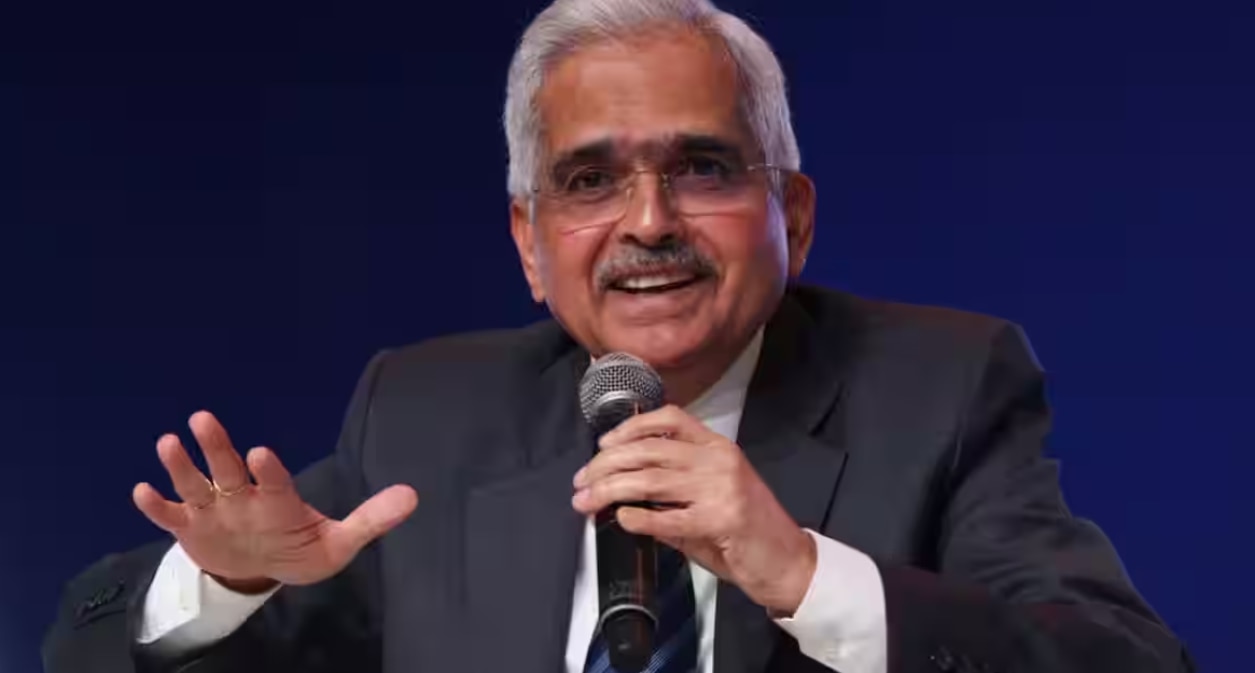

Mumbai: The Reserve Bank of India on Friday decided to keep the policy repo rate unchanged at 6.5 per cent as retail inflation continues to be above its target of 4 per cent. This is the seventh consecutive meeting that the MPC has maintained a status quo on the repo rate. The repo rate, is the interest rate at which banks draw funds from RBI to overcome short-term liquidity mismatches. This is the first monetary policy statement of the current financial year 2024-25, said RBI Governor Shaktikanta Das.

“It was decided by a majority of 5:1 to keep the interest rate unchanged at 6.50 per cent. Consquently the Standing Deposit Facility, the SDF rate remains at 6.25 per cent. Marginal Standing Facility (MSF) rate and the bank remain at 6.75 per cent,” said Das.

Reacting to the development, Rishabh Siroya, Founder of Siroya Corp said that the RBI’s decision to maintain the key policy repo rate at 6.5% for the seventh consecutive time instills confidence across both residential and commercial real estate sectors.

“Steady interest rates alleviate borrowing costs, making properties more accessible to buyers and businesses, thus stimulating demand and driving industry growth. With rates remaining unchanged, the market stands poised for continuous momentum, supported by robust demand in luxury segments and an increase in project launches. The stability in borrowing costs not only enhances affordability but also boosts investor sentiment, fostering optimism and resilience. As the industry progresses through this phase, the unchanged repo rates symbolize stability, ushering in a promising era marked by sustained growth and opportunities for developers and investors alike,” Rishabh Siroya said.

Pratik Kataria, Director Sainath Developers – The House of Kataria & Joint Treasurer, NAREDCO Maharashtra, said the Reserve Bank of India maintains stability, holding the key repo rate steady at 6.5% to curb inflation.

“In its seventh consecutive decision, the Monetary Policy Committee underscores a strategic commitment. This stance benefits prospective homebuyers by ensuring minimal fluctuations in loan interest rates, enhancing affordability. Stability in borrowing costs aids builders in project planning and sustains construction momentum. The RBI’s cautious approach fosters a balanced economic growth trajectory, averting rapid price escalations. This fosters investor confidence in the real estate sector, offering a symbiotic win for both buyers and industry stakeholders. In this equilibrium, the economy finds resilience and progress,” Pratik Kataria said.

Manju Yagnik, Vice Chairperson of Nahar Group and Senior Vice President of NAREDCO- Maharashtra said that the RBI has decided to keep the repo rates unchanged at 6.5%. He said this move builds on the advantages of the earlier policy announcements by widening the advantageous conditions for homebuyers.

“As a result, those considering becoming homeowners can still benefit from low-interest rates on home loans. The housing market is expanding rapidly, and maintaining steady home loan rates is essential to keep the market in check and raise consumer confidence in general. The RBI’s decision offers homeowners a significant benefit and much-needed relief in the face of rising housing costs. Buyers are satisfied with a steady repo rate since it gives them another opportunity to purchase real estate at a good price. This decision sets a base for the housing sector’s long-term stability and expansion and boosts the optimistic attitude currently permeating the market. With the understanding that the market is in a favourable position to support their investment decisions, purchasers can move confidently through it,” she said.